Search News

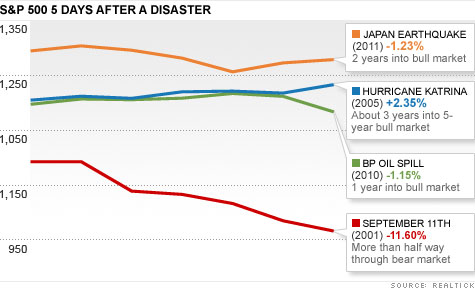

U.S. markets have reacted very differently to various disasters over the years. Click the chart for more market data.

U.S. markets have reacted very differently to various disasters over the years. Click the chart for more market data.

NEW YORK (CNNMoney) -- Once again, investors will focus their attention abroad this week on the crises in Libya and Japan.

Stocks took a beating last week as the tragic Japanese earthquake quickly became a potential nuclear catastrophe, sending investors fleeing into safer investments. The Dow fell 1.5% last week while the S&P 500 fell 1.9% and Nasdaq composite dropped 2.7%.

The uncertainty surrounding Japan's currency and the possibility of more supply shortages for companies led worried investors to pull out of stocks. Last week General Motors said it would shut down production at one Louisiana plant due to the earthquake.

On Friday, world leaders from the Group of 7 leading economies orchestrated a Japanese yen intervention.

"This market has been so dominated by Japan, it's hard to see anything outside of that influencing investors at the moment," said Bill Stone, chief investment strategist with PNC Financial.

Developments in Libya will also play a big role in the markets this week. On Saturday a coalition of United States, United Kingdom and French forces launched air strikes against Gadhafi forces to protect Libyan civilians. But in a televised speech, Libyan leader Muammar Gadhafi remained defiant and referred to the allied military as "terrorists."

On Friday stocks rose in part because Gadhafi had announced a cease-fire with rebels which failed to materialize. Additionally oil prices declined on that news.

The upcoming week's economic agenda is thin, with only a few notable reports like durable goods and initial jobless claims out later in the week.

U.S. corporate earnings will once again be in focus for investors. Companies scheduled to report next week range from electronics retailer Best Buy to smartphone maker Research in Motion and software giant Oracle.

Jack Ablin, chief investment officer for Harris Private Bank, said he's looking forward to seeing Best Buy's results because of its exposure to changes in U.S. consumer behavior.

"The biggest mystery right now is how U.S. consumers are responding to higher gas prices," Ablin said. "Best Buy is a good company to watch to get a feel if consumers are cutting back."

Monday: Luxury company Tiffany & Co. (TIF) will report its results before the opening bell. The jewelry company, famous for its blue boxes, is expected to post a profit of $1.39 a share, up from $1.09 a share last year.

The National Association of Realtors will release its February existing home sales data at 10 a.m. ET. Economists on average expect existing home sales will fall to 5.05 million annualized units for February compared with January's 5.36 million units.

Japanese markets will be closed on Monday in observance of a national holiday.

Tuesday: Retailers Dollar General (DG, Fortune 500), Express (EXPR) and Walgreen (WAG, Fortune 500) will issue their results before the bell. Also reporting Tuesday is cruise line operator Carnival (CCL) and investment bank Jefferies (JEF).

After the closing bell, investors will get results from software maker Adobe Systems (ADBE) and credit card company Discover (DIS, Fortune 500).

There is no major economic data out on Tuesday.

Wednesday: Cereal maker General Mills (GIS, Fortune 500) will report its results before the bell. Analysts expect General Mills to have a profit of 56 cents a share

Investors will get February new home sales figures from the Census Bureau at 10 a.m. ET. Economists are looking for 288,000 annualized units for February, up slightly from 284,000 units in January.

Thursday: Analysts expect the Best Buy (BBY, Fortune 500) to earn $1.85 a share for its first quarter, according to Briefing.com.

Other names reporting before the opening bell include video game retailer GameStop (GME, Fortune 500), homebuilder Lennar (LEN) and food processor ConAgra (CAG, Fortune 500).

After the bell, software giant Oracle (ORCL, Fortune 500) and smartphone maker Research in Motion (RIMM) will post their results. Analysts expect RIMM to earn $1.75 a share while Oracle is expected to earn 49 cents a share.

The bulk of potentially market-moving economic data will be out on Thursday. The Labor Department will release its weekly jobless claims report while the Commerce Department will issue its February durable goods report at 8:30 a.m. ET.

Economists on average expect durable good orders rose 0.9% in February compared with the 3.2% rise posted in January. Initial jobless claims are expected to remain roughly unchanged at 384,000 claims.

Friday: Homebuilder KBHome (KBH) is scheduled to report before the opening bell.

Wall Street will get the third and final reading of fourth-quarter U.S. gross domestic product. It's not expected to change much, with economists looking for 4Q GDP to be increased 0.1 percentage points to 2.9%.

Also out Friday is the University of Michigan's consumer sentiment survey for March. The market expects a reading of 68.0. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |