Search News

Click the chart for more on bonds.

Click the chart for more on bonds.

NEW YORK (CNNMoney) -- Bond yields are continuing their pullback, as political upheaval in Libya dominates headlines and pushes oil prices above $100 a barrel.

Civil unrest in Libya has entered its 10th day, fueled by citizens protesting dictator Moammar Gadhafi's 42-year reign and high unemployment. Libya is Africa's third-largest oil producer and sits atop the continent's largest reserves.

Political unrest tends to send bond prices higher, as investors look for safer investments backed by the U.S. government. Bond prices and yields move in opposite directions.

"Like everyone else, bond investors' eyes are on Libya and the price of oil," said David Coard, head of fixed-income trading at The Williams Capital Group.

Oil prices held firmly above $100 a barrel Thursday, after briefly breaking the barrier the previous day. Earlier in the morning, the U.S. benchmark oil contract for April delivery jumped 3.2%, to $101.41 a barrel. Just last week, crude prices were trading below $90 a barrel.

"The uncertainty and volatility in other markets is making safe-haven investments even more attractive," Coard said. "Obviously we're still looking at how events unfold, but everyone's concerned about the overall picture in Libya and the Middle East."

Pro-democracy protests have rippled through Bahrain, Iraq and Tunisia as well -- following the political protests that have continued in the streets of Egypt, since January 25.

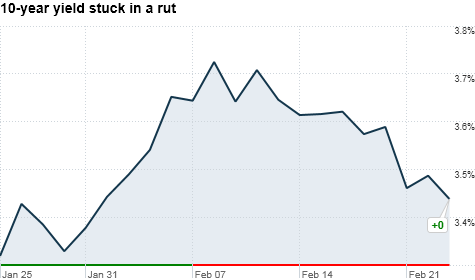

The 10-year Treasury yield has been stuck in a two-month-long rut at 3.5%. It finally showed signs of breaking out before the Middle East protests began to spread. But the benchmark note's yield -- which affects interest rates on everything from savings accounts to home loans -- has struggled to move much higher than 3.6%.

"Whenever you've got turmoil and uncertainty, it's hard to say what makes sense for Treasuries," Coard said. "If we didn't have this flight to quality, I think we would see higher yields."

What yields are doing: Treasury yields for the 30-year note fell to 4.52%, the 2-year held steady at 0.54%, and the 5-year note dropped to 2.16%.

The 10-year Treasury's yield was at 3.42% in afternoon trade, down from 3.49% late Wednesday. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |