Search News

Click chart for more bond yields.

Click chart for more bond yields.

NEW YORK (CNNMoney) -- U.S. treasury prices rose during a shortened trading session Friday, ending a volatile year on a positive note.

The price on the benchmark 10-year note rose slightly, pushing the yield down to 3.30% from 3.37% late Thursday. Bond prices and yields move in opposite directions. The yield on the 30-year bond fell to 4.33%, while the yield on the 2-year note edged down to to 0.60%. The 5-year note's yield slipped to 2.01%.

Trading volume remained light amid the year-end holiday period.

U.S. debt, which is considered a safe haven, was an attractive asset to investors during the earlier part of 2010, as concerns over Europe's sovereign debt issues were at the forefront.

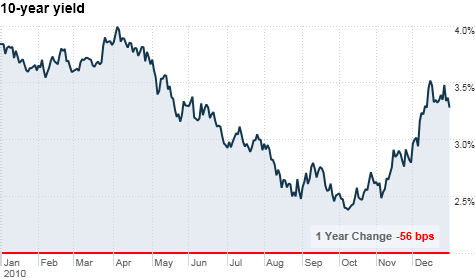

But as those worries faded, so did the appeal for Treasuries. That has sent yields higher, especially as better-than-expected economic news bolstered demand for riskier asset. After hitting a low below 2.4% in early October, the benchmark yield finished the year at 3.3%.

As traders get back in gear for 2011 next week, analysts expect yields will continue rising as the economy recovers, despite the Federal Reserve's attempt to push rates lower.

In November, the Fed announced it will pump $600 billion into the economy by June through purchases of long-term Treasuries. As part of the program, which winds down during the middle of next year, the central bank is expect to scoop up more Treasuries next week.

The Treasury market closed at 2 p.m. ET Friday. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |