Search News

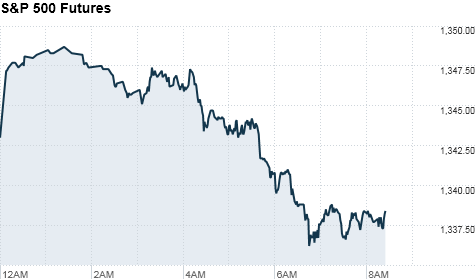

Click chart for more premarket data.

Click chart for more premarket data.

NEW YORK (CNNMoney) -- U.S. futures were set for a lower open Thursday after a report released Thursday morning showed continued weakness in the labor market.

The number of people filing first-time unemployment claims surged to 474,000 in the latest week -- its highest total in 8 months -- according to a government report.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were all between 0.3% and 0.4% lower ahead of the opening bell. Futures measure current index values against perceived future performance.

Investors have remained on edge as other labor reports released this week have painted a mixed picture.

"There is an underlying unease in the markets," said Jim Russell, Partner at The Collingwood Group.

This week has centered around the ever-important monthly jobs report due out Friday morning.

Economists surveyed by CNNMoney expect the unemployment rate to hold steady at 8.8%, with employers forecasted to add 185,000 jobs in April. For the full year, economists expect 2.3 million new jobs -- just under 200,000 per month -- and an unemployment rate of 8.4% by year end.

Stocks have been trending higher since the start of the year, but investors fear the economy is still on shaky ground.

Concerns over the looming debt ceiling facing Congress and Europe's debt problems have also weighed on the market.

The European Central Bank and the Bank of England both left their key interest rates unchanged, as was widely expected.

Stocks ended in the red Wednesday, as disappointing reports on jobs and the service sector weighed on investors.

Companies: Detroit giant General Motors (GM) reported a first-quarter net profit of $3.2 billion, its fifth consecutive profitable quarter. Shares fell 1% in premarket trade.

Dow component Kraft (KFT, Fortune 500) reports quarterly results on Thursday, with analysts expecting earnings of 47 cents a share.

Shares of Whole Foods (WFMI, Fortune 500) rose 5% a day after the company reported solid results after Wednesday's closing bell and raised its outlook.

Other companies reporting Thursday include Priceline.com (PCLN), Visa (V, Fortune 500) and insurance giant AIG (AIG, Fortune 500).

Also, retailers - including Target (TGT, Fortune 500) and Macy's (M, Fortune 500) - reported a strong surge in April stores sales boosted by Easter purchases in the month. Shares of Macy's rose more than 1% and Target's stock also edged up.

Currencies and commodities: The dollar fell against the euro and the Japanese yen, but gained slightly on the British pound.

Commodities continued their decline, with oil for June delivery slipped $2.91, or more than 2%, to $106.33 a barrel.

Gold futures for June delivery fell $14.40, or less than 1%, to $1500.90 an ounce.

Silver futures for July delivery extended their retreat, sliding $1.65, or 3%, to $37.74 an ounce. Just a week ago, silver prices were within spitting distance of breaching $50 an ounce.

Commodity prices are top of mind for investors these days. In "the short term, investors are going to be looking at how the oil, commodity prices are moving," said Russell. "When we have regular gas over $4 a gallon, the trickle down we see is a reduction in driving."

Bonds: The price on the benchmark 10-year U.S. Treasury edged up a small amount, pushing the yield down to 3.19% from 3.22% late Wednesday.

World markets: European stocks were mixed in morning trading. Britain's FTSE 100 slipped 0.2% and France's CAC 40 edged lower 0.5%, while the DAX in Germany rose 0.1%.

Asian markets ended the session mixed. The Shanghai Composite ticked up 0.2% and the Hang Seng in Hong Kong dipped 0.2%. Japan's Nikkei was closed for holiday. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |