Search News

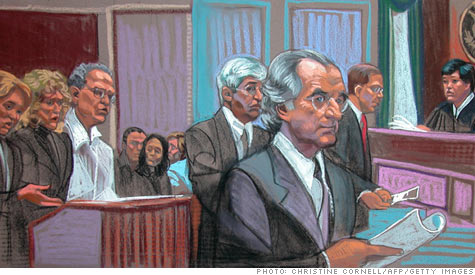

Bernard Madoff pleaded guilty in 2009 to running the most massive Ponzi scheme in history.

Bernard Madoff pleaded guilty in 2009 to running the most massive Ponzi scheme in history.

NEW YORK (CNNMoney.com) -- The court-appointed trustee in the recovery of assets stolen by Bernard Madoff has accused an Austrian banker of being a key player in the Ponzi scheme, suing her for $19.6 billion.

Trustee Irving Picard filed suit Friday in U.S. Bankruptcy Court in New York against Sonja Kohn, principal shareholder of Bank Medici, along with Bank Austria and UniCredit, owners of a 25% share in Medici, and six members of Kohn's family.

"In Sonja Kohn, Madoff found a criminal soul mate, whose greed and dishonest inventiveness equaled his own," said Picard, in a prepared statement. "Given the scope of Madoff's Ponzi scheme, the deceptive nature of the defendants, and the deliberately Byzantine structure of the Medici Enterprise, we believe that even more information regarding the full scope of this criminal enterprise will be revealed through discovery."

The suit accused Kohn of being the "mastermind" in the so-called Medici Enterprise, which served an "indispensable role in facilitating his Ponzi scheme" over a 23-year "criminal relationship."

The trustee also accused Kohn and co-conspirators of violating federal Racketeer Influenced and Corrupt Organizations Act, or RICO, which is typically used against the Mafia and other criminal organizations.

The complaint accused Kohn and her co-conspirators of a "pattern of racketeering activity comprised of, among other things, money laundering, mail and wire fraud, and financial institution fraud."

UniCredit said in an emailed statement that the company planned to defend itself "vigorously," adding that it had a no comment policy regarding pending legal matters. "Our attorneys are reviewing the matter and we will manage this through the normal course legal process," the company said.

Efforts to reach Kohn's attorney in Vienna and Bank of Austria representatives were not immediately successful.

The trustee said that more than $9 billion of the stolen money was "directly attributable" to Kohn and her enterprise.

"The total amount lost in the Ponzi scheme is approximately $19.6 billion, making these actors arguably the single most critical building block -- the sine qua non -- of the Ponzi scheme," said Timothy Pfeifer, the court-appointed counsel from the firm Baker & Hostetler, in a prepared statement.

The trustee said the Madoff and Kohn first met in New York in 1985 and from that point on, he "paid her to feed money into the Ponzi scheme." Kohn allegedly established Bank Medici in Austria for the express purpose of serving "as a mechanism to solicit investors for the Ponzi scheme," the trustee said.

The complaint alleges Kohn and her family funneled at least $62 billion through Madoff's firm and into private accounts.

The trustee has filed a wave of lawsuits ahead of the second anniversary of Madoff's arrest on Dec. 11, 2008. Madoff pleaded guilty in March, 2009 in federal court for orchestrating the largest Ponzi scheme in history. He was sentenced to 150 years and is incarcerated at a medium security federal prison in North Carolina. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |