Search News

Click chart for more pre-market action

Click chart for more pre-market action

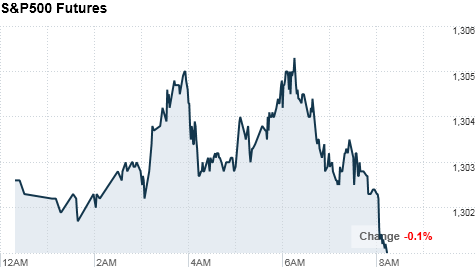

NEW YORK (CNNMoney) -- U.S. stocks were poised for a slightly weak open Wednesday, as investors sideline worries about Egypt, and focus on corporate earnings and the labor market.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were slightly lower of the opening bell. Futures measure current index values against perceived future performance.

U.S. stocks started February with a bang Tuesday. The Dow and S&P 500 closed above key psychological levels for the first time in more than two years, with the Dow finishing above 12,000.

As long as traffic remains uninterrupted through the Suez Canal, then the unrest in Egypt and Jordan are unlikely to drag down international markets, said Peter Cardillo, chief market economist for Avalon Partners. But he said that Wall Street is more focused on the U.S. labor market right now.

Before the market open, outplacement firm Challenger, Gray & Christmas said employers had plans to cut 38,519 jobs in January, a 20% increase over February. In December, planned layoffs totaled 32,004; the lowest monthly figure since June 2000.

Also, a report from payroll services firm ADP reported job growth for January that was much stronger than expected.

Hamed Khorsand, analyst at BWF Financial, said that investors were "taking some money off the table" following Tuesday's strong performance on Wall Street. He said there wasn't any positive news on Wednesday "spectacular" enough "to give some enthusiasm to the markets."

All of these reports are a precursor to Friday's big monthly jobs report. The U.S. Labor Department is expected to report a 148,000 job increase in January, compared to 113,000 the prior month. Unemployment is expected to have notched up to 9.5% in January, compared to 9.4% the prior month.

Economy: Meanwhile, the U.S. government's weekly crude oil inventories report and readings on mortgage applications are on tap for Wednesday morning.

In Washington, the Senate Budget Committee will meet for the second day of hearings on the economic outlook, tax reform and challenges to the economic recovery.

Companies: Time Warner (TWX, Fortune 500) posted fourth-quarter earnings Wednesday that beat Wall Street expectations, driven in part by a recovering advertising market. Shares of Time Warner, the parent of CNNMoney and Fortune, edged up about more than 3% in premarket trading.

Shares of video game company Electronic Arts (ERTS, Fortune 500) jumped nearly 10% in premarket trading, a day after they reported a 75% jump in quarterly earnings and announced a stock buyback.

Shares of Southwest Airline (LUV, Fortune 500) also slumped more than 15% in premarket trading.

Toyota (TM) shares gained more than 2% in pre-market trading, after reporting almost 24% rise in January sales Tuesday. The Japanese automaker also said late Tuesday that it is offering "voluntary exit packages" to certain employees, as part of a restructuring plan.

Shares of Borders Group (BGP) plunged more than 35% Tuesday before the market close, and fell 10% in pre-market trading Wednesday on a report claiming the company will file for bankruptcy.

After the closing bell, Visa (V, Fortune 500) is expected to report earnings per share of $1.21 on revenue of $2.23 billion.

World markets: European stocks were slightly higher in morning trading. Britain's FTSE 100 ticked up 0.6%, while the DAX in Germany and France's CAC 40 slipped about 0.3%.

Asian markets ended the session with gains. The Shanghai Composite edged up 0.3%, while the Hang Seng in Hong Kong and Japan's Nikkei both rallied 1.8%.

Currencies and commodities: The dollar fell against the British pound, but rose versus the euro and the Japanese yen.

Oil for March delivery was practically unchanged, slipping 9 cents to $90.68 a barrel.

Gold futures for April delivery fell $1.50 to $1,338.80 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 3.41% from 3.44% late Tuesday. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |