Search News

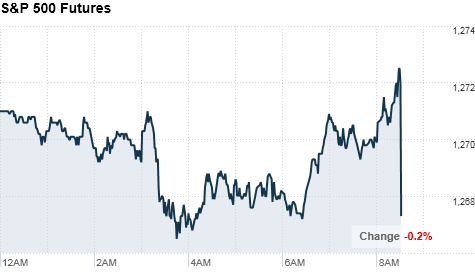

click chart for more premarket data

click chart for more premarket data

NEW YORK (CNNMoney) -- U.S. stocks were headed for a slightly lower open Friday, as investors digested the government's latest reading on the labor market.

The U.S. economy added slightly fewer-than-expecte jobs in December, but the unemployment rate edged lower than economists had anticipated.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were down modestly ahead of the opening bell. Futures measure current index values against perceived future performance. Futures had been pointing to a slightly higher open ahead of the report but turned negative after the headline number disappointed.

Wall Street has been gearing up for this report all week, keeping trading somewhat volatile as investors placed bets on whether lagging employment is starting to pick up.

"It was generally a little on the weak side -- not only relative to expectations but also relative to where jobs had been running beforehand," said Bruce McCain, chief market strategist at Key Private Bank. "While it's going to weigh on the market a little, I suspect in the end it's not going to have a huge effect given the general improvement in economic data recently."

Choppy trading is likely to continue over the next couple weeks as investors continue to digest the strong gains logged in December, he said.

On Thursday, stocks ended mixed as the dollar strengthened. Investors spent the day mulling a rise in jobless claims, and softer-than-expected same-store retail sales.

Economy: The government's monthly jobs report showed employers boosted payrolls by 103,000 last month. That was lower than expected, with a CNNMoney survey of 27 economists looking for a 150,000 gain last month.

Meanwhile, the unemployment rate dropped to 9.4% from 9.8%.

Earlier in the week, investors weighed a strong report on private sector payrolls against disappointing jobless claims data.

In the afternoon, the government will release a report on consumer credit for November. Economists predict a decline in total borrowing of $2.5 billion -- down from an increase of $3.4 billion the previous month, according to a consensus estimate from Briefing.com.

Companies: Before the opening bell, KB Home (KBH) released quarterly earnings results that beat expectations. The company reported earnings per share of 23 cents, compared to the loss of 17 cents expected by analysts surveyed by Thomson Reuters.

World markets: European stocks were lower in morning trading. Britain's FTSE 100 dipped 0.3%, the DAX in Germany edged up 0.2% and France's CAC 40 slipped 0.2%.

Asian markets ended the session mixed. The Shanghai Composite finished 0.5% higher and Japan's Nikkei ticked up 0.1%, while the Hang Seng in Hong Kong fell 0.4%.

Currencies and commodities: The dollar gained against the euro, the Japanese yen and the British pound.

Oil for February delivery rose 69 cents to $89.07 a barrel.

Gold futures for February delivery slipped $13.20 to $1,358.50 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 3.44% from 3.41% late Thursday. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |