Search News

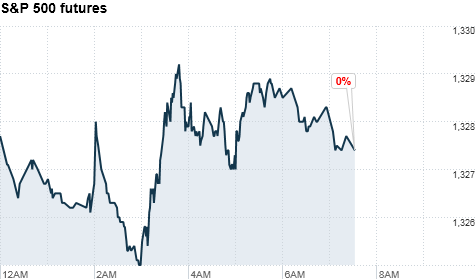

Click the chart for more premarket data.

Click the chart for more premarket data.

NEW YORK (CNNMoney) -- U.S. stocks were headed for a flat opening Tuesday, as investors digested a weaker-than-expected report on January retail sales.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were little changed ahead of the opening bell. Futures measure current index values against perceived future performance.

Stocks ended Monday's session mixed, as investors digested President Obama's 2012 budget proposal in a quiet trading session. The $3.7 trillion budget request would cut the nation's long-term deficit by about $1.1 trillion, over the next 10 years.

The market has been moving gradually higher this year, amid expectations of an improving economy. The S&P 500 is up nearly 6% so far in 2011.

"Despite inflation problems in emerging markets, political turmoil and ever higher commodity prices, the market continues to grind higher," said Bruce McCain, chief investment strategist at Key Private Bank.

While the advance has not been "hyperbolic," he said investors continue to have a strong appetite for stocks and that "for now the trend is higher."

Economy: The Commerce Department said retail sales rose 0.3% in January, down from an increase of 0.5% in December. Sales were expected to have gained 0.5% in January, according to consensus estimates from economists surveyed by Briefing.com.

Sales, excluding autos and auto parts, also rose to a weaker-than-expected 0.3% -- compared to a 0.5% increase in ex-auto sales in December. Economists had forecast a rise of 0.6% in the measure for January.

The price index for U.S. imports increased 1.5% in January, the U.S. Bureau of Labor Statistics stated. The report cited higher prices for fuel and nonfuel imports as contributors to the advance. U.S. export prices rose 1.2% in January, following increases of 1.5% in November and 0.6% in December.

After the opening bell, the National Association of Homebuilders is scheduled to release its preliminary housing market index for February. The index is forecast to rise to 17, up from 16 the previous month.

Companies: Sirius XM Radio (SIRI) reported a loss of 2 cents per share in the fourth quarter, and issued a 2011 sales outlook that was slightly below analysts' expectations. Shares were down 3% in premarket trading.

Shares of Netflix (NFLX) fell 1.5% in premarket trading, a day after the stock rose to an all-time high. Chipmaker Qualcomm (QCOM, Fortune 500) said Monday it is developing a new platform to bring Netflix and other video streaming services onto Google (GOOG, Fortune 500) Android-enabled smartphones.

Hotel chain Marriott (MAR, Fortune 500) announced late Monday plans to split into two separate, publicly-traded companies. Under the plan, Marriott will spin off its timeshare operations and development business, as a new independent company. Shares were up 4% before the bell.

After the closing bell, Dell (DELL, Fortune 500) will report its quarterly results. Analysts surveyed by Thomson Reuters expect the company to report earnings per share of 37 cents, on $15.71 billion in revenue.

World markets: European stocks were mixed in morning trading. Britain's FTSE 100 ticked fell 0.1%, the DAX in Germany gained 0.1% and France's CAC 40 added 0.4%.

China's consumer price index rose 4.9% in January, up slightly from 4.6% growth in December, according to data released by the Chinese government Tuesday morning.

Asian markets ended the session mixed. The Shanghai Composite was flat and the Hang Seng in Hong Kong slid nearly 1%, while Japan's Nikkei added 0.2%.

Currencies and commodities: The dollar fell against the euro, the Japanese yen and the British pound.

Oil for March delivery gained 41 cents to $85.22 a barrel.

Gold futures for April delivery rose $8.70 to $1,373.60 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury was unchanged, with the yield at 3.61%. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |