Search News

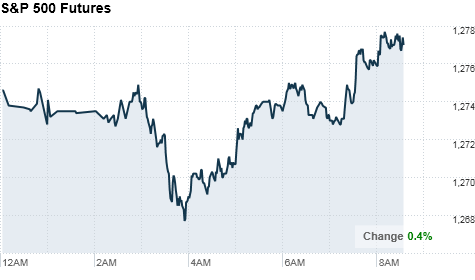

Click chart for more pre-market action.

Click chart for more pre-market action.

NEW YORK (CNNMoney) -- U.S. stocks were headed for a higher open Monday, with strong earnings from Exxon Mobil outweighing investor worries about growing political unrest in Egypt.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were higher ahead of the opening bell. Futures measure current index values against perceived future performance.

On Friday, stocks logged their biggest drop in months, as mounting political protests and tensions across Egypt sparked caution among investors -- sending the CBOE volatility index (VIX), known as the VIX and used to gauge fear in the market, more than 24% higher.

The Dow Jones industrial average lost 166 points, marking a sharp retreat for the index after it flirted with the 12,000 barrier earlier in the week.

Protests in Egypt continued over the weekend, leading Moody's Investors Service to downgrade its rating on the nation's debt to "negative" from "stable".

But Tom Winmill, portfolio manager at Midas Funds, said the worst may be over when it comes to the impact of Egypt's unrest on U.S. markets.

"While there's still a lot of uncertainty regarding the outcome of the Egypt political crisis, this might be the end of the scare," he said. "It looks like a very good buying opportunity, because once the situation is resolved I think markets will resume their upward trend."

But Egypt won't be the last country to fuel worries about political and economic situations abroad, said Winmill.

"I think we'll see a lot more civil unrest as economic situations become intolerable to the general populations," he said. "By the end of the week, I think there will be a resolution and happiness will reign supreme in the markets. But let's be prepared for the next one, because there will certainly be another crisis in another developing country."

World markets: Ongoing tensions, along with Moody's downgrade, hit world markets early Monday.

European stocks hovered around breakeven during mid-morning trade. Britain's FTSE 100 and the DAX in Germany were flat, and France's CAC 40 rose 0.3%.

Asian markets ended mixed. The Shanghai Composite gained 1.38%, but the Hang Seng in Hong Kong dropped 0.7% and Japan's Nikkei tumbled 1.2%.

Companies: Exxon Mobil (XOM, Fortune 500) beat expectations from analysts in a fourth-quarter report issued before the open.

The world's largest publicly traded oil company logged earnings of $9.25 billion, or $1.85 a share, up 46% from $6.05 billion, or $1.27, a year earlier.

Analysts surveyed by Thomson Reuters had expected earnings per share of $1.63. Revenue climbed 17% to $105.2 billion, beating forecasts for sales of $99.1 billion.

Exxon's stock rose 1% in premarket trading.

Over the weekend, Massey Energy (MEE) was acquired by rival Alpha Natural Resources in a $7.1 billion deal. Shares of Massey jumped 13% in pre-market trading Monday.

Economy: The Commerce Department reported personal spending slightly outpaced expectations last month, but personal income fell short of the forecast.

Personal income rose 0.4% in December, following a gain of 0.4% in November. Personal spending rose 0.7% in December, following a gain of 0.3% in November.

Economists expected personal income to rise 0.5% in December, according to a consensus survey from Briefing.com. Personal spending was forecast to rise 0.6%.

After the opening bell, a closely watched report on manufacturing activity in the Chicago area will be released. Analysts expect growth to slow slightly. The index is forecast to slip to a reading of 65, from 66.8 in the previous month.

The most closely watched report of the week comes Friday, when the government releases its January jobs data.

"If we get positive news there, the market could react strongly if it shows that the stimulus is working and there has been a further recovery in the U.S. economy," Winmill said.

Currencies and commodities: The dollar fell against the euro, the British pound and the Japanese yen.

Oil for March delivery rose 18 cents to $89.52 a barrel.

Gold futures for February delivery fell $13.20 to $1,338.80 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 3.35% from 3.33% late Friday. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |