Search News

Click chart for more market data.

Click chart for more market data.

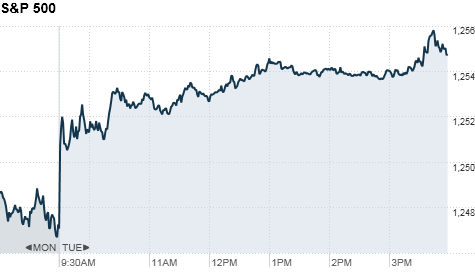

NEW YORK (CNNMoney.com) -- U.S. stocks rose modestly Tuesday but managed to close at their highest levels in more than two years as investors set their sights on 2011.

The Dow Jones industrial average (INDU) rose 55 points, or 0.5%, led by gains in shares of American Express (AXP, Fortune 500), Bank of America (BAC, Fortune 500) and JPMorgan Chase (JPM, Fortune 500). The blue chip index finished at 11,533, its highest level since August 29, 2008.

The S&P 500 (SPX) added 8 points, or 0.6%, with Adobe (ADBE) and Jabil Circuit (JBL, Fortune 500) among the biggest winners. The broader index closed at its highest level since September 19, 2008.

The tech-heavy Nasdaq (COMP) gained 18 points, or 0.7%, to reach its highest level since December 28, 2007.

Stocks are up about 5% this month, with the S&P 500 and the Nasdaq posting gains for 13 of the month's 15 trading session so far. All three major indexes are poised for double-digit gains for the year.

But as investors close out their books leading up to the holidays, the rest of the year is likely to be pretty quiet.

"Trading volume is fairly light, and it's not uncommon to see the market continue on the trajectory it has been on during the month of December," said Robert Siewert, portfolio manager at Glenmede.

Still, investors are feeling more optimistic lately.

"Looking out into 2011, the economy remains pointed in the right direction," Siewert said. "As long as the economic conditions continue to improve, the stock market should continue to benefit."

On Monday, stocks ended mixed after waffling between gains and losses. The three major indexes have risen to two-year highs during the last few weeks, since President Obama announced the compromise deal on the Bush-era tax rates. Last Friday, the president signed a tax-cut plan into law.

World markets: Korean peninsula tensions have eased slightly. North Korea initially threatened it would retaliate militarily following a South Korean live-fire naval drill exercise. However, North Korean military leaders instead issued a warning to South Korea and the United States.

Asian markets ended the session higher. The Shanghai Composite jumped 1.8%, the Hang Seng in Hong Kong rallied 1.6% and Japan's Nikkei gained 1.5%.

Also in Asia, the Bank of Japan held its key interest rate unchanged between zero and 0.1%. And China's vice premier said China has supported the European Union with its debt crisis, also according to government-owned news agency Xinhua.

European stocks were also ended higher. Britain's FTSE 100 gained 1%, the DAX in Germany rose 0.9%, and France's CAC 40 rallied 1.1%.

Eurozone debt woes continue to brew for overseas investors.

Moody's Investors Service put Portugal's government bond ratings on review for a possible downgrade. Moody's cited "uncertainties about Portugal's longer-term economic vitality;" "concerns about Portugal's ability to access the capital markets at a sustainable price," and concerns about whether the government will be able to support the banking sector, "which may be needed for the banks to regain access to the private capital markets" as reasons for the downgrade watch, according to a statement from the company.

Companies: Toyota Motor Corp. (TM) -- the Japanese automaker that suffered a series of high-profile recalls -- will pay $32.4 million in civil penalties, the U.S. Department of Transportation said Monday. The penalty is the maximum allowed by law. Toyota's stock rose 1%.

Deutsche Bank (DB) AG agreed Tuesday to pay $553.6 million for taking part in fraudulent federal tax shelters, according to federal regulators. The stock gainsed 0.5%.

After the closing bell, Nike (NKE, Fortune 500) said its profit rose 22% to $457 million, or 94 cents per share, on revenue of $4.8 billion. Analysts were expecting the sporting giant to report earnings per share of 88 cents. Shares rose 0.3% after hours.

After the closing bell on Monday, Adobe Systems (ADBE) reported a profit of $269 million, or 53 cents per share, compared with a loss of $32 million, or 6 cents per share, during the same period a year earlier. Shares of Adobe surged 6%.

Economy: The Census Bureau reported Tuesday that the population of the United States grew 9.7%, to 308.7 million people over the past decade -- the slowest rate of growth since the Great Depression.

Nevada was the fastest growing state over the decade, followed by Arizona and Utah. Michigan was the big loser -- with Rhode Island, Ohio and Louisiana also lagging badly.

Currencies and commodities: The dollar rose against the euro, the British pound and the Japanese yen.

Oil for February delivery added 45 cents to settle at $89.82 a barrel.

Gold futures for February delivery rose $2.70 to settle $1,388.80 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury ticked down, pushing the yield up to 3.31%. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |