Search News

Take our tax quiz: Which of these items were successfully deducted?

Take our tax quiz: Which of these items were successfully deducted?

NEW YORK (CNNMoney) -- You had three extra days to file your taxes this year, but the time has finally come to hand over your paperwork to Uncle Sam.

The IRS has already processed nearly 96 million tax returns this season, according to the agency's latest filing statistics. That's a 2.8% increase from this same time last year.

The biggest chunk of taxpayers has chosen to file their taxes electronically this year. The IRS has received more than 83 million e-filed returns this year -- an 8% jump from last year.

And at the same time you're busy getting your forms sent in, the IRS is busy doling out refunds. The agency has already paid nearly 81 million taxpayers a total of $234 billion, with the average taxpayer receiving a refund of $2,895 -- 1.5% lower than the average refund of $2,940 people received at the same time last year.

But some people have received significantly higher refunds this year, including families who qualify for new or expanded credits such as the adoption tax credit -- which is landing one family a whopping $54,000 refund this year.

Even if you're unemployed, there are a handful of deductions and credits you can claim that will help you out this tax season.

As an unemployed taxpayer, you can deduct job search-related expenses, continuing-education courses, moving expenses if you needed to relocate for a job, or home office and meal costs if you began working from home.

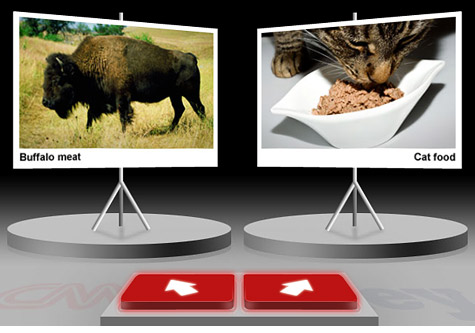

But when claiming anything, make sure it's legitimate (tip: think twice before trying to write off emu feathers, prostitutes or buffalo meat, which taxpayers have actually tried to slip by the IRS in the past).

Otherwise, you could end up among the unlucky group of taxpayers facing audits this year. Last year, the IRS audited about 1.6 million taxpayers. But not all those people had to sit face to face in a grueling meeting with the tax man. In fact, you're now almost four times as likely to conduct your audit by mail as you are to be audited in person.

While audits only rose about 1% overall, the wealthiest taxpayers were at a significantly higher risk of being audited last year. Audits of people making more than $10 million surged 73%, hitting more than 18% of taxpayers in the highest income bracket, according to the IRS.

Taxpayers making between $5 million and $10 million were under more scrutiny as well. The IRS examined nearly 12% of the returns it received from people in this tax bracket -- a 54% jump from the previous year.

Regular millionaires were also in the crosshairs. Audits of taxpayers with income over $1 million increased 15% last year.

To avoid being hit with an audit, be sure to hold on to your receipts, don't deduct anything you can't prove, report all your income and review your return for mistakes.

If you need more time to get your taxes in order, you can file an extension through midnight of April 18 by submitting Form 4868. But remember that, while this will give you more time to file your taxes, people who owe money to the IRS still need to pay by April 18.

But if you haven't filed an extension, hurry up and file! If the tax man doesn't get your return in his hands today, you could end up facing steep penalties, depending on how late you file. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |