Search News

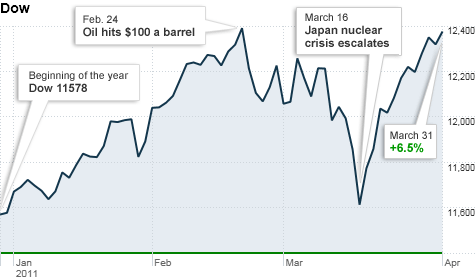

Despite the ongoing trouble in the Middle East and Japan, the Dow has risen nearly 7% in the past three months.

Despite the ongoing trouble in the Middle East and Japan, the Dow has risen nearly 7% in the past three months.

NEW YORK (CNNMoney) -- U.S. investors head back to Wall Street in a bullish mood.

A better-than-expected jobs report Friday helped boost the Dow Jones Industrial Average, sending it up 1.2% for the week. The gains came a day after the Dow's best first-quarter performance since 1999.

With little on the agenda this week, fund managers expect U.S. stocks will hold steady as investors hold out for the start of earnings season later this month.

"The path of least resistance remains up," said Bob Doll, chief equity strategist at asset management firm BlackRock.

For anyone looking for a correction, Bruce McCain, chief investment strategist at Key Private Bank, noted that stocks got one in mid-March following the earthquake in Japan, and now he believes the market can continue upward.

This week's agenda is thin, with investors receiving a handful of notable economic reports and only a few companies reporting quarterly results. Among the names checking in this week: agricultural product giant Monsanto (MON, Fortune 500) and home-furnishings retailer Bed Bath and Beyond (BBBY, Fortune 500).

One data point to watch will be the Institute for Supply Management's service sector index out on Monday. The report focuses on the state of the U.S. consumer compared to its manufacturing counterpart, which could be important as oil and energy costs remain elevated.

"Companies are going to need to pass along their higher production costs to the consumer," McCain said.

Doll is concerned about high oil prices, which have lingered above $100 a barrel for the past few weeks. In absence of any major news, crude rose above $108 a barrel in late Friday trading -- its highest level in two and a half years.

"The market has so far looked the other way in the face of high oil prices," he said. "But I don't think the market can handle much more of these one-dollar-, two-dollars-a-day jumps in crude prices."

Monday: Investors will get the Institute for Supply Management's service-sector index for March. Economists are looking for the index to slip slightly to 59.5 compared with last month's reading of 59.7.

Tuesday: Homebuilder KB Home (KBH) reports its quarterly results before the opening bell. Analysts polled by Thomson Reuters expect KB to post a loss of 27 cents a share as the housing market continues to struggle.

Wednesday: Monsanto reports before the open on Wednesday. Analysts expect the agricultural product giant to post a profit of $1.85 a share.

After the bell, investors get results from Bed Bath & Beyond, which is expect to earn 97 cents a share.

No major economic data is scheduled for release on Wednesday.

Thursday: The Labor Department releases weekly jobless claims at 8:30 a.m. ET, and the Federal Reserve comes out with February consumer credit statistics at 3 p.m.

Economists are looking for initial claims to remain steady at 388,000, according to Briefing.com.

Pier 1 Imports (PIR), Rite Aid (RAD, Fortune 500) and Constellation Brands (STZ) will report their quarterly results before the market open.

Friday: Investors will get February wholesale inventories figures from the Commerce Department at 10 a.m. Economists expect a rise of 1% versus 1.1% in January. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |