Search News

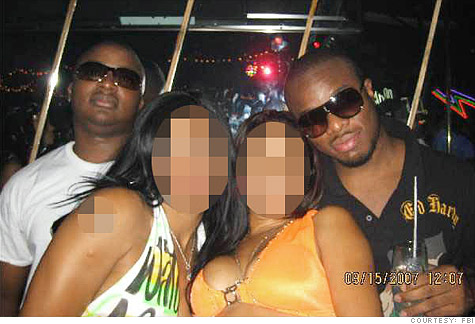

Tobechi Onwuhara (right) at a Dallas nightclub with Ezenwa Onyedebelu.

Tobechi Onwuhara (right) at a Dallas nightclub with Ezenwa Onyedebelu.

FORTUNE -- A luxury suite at the W Hotel in Dallas is as good a place as any to conquer the world. At least it seemed that way in 2007 when Tobechi Onwuhara got the crew together. They'd meet there often, seven or eight of them. Some had nicknames from the Ian Fleming lexicon: C, Q, and E. Others were called Mookie, Orji, Uche. They would spread out on designer sofas and at the wet bar, open three-ring binders, and fire up laptops with hard-to-trace wireless cards. On a nearby table there'd be prepaid cellphones with area codes taped to them. A phone for Southern California. A phone for Northern Virginia. A phone for any place Onwuhara had found the "good money."

In those days, the good money wasn't hard to find. The housing boom had flooded the country with capital. Lenders were making promiscuous loans to unsophisticated borrowers. It was an ideal environment for Onwuhara, 27, a brilliant, pug-faced visionary who favored True Religion jeans and Ed Hardy shirts. Looking out over the neon skyline of downtown Dallas, it was easy for the crew to believe his assurances: He'd make them rich. When the sun glinted off one of his $100,000 diamond-encrusted Audemars Piguet watches, who could doubt it? Every few months he would buy a new Maserati or Bentley. He owned expensive properties in Miami, Dallas, and Phoenix. He even had a secret love condo in the W, where scantily clad women visited in such numbers that one bellhop became convinced that the first-generation Nigerian-American was a porn director.

The truth was very different. In his ancestral homeland, Onwuhara might have been a chief. In America he became one of the world's most successful cyberscammers, a criminal genius who used his talents to filet a poorly regulated banking and credit system. In less than three years Onwuhara stole a confirmed $44 million, according to the FBI, which believes the total may be anywhere from $80 million to $100 million. All he needed was an Internet connection and a cellphone.

Onwuhara called it "washing." He'd set up a boiler room in a fancy hotel (the Waldorf-Astoria was another favorite) to wash information on wealthy victims. Then he'd wash bank accounts. One group in his crew would do online research using databases and websites to harvest names, dates of birth, and mortgage information. They'd build profiles of victims for a second group, who would call banks posing as account holders. The callers cadged security information and passwords. Then Onwuhara would breach the accounts and wire funds from them to a network of money mules he had established in Asia. The money would be laundered and wired back to his accounts in the U.S.

"I call it modern-day bank robbery," says FBI special agent Michael Nail. "You can sit at home in your PJs and slippers with a laptop, and you can actually rob a bank."

Onwuhara specialized in hitting home equity lines of credit (HELOCs), the reservoirs of cash that banks make available to homeowners. Once Onwuhara gained access to a HELOC, he could siphon out vast sums in seconds. His weapon was persuasion. It got him enough money to start building a colonnaded fortress in Nigeria; enough to gamble at the high-stakes tables in Vegas casinos all night. Even his accomplices appear not to have known how much he was really pulling down -- not even his beautiful fiancée, Precious Matthews.

"He was playing all of us," says Paula Gipson, a member of the crew. "The banks, us, Precious, everybody."

Conversations with Gipson and other Onwuhara associates, interviews with his family and with investigators, and hundreds of pages of court documents reveal a digital scavenger of extraordinary creativity and guile. Onwuhara orchestrated his swindles using information about homeowners that is widely available online. In fragments, this information is innocuous. When assembled properly, it can be used like an electronic skeleton key to get into almost any credit account. Onwuhara needed only a few short years to rack up an illicit fortune. And he's still at large.

Read the full version of how Onwuhara did it ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |