Search News

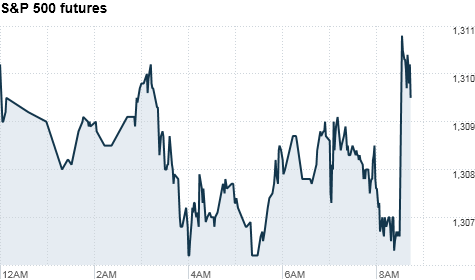

Click the chart for more premarket data.

Click the chart for more premarket data.

NEW YORK (CNNMoney) -- U.S. stocks were expected to open little changed Friday, after the government's latest inflation data was in line with expectations, but disappointing earnings from Google and Bank of America continued to weigh on investors.

After being down further all morning, Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were hovering a hair below breakeven ahead of the opening bell. Futures measure current index values against perceived future performance.

Investors are focusing on the Labor Department's latest Consumer Price Index, which showed prices rose 0.5% in March.

While that was in line with expectations, core CPI -- which strips out volatile food and energy prices -- came in lower than forecasts, rising 0.1% during the month.

Inflation has become an increasing concern for investors, as businesses find themselves choosing between absorbing the rising costs of oil and raw materials and passing those costs on to consumers. Either way, inflation can hurt the purchasing power of businesses and consumers.

While gas and food have soared recently, core CPI shows underlying inflation remains tame.

Investors welcomed the news after Google and Bank of America earnings disappointed and dragged on futures earlier in the morning.

"Obviously right now, investors are a little concerned," said Ethan Anderson, senior portfolio manager at Rehmann in Grand Rapids, Mich. "You're seeing data out of China showing higher inflation and that puts more upward pressure on interest rates. Meanwhile, earnings reports haven't been horrible, but they have certainly not been incredibly impressive either."

Dow component Bank of America (BAC, Fortune 500) fell 1% in premarket trading after the bank fell short of analyst estimates when it reported first-quarter earnings of $2 billion, or 17 cents a share. Analysts were forecasting a 27-cent profit.

Like JPMorgan Chase (JPM, Fortune 500) earlier this week, Bank of America said losses from mortgage-related assets would continue to hurt its bottom line.

Google (GOOG, Fortune 500) shares also dragged on premarket trading, falling 5.7% early Friday. Late Thursday, Google reported a quarterly profit that rose from year-ago results but missed Wall Street forecasts.

U.S. stocks ended Thursday's session mostly flat, erasing earlier losses, as commodities and energy stocks climbed higher. The gains in oil offset weakness in the banking and technology sectors.

Economy: Investors also get the University of Michigan's consumer sentiment survey for April, industrial production and capacity utilizations figures from the Commerce Department, and the Empire State manufacturing index from the New York Federal Reserve.

Companies: Other companies reporting results on Friday included broker Charles Schwab (SCHW, Fortune 500) and toy maker Mattel (MAT, Fortune 500).

World markets: International investors are mulling the latest economic data from China, which showed the world's second largest economy grew at a 9.7% year-over-year speed in the first quarter. That rate is slightly lower than the prior quarter but still faster than economists' had expected.

Meanwhile, inflation rose at a feverish pace of 5% in the first quarter, led by surging food prices.

Asian markets ended mixed. The Shanghai Composite rose 0.3%, the Hang Seng in Hong Kong was flat and Japan's Nikkei fell 0.7%.

Over in Europe, Ireland was hit with another downgrade from Moody's Investors Service, which cut the country's credit rating to "Baa3," one notch above junk status.

European stocks were mostly higher in midday trading. Britain's FTSE 100 gained 0.2%, the DAX in Germany added 0.5% and France's CAC 40 was fell 0.3%.

Currencies and commodities: The dollar rose against the euro, but fell versus the Japanese yen and the British pound.

Oil for May delivery slipped 35 cents to $107.75 a barrel.

Gold futures for June delivery rose $3 to $1,475.40 an ounce, after breaching a new intra-day trading high of $1,480.50 the prior evening.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 3.47% from 3.49% late Thursday. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |