Search News

NEW YORK (CNNMoney) -- Oil stocks have been gushing all year thanks to surging crude prices. But is the party almost over?

Energy giants ConocoPhillips (COP, Fortune 500), Exxon Mobil (XOM, Fortune 500), Royal Dutch Shell (RDSA) and Chevron (CVX, Fortune 500) all reported enormous jumps in profits in the past few days. Investors were largely unimpressed, however.

Shares of ConocoPhillips fell Wednesday as its profits missed forecasts. Exxon's stock fell Thursday after its earnings release. Shell gained less than 1%. And Chevron was down Friday morning following its latest quarterly results.

It appears investors may have already priced in strong earnings. Expectations may now be unreasonable. After all, Exxon and Chevron are each up nearly 20% this year, making them among the best performers in the Dow Jones industrial average so far in 2011.

"It's a crowded trade right now. The energy sector is overbought compared to the overall market," said John Kosar, director of research with Asbury Research in Chicago.

There's chatter about how oil sector profits could top the records from 2008 -- even though crude prices are still a good $30 or so below the July 2008 peak.

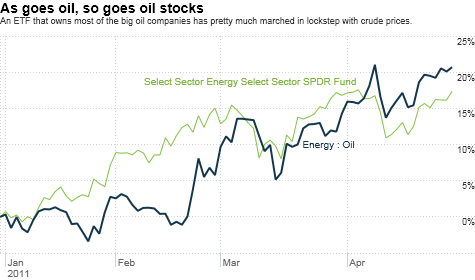

But if oil prices don't reach new records, it may be tough for profits to surpass 2008 levels. That could mean an end to the big rally for energy stocks, which -- as the chart at the top of this column clearly shows --- have been tracking the price of crude quite closely.

"Investors are looking past the strong oil company results," said Richard Ross, global technical strategist with Auerbach Grayson, a brokerage in New York.

"They are saying 'You didn't make money because of your operational genius, but because you're supposed to make money when oil is at multi-year highs,' " he added.

Perry Piazza, director of investment strategies at Contango Capital Advisors, wealth management firm in San Francisco, said that investors also may be starting to figure out that oil prices are only this high because of turmoil in the Middle East and North Africa.

That can't last forever. He said the fair value for oil (based on actual supply and not fear of supply disruptions) probably is more in a range of $85 to $100 as opposed to $120 or higher.

At the same time, energy companies (and investors) seem to be looking for other opportunities beyond good-old fashioned oil.

French oil giant Total (TOT) announced late Thursday that it was planning to buy a majority stake in U.S. solar energy firm SunPower (SPWRA).

Shares of SunPower surged 35% on the news, and rivals in the U.S., Canada and China, such as First Solar (FSLR), Canadian Solar (CSIQ) and Yingli Green Energy (YGE), all popped as well.

Solar stocks have been on a tear since the Japan earthquake in March. Investors are betting that more countries will scrap nuclear plants due to meltdown fears at reactors damaged by the quake and tsunami.

Coal stocks have also benefited in the past month as a sort of "alternative" energy play.

As long as oil prices remain relatively high, investors are likely to keep searching for other energy sector bets. The memory of 2008 is still fresh in many people's minds. At some point, oil gets too high and when it turns lower, it can do so in violently quick fashion.

Sure, the oil companies may be cashing in now with crude as high as it is. But it seems as if investors are increasingly coming to the realization that this may be as good as it gets for oil.

Even if oil creeps a little higher from here, that may not be enough to excite energy investors.

"The market requires surprise. The surprise when it comes to higher oil prices is gone," said Keith Springer, president of Springer Financial Advisors in Sacramento, Calif.

Reader comment of the week. I had a lot of fun mocking Ben Bernanke's "historic" press conference on Wednesday over on Twitter. At one point, I joked that Bernanke was going to step down as Fed chairman in order to take over the day-to-day job overseeing the Los Angeles Dodgers.

The virtual peanut gallery was all in rare form. David Gaffen of Reuters had this response to my baseball line.

"So he can bail them out by giving them 6 outs every inning?"

Nice one David! I tossed you a meatball right over the middle of the plate and you knocked it out of the park.

The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |