Search News

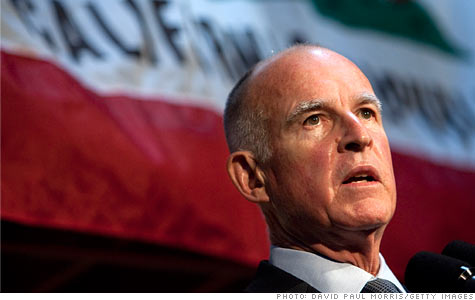

California Gov. Jerry Brown faces tough choices in closing a $25 billion budget gap.

California Gov. Jerry Brown faces tough choices in closing a $25 billion budget gap.

NEW YORK (CNNMoney) -- After years of cutting billions and billions in spending, California has to do it again.

On Monday, newly inaugurated governor Jerry Brown said he'll release a budget that slashes spending by $12.5 billion in the coming fiscal year, as the state moves to cut a $25 billion shortfall by June 30.

As part of the plan, Brown intends to cut state employees' take-home pay by 8% to 10%, and will propose a "vast and historic" restructuring of government operations.

Brown, who also served as California's governor in the 1970s and 1980s, was scheduled to lay out his plan to address the budget crisis in a press conference later Monday.

Among cuts previously announced, Brown is slashing his own office's spending by 25% or $4.5 million. This includes getting rid of the Office of the First Lady, though he named his wife, Anne Gust Brown, as an unpaid adviser. He is also eliminating an education advisory office that cost $1.9 million a year.

But those are just a drop in the bucket.

Not only must the state close a $6 billion gap before the new fiscal year begins on July 1, the governor and lawmakers must wrestle with a $19 billion deficit for fiscal 2011-12. The larger shortfall was created by $10 billion in planned spending increases and a $9 billion drop in revenues due to expiring personal income tax, sales tax and vehicle licensing fee provisions. (Another blow to state budgets: Build America bonds end)

California has endured a decade of spending cuts, said Jean Ross, executive director of the California Budget Project, a fiscal and policy analysis group.

The state's fiscal troubles largely stem from its heavy reliance on personal income taxes. This revenue stream dries up when recessions hit and unemployment soars.

California also never fully recovered from the dot-com bust earlier this decade, which led to big budget problems at the time. So the state didn't have large reserves to fall back on when the bottom fell out of the economy in 2008.

During the recession, then-Gov. Arnold Schwarzenegger made severe reductions to state-supported programs, including education and services for low-income residents, even though demand for these services were rising. The state issued IOUs for several months in 2009 after it ran short of money to issue tax refunds and pay vendors.

As a result of repeated budget cuts, school districts laid off teachers and consolidated classrooms. Universities hiked fees, setting off student protests across the state. Low-income adults lost dental care under the state's Medicaid program, known as Medi-Cal. And state workers lost three days of pay a month under a furlough program.

"We've seen very deep reductions in virtually everything the state does in California," Ross said.

While campaigning for governor last year, Brown said his philosophy is one of frugality. He noted that he vetoed pay raises for state workers twice and rejected his own salary increase while he was governor.

Last year, he pledged to cut discretionary spending at state agencies, including the governor's office, and to reduce expenses such as overtime and travel.

Brown said he would also reduce prison costs by cutting offsite medical visits and releasing elderly and terminally ill inmates who are no longer a threat to society. And he vowed to target Medi-Cal, looking to implement more managed care and intensify anti-fraud measures.

As for taxes, Californians are waiting to see whether Brown pushes to continue tax hikes that were implemented in 2009. These included a quarter-percentage point increase in personal income tax rates, which expired at the end of 2010, and a 1 percentage point bump in the sales tax, which lapses at the end of June.

Brown has said that any tax increases will have to get voters' approval. And they haven't looked favorably on tax hikes, voting down a ballot measure in November to institute an $18 motor vehicle surcharge to fund state parks and requiring new fees be approved by two-thirds of lawmakers instead of just a majority.

"The voters get to decide whether they want to live with the budget cuts or not," said Jerry Nickelsburg, senior economist with the UCLA Anderson Forecast, which monitors the California and national economies. "If they would like more government services, they'll have to vote for more state taxes." ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |