Search News

(MONEY Magazine) -- The card that landed in mailboxes throughout central Illinois in early 2008 promoted "the most informative retirement workshop you've ever attended."

Pinnacle Investment Advisers, which had four offices in the area, was offering discussions of Medicaid planning, IRAs, and tax-efficient income over lunch or dinner. Bios of Pinnacle owners Susan and Tom Cooper mention their grandchildren, his Vietnam service, and her Bible study group.

A group of seniors soon assembled at the river-front Embassy Suites in East Peoria to enjoy their free meal. There and in follow-up meetings, Susan and Tom, now 67 and 69, delivered a message that went something like this: Scared of stocks? They could help. Worried about out living your money? They had a plan for that too.

In fact, there was a product that offered the best of both worlds: returns that rise when stocks do yet are guaranteed to never be negative. And they were selling it.

Retired librarian Ruth Cline attended one of the Coopers' seminars and liked what she heard. In 2008, when she was 71, she bought what they were recommending: an indexed deferred annuity. Often referred to simply as an index annuity, it pays interest that's linked to the performance of a given investment index.

In fact, this was the second time Cline had bought one. The Coopers had sold her another six years before -- and then advised her to move out of it and into the new version. The switch slammed Cline with an early-withdrawal penalty of 16% of her $98,000 account balance, according to court papers filed by the State of Illinois.

Illinois's securities division is now pursuing a case against Pinnacle, alleging that it moved Cline and 14 other people into new index annuities they didn't need, costing the clients $208,000 in surrender fees and earning the firm $126,000 in commissions.

At hearings this fall, the Coopers said that more than $95,000 in bonuses offered by the new annuities helped make up for the surrender fees. They added that the new annuities offered features the previous ones lacked, such as riders ensuring that account balances go to heirs. The state's lawyer, David Finnigan, says those features didn't begin to justify the charges.

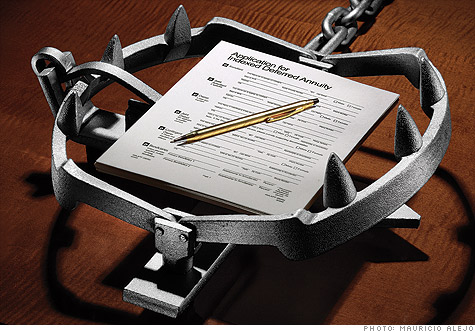

While the Coopers' case has yet to be decided, the state's allegations illustrate pervasive problems with index annuities, which were invented in the mid-'90s and have soared in popularity since the 2000 tech bubble collapsed (see box). They include:

As if that weren't enough, index annuities don't even deliver attractive returns. According to William Reichenstein, an investment management professor at Baylor University, over the long term a very conservative portfolio easily beats an index annuity. "These are very seductive products, marketed very effectively," he says, "but they almost always underperform."

What especially galls consumer advocates is that the problems with index annuities have been known for years, but insurance regulators haven't done nearly enough to stop them. According to data that 16 states provided to MONEY, index annuities accounted for 30% of annuity-related complaints to regulators in 2009, even though they represent just 13% of annuity sales. In senior-heavy Florida, it was 55% of complaints.

"When you have a market incentive to sell, sell, sell, why would anyone be surprised that there are all sorts of abuses?" says Birny Birnbaum, a former consumer representative to the National Association of Insurance Commissioners (NAIC) who worked with New York's insurance department to craft a new requirement that agents disclose compensation.

A MONEY investigation reveals why the problems with this controversial product persist -- and what you need to know to protect yourself or your parents. Such knowledge is essential because buyers who have gotten a bad deal often don't realize it.

When Illinois lawyer Finnigan summoned Cline and the other alleged Pinnacle victims to the stand in October, most didn't seem to understand why the Coopers were being accused of wrongdoing. Wasn't Cline concerned about paying some $16,000 in penalties, Finnigan asked? "No," she said. "Money I haven't seen doesn't affect me. Gasoline this morning was $2.87 a gallon. That I can comprehend."

You may be familiar with a traditional deferred fixed annuity, in which an insurance company invests your money in bonds during an "accumulation period" of seven years or so, then lets you convert your account into a stream of income payments that are guaranteed by the company. An index annuity is essentially a fixed annuity that's been juiced up by tying its interest rate to the performance of a stock market index such as the S&P 500.

If the index rises, the insurer exercises stock options it has bought against that index, and your account earns some percentage of the gain. If the index falls, you lose nothing: The insurer lets the options expire and still makes money from bond investments (where it has put the bulk of your money).

The promise of zero losses led shell-shocked investors to pour nearly $30 billion into index annuities in 2009, even as they pulled $9 billion out of U.S. stock funds.

You won't make as much as you might think, though, because the insurer caps your return and can change the cap each year. Let's say your annuity is tied to the S&P 500, and the S&P soars 20% next year. A common cap right now is 4.5% -- so that's the max you'd earn. (Over the past decade the cap has been as high as 13%.)

No matter how your account performs, the insurer will do just fine: Moving around the cap lets the insurer preserve its spread, typically 2% to 3% of assets a year, to cover its costs and make a profit.

Those expenses -- plus the fact that you don't benefit from dividends in an index annuity as you would in stocks or a stock fund -- put a major drag on returns.

For the five years ended in September, the average index annuity paid an annualized 3.89%, barely better than the 3.81% you would have earned in a five-year CD and appreciably worse than the 5.1% paid by taxable bond funds, according to the research firm Advantage Compendium.

A typical index annuity would have lagged an investment portfolio with equivalent risk -- 85% one-month Treasury bills, 15% U.S. large-cap stocks -- by nearly two percentage points annually, on average, over the past 44 years. That's according to recent analysis by Baylor's Reichenstein, who has been an expert plaintiff's witness in a lawsuit involving these products.

In only two of the past 44 rolling 10-year periods would the most widely sold index annuity have beaten that 85% T-bill/15% stock portfolio, says Reichenstein. For performance comparisons during various market conditions, see the chart on page 142.

Sellers often tout the fact that money in index annuities grows tax deferred. But 58% of buyers hold these products in tax-deferred accounts such as IRAs anyway, according to industry researcher LIMRA.

Even if you had held Reichenstein's conservative portfolio outside a tax-favored account and were in the highest 35% income tax bracket, after the IRS took its cut you would have beaten the index annuity in 39 of 44 rolling 10-year periods, assuming you used low-cost Vanguard funds with current expenses.

Insurers respond that index annuities provide benefits that most investment products don't. One is the option to annuitize payments, thereby getting guaranteed income for life -- increasingly a more valuable feature to buyers than potential returns, according to Gary Bhojwani, CEO of market leader Allianz Life.

Another benefit is ironclad safety. Annuity buyers are willing to trade off a higher return, return, he says, for the guarantee of never experiencing a negative one. "None of our customers have lost a penny of principal," Bhojwani adds.

However, there are other ways of getting guaranteed lifetime income (more on that later). And FDIC-insured CDs -- or Treasuries held to maturity -- provide equivalent or better safety.

"The costs and onerous terms of an index annuity aren't enough to compensate for the minimal extra return you get over a CD," says financial planner Charles Fitzgerald, a director of the Financial Planning Association of Florida.

Moreover, you can lose principal in an index annuity -- lots of it -- if you cash out too soon.

Virtually all annuities impose penalties if you exit early, to recoup commissions and other costs that the insurer pays upfront. But index annuities carry the steepest and longest-lasting ones: an average of 12.5% to start, compared with 7.5% for the typical plain-vanilla fixed annuity, declining gradually for up to 16 years.

Josephine Passanisi, a retired small-business owner from the suburbs of Palm Beach, Fla., says she learned about such penalties too late. In 2005, when she was 70, she gave agent Larry Krakow $275,000 -- most of her life savings -- to invest in an Allianz index annuity. (Like the vast majority of agents who sell these products, Krakow was independent -- that is, he earned a commission from the insurer but was not an employee.)

Passanisi says Krakow never explained that she was locking up her money for 15 years, until she was 85; she never wanted to do that. To get it back, she'd pay a 12.5% penalty. "He told me I would be able to sleep at night," Passanisi says. "But I couldn't sleep nights anymore."

After she complained to the State of Florida, regulators suspended Krakow's license; in 2008, Allianz refunded her money in full. Krakow told MONEY that Passanisi understood the terms and was fine with her purchase until a competing agent started criticizing it.

Insurers say that index annuities are meant to be held over the long term. However, in the wake of complaints like Passanisi's, they have added provisions to most new index annuities that allow you to take out up to 100% of your money penalty-free if you are diagnosed with a terminal illness or enter a nursing home. (Some states also cap surrender charges, usually at around 10%.) That's a positive step but doesn't go far enough, says Brenda Cude, a consumer economics professor at the University of Georgia.

How many index annuity owners wind up paying early-withdrawal penalties? No industry statistics exist. But Karrol Kitt, a personal finance professor at the University of Texas and a consumer representative for the NAIC, says that a look at insurers' books implies the numbers are significant.

For example, in 2009 American Equity Investment Life, which does 92% of its business in index annuities, collected $63 million in surrender penalties -- equal to more than half its $101 million operating income.

Part of what sold Passanisi on her annuity, she says, was that Krakow told her she would get a $27,500 upfront bonus. Roughly half of index annuities offer such bonuses, usually totaling 5% to 10% of the amount you put in, as a way to encourage people to buy.

But "bonuses are never free," says Jack Marrion of Advantage Compendium. They always come with tradeoffs such as higher surrender fees or lower caps on returns, he says. And you typically have to satisfy certain requirements -- such as refraining from cashing out early -- or you forfeit all or a portion of the bonus. You might get dinged even more than the bonus amount.

Index annuities come in mind-boggling permutations. Not only can you split your money among as many as six different indexes, but you can choose among several interest-calculation formulas. For example, you can base your rate on the year-to-date change in each index (subject to a cap). Or you can have your rate calculated monthly (with different caps) and added together. Or, with certain products, you can let one part of the money earn a fixed rate the first year and another rate through the eighth year.

Why so complicated? Says John Currier, at Aviva, the second-largest index annuity seller: "Customers like choices." But Kitt believes that index annuities are confusing by design. "Consumers don't have the sophistication to understand them," she says.

Even some large insurers aren't fans. MetLife and New York Life say index annuities' complexity is one reason they decided not to sell them. "With all of the moving parts that affect how these products ultimately perform," says John Meyer, who runs the individual annuities division for New York Life, "we felt there was a high likelihood that clients could misunderstand what they were getting and possibly end up being disappointed."

Executives at the major index annuity sellers, including Allianz's Bhojwani, say that in recent years their companies have improved the way index annuities get explained to buyers. Bhojwani adds, "Specialists call customers older than 75 to make sure they understand everything they've bought." (Buyers can cancel the deal within a certain number of days that varies by state.)

Celina and Alberto Grubicy, a retired couple from Vero Beach, Fla., were too young to have gotten such a call. In 2007, when Celina was 66 and Alberto 65, they bought two Allianz index annuities totaling $1.1 million from agent Mitchell Storfer. The terms of each annuity were spelled out in the contract, but "the contract [might as well have been written in] Chinese," says Celina. "So we relied on what the agent told us."

One of the things Storfer did, according to Florida regulators, was misrepresent the interest-rate calculation, leading the Grubicys to believe that they could earn much more than they actually could -- up to 36% a year, the couple says.

After investigating the Grubicy case and two more like it, Florida revoked Storfer's license to sell insurance products. Storfer, who is appealing (the state is allowing him to sell to people under age 55 pending appeal), says that he did explain the terms correctly and that the Grubicys signed forms saying they understood them. Allianz refunded the Grubicys' money.

Stories like these aren't unusual, says Kitt, because even the agents themselves often don't understand how index annuities work.

In Arizona, 39% of index annuity complaints in 2008 and 2009 claimed agents "misrepresented" the product -- whether owing to honest mistakes or fraud. Most insurers offer training in index annuities but don't require the agents to complete it. (Some states do mandate training, as do a few insurers. For example, Allianz began requiring it in 2008 after a spate of lawsuits.)

And though most states have continuing-education requirements for agents, "much of it is about how to sell, not how the products work," says Tony Bahu, a former agent who evaluates annuities contracts for consumers for a fee.

An agent can make nearly twice the commission from an index annuity than from a plain-vanilla one -- an average of 6.8% vs. 3.5%, reports Advantage Compendium and Beacon Research. And there are often extra incentives on top of that. For example, Allianz offers a percentage point over its standard 7% if agents meet certain sales targets, plus it gives "credits" that agents can exchange for trips, TVs, and other prizes.

Allianz senior vice president Tom Burns says that the company must pay such commissions to induce agents to sell its products rather than those of competitors. Matthew Gaul, deputy superintendent for life insurance at New York's insurance department, sees another motive: "There's no question the incentives insurance companies pay are designed to influence the advice agents give."

In the worst cases, says Birnbaum, those tempting commissions encourage agents to move customers from one index annuity to another, even if doing so racks up big surrender fees.

In 2008 one of every three fixed annuities (which includes index annuities) sold replaced an existing annuity, according to a MONEY analysis of regulatory data from 25 states. In some, including Washington and Utah, it was as high as 40%. States don't track how many of those surrenders involved penalties. But Kim Shaul, Wisconsin's deputy insurance regulator, says, "In most cases, annuity replacements aren't right for the customer."

Remember those "informative" free-meal seminars mentioned earlier? Typically the purpose of such meetings is not to educate but to sell, according to Andres Castillo at AARP, which monitors them. And many are organized not by the agents but by unregulated firms that have become key players in the marketing machine for index annuities -- and for insurance products in general.

More than 600 of these firms have sprung up to help independent agents promote themselves, find prospects, and land the sale. They're the ones printing the fliers, booking the conference rooms, and buying the seniors' steak dinners. What troubles Barry Lanier, head of investigations for Florida's insurance agent division, is that "some [of these firms] have been influential in teaching agents less honorable ways of selling."

For example, Annuity Service Center was disciplined by Illinois regulators in 2008 for mailing postcards inviting recipients to get in touch about a possible annuity that had reached the end of its surrender period. According to the state's complaint, the firm had no idea whether recipients actually owned an annuity; it was fishing for customers and would go on to schedule sales calls for agents. The company was ordered to pay a $15,000 fine and is no longer in business.

Marketing firms are paid sometimes by agents, but more often by insurers -- around 1% of each sale they help the agent land. After all, it's in the insurers' interest to keep sales humming. In fact, some of the marketing firms are owned by insurers outright. Allianz, which owns nine of the 30 marketing firms it works with, says that it recently installed "suitability officers" at each of those nine firms to ensure agents' sales methods are proper.

Index annuities are regulated by 51 different state insurance departments, many of which don't try as hard as they could to screen out crooks. While everyone who applies for a securities license must undergo an FBI background check with fingerprinting, only 17 states ran such checks for would-be agents as of March 2009, according to a recent Government Accountability Office report. (The main reason, says the GAO: lobbying. The insurance industry is the nation's sixth-largest political giver.) After Texas began doing the checks in 2007, the number of applicants it discovered with criminal histories rose 36%.

Nor are the regulators very good at communicating with one another. Over the past five years FINRA (the securities industry's self-regulatory body) has yanked the securities licenses of more than 1,800 brokers for serious misdeeds, such as falsifying documents and stealing clients' money.

But 16% of those people currently have active insurance licenses, according to a MONEY analysis -- meaning they're free to sell index annuities, which are legally classified not as investments but as insurance products. In Florida and Massachusetts the percentage tops 35%. "That's alarming," says Missouri Securities Commissioner Matt Kitzi, who heads the national securities association's enforcement committee.

By the way, the only reason Illinois securities lawyers were able to bring the case against Pinnacle is that the firm is a registered investment adviser and therefore subject to their oversight.

The chorus of complaints about index annuities has led the SEC to try to reclassify them as investments. While such a change probably wouldn't result in major reform, it would offer buyers stronger protections from fraud and conflicts of interest.

But when details of last year's massive financial reform bill were being hammered out, Democratic Sen. Tom Harkin slipped in an amendment affirming that index annuities are not securities -- and therefore are out of the SEC's reach. Harkin is from Iowa, home of five big index annuity sellers. "The assumption that the SEC is inherently better suited to [regulate index annuities] is incorrect," says Harkin.

To bolster his case, he points to the latest annuity suitability legislation drafted by the NAIC last year. It would strengthen requirements on insurers to sell fairly and to train agents -- requiring, for example, product-specific training and adding a one-time four-hour annuity course.

Consumer advocates, who had wanted twice as much annuity education, say that the legislation doesn't go far enough. And Birnbaum contends that it doesn't address the core problem: commissions. "If we ignore the financial incentives and instead layer on a bunch of vague responsibilities," he says, "we're not getting at the fundamental issue."

What's more, the states still need to pass the proposal before its provisions take effect. Making that happen is "my No. 1 goal," says Iowa insurance commissioner Susan Voss, the incoming NAIC president. If history is any guide, though, it will be a long wait. According to the NAIC, as of April, 17 states had still not passed 2003 and 2006 versions of the law.

If you or your parents are about to retire and find the benefits of an index annuity appealing -- namely, a safe return with some upside if the market does well, plus the ability to generate income -- you can easily put together a portfolio that gives you those benefits without all the negatives, financial planners say.

For equivalent safety, Baylor's Reichenstein suggests putting 85% of your money into FDIC-insured bank CDs and 15% into a low-cost S&P 500 index fund such as the Vanguard 500 Index (VFINX). "There's never been even a three-year period since 1957 where this portfolio has lost money," he says.

And when you're ready to receive income, you might turn to an immediate annuity. You hand over a lump sum and right away this product starts paying a fixed, guaranteed amount each month for as long as you live.

Because you give up control of that money for good, limit the amount you put in. MONEY retirement columnist Walter Updegrave suggests that you put in just enough so that the income the annuity throws off -- plus income from your pension and Social Security -- is sufficient to cover all or most of your basic living expenses. Keep the rest of your money invested in a diversified portfolio. This strategy can give you more for your money than you could get from an index annuity.

To shop for an immediate annuity that pays you the most income, go to immediateannuities.com. For example, at Mutual of Omaha, $100,000 could buy a 65-year-old man $641 a month.

Unfortunately, that advice comes a little late for Ruth Cline. Even if Illinois wins its case against Pinnacle -- a ruling isn't expected before spring -- it's unclear whether she would get her surrender fees refunded. Her best shot at coming out ahead: Choose to collect her money as monthly payments for life -- and live a very long time.

With additional reporting by Holly Gilbert and Jasmin Sun contributed to this article. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |