Search News

Click the chart for more exchange rates.

Click the chart for more exchange rates.

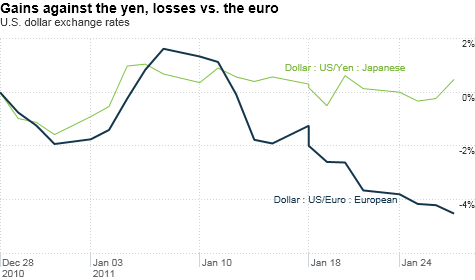

NEW YORK (CNNMoney) -- The dollar gained some traction against the Japanese yen Thursday, but it's still in the dumps against the world's other major currencies.

A surprise downgrade of Japan's debt sparked a rally in the U.S. dollar versus the yen Thursday, sending the buck up 1% to ¥82.98 in morning trading.

Because the downgrade ate into confidence about Japanese bonds, investors fled to the greenback as a safer alternative.

But that so-called "flight to quality" trade comes during the same time that investors have been fleeing from the dollar on renewed optimism about Europe's debt crisis.

Investors are starting to speculate that the European Central Bank may raise interest rates sooner than originally expected, and that has sent the euro rallying 6.4% against the dollar, to $1.37 since Jan. 7.

"European officials have been making the right noises about trying to get ahead of the curve of market expectations," said Marc Chandler, global head of currency strategy for Brown Brothers Harriman.

Meanwhile, there's a stark contrast between the hawkish comments out of Europe's monetary policy leaders and the Federal Reserve's stance on U.S. inflation.

The Fed released an anticlimactic statement on Wednesday, saying it plans to keep interest rates at historic lows for an "extended period" and follow through with all $600 billion of its controversial bond-buying program to stimulate the economy.

Currency traders fear that that policy, referred to as quantitative easing, could spur long-term inflation and devalue the dollar.

Meanwhile, weak economic data on Thursday morning helped fuel even further pessimism about the greenback.

Weekly jobless claims rose more than expected, signaling continued weakness in the job market, and orders for durable goods slipped 2.5% in December, when economists had expected an uptick.

"The dollar's weakness... shows that investors were disappointed by this morning's U.S. economic reports which reinforced the realistic possibility that the Federal Reserve could be one of the last central banks to raise interest rates," Kathy Lien, director of currency research for Global Forex Trading, wrote in a research note. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |