Search News

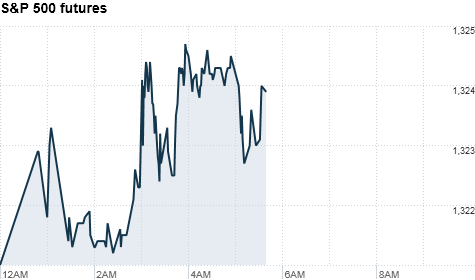

Click chart for more premarket data.

Click chart for more premarket data.

NEW YORK (CNNMoney) -- U.S. stocks were poised to open the second quarter higher, following the government's stronger-than-expected jobs report -- one of the most closely-watched economic indicators on Wall Street.

The report showed a gain of 216,000 jobs in March -- easily topping forecasts. The unemployment rate dipped to 8.8% -- its lowest level in two years.

Investors were also digesting a new offer for the NYSE (NYX, Fortune 500) from Nasdaq (NDAQ) and ICE (ICE).

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were higher ahead of the opening bell. Futures measure current index values against perceived future performance.

"The revival in U.S. economic growth is resilient enough to withstand the shocks that we've been hit with like higher oil prices and concerns out of Japan," said Lakshman Achuthan, managing director of the Economic Cycle Research Institute.

"Even if something new came along, it wouldn't necessarily just tank the economy," he said. "The markets are probably getting a sense that the first quarter was not a bad quarter."

On Thursday, U.S. stocks ended the day narrowly mixed, but stocks posted solid gains the first three months of the year, despite geopolitical turmoil in the Middle East and the March earthquake and nuclear crisis in Japan.

Companies: Nasdaq and IntercontinentalExchange offered $42.50 a share, or $11.3 billion, for NYSE Euronext, topping the bid from rival Deutsche Boerse by nearly 19%. Shares of NYSE rose 10% in premarket trading to $39.10. Nasdaq's stock fell 4%, while shares of ICE slid 2.5%.

Also, major automakers including General Motors (GM), Ford (F, Fortune 500) and Toyota (TM) will release their monthly sales reports after the start of trade.

Economy: Also on tap for Friday morning, the Institute for Supply Management's March manufacturing index and the Commerce Department's February construction spending report will be released at 10 a.m.

Economists expect the ISM manufacturing index to remain steady at a reading of 61.4, while construction spending is expected to fall by 0.7%.

World markets: Asian markets ended the session mixed. The Shanghai Composite rose 1.3%, and the Hang Seng in Hong Kong added 1.2%. But Japan's Nikkei eased 0.5%, after a report showed auto sales in the nation plunged 37% in March.

European stocks rose in midday trading. Britain's FTSE 100 rose 1%, the DAX in Germany gained 1.2% and France's CAC 40 edged higher 0.8%.

Currencies and commodities: The dollar rose against the euro, the Japanese yen and the British pound.

Oil for May delivery rose 76 cents to $107.48 a barrel.

Gold futures for June delivery slipped $15 to $1,424.60 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 3.51% from 3.45% late Thursday. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |