Search News

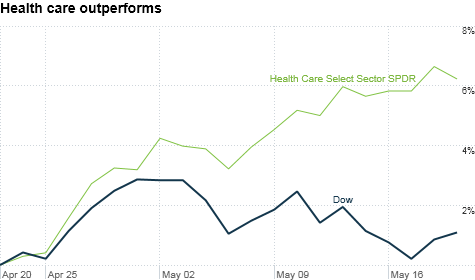

Conservative stock sectors like health care have outperformed the broader market, particularly in the past month. Click the chart for more market data.

NEW YORK (CNNMoney) -- While a portion of Wall Street continues to cheer this two-year-old bull market, there's a growing chorus of strategists who say now is the time to switch up strategies and start playing defense.

There's a confluence of things keeping investors on edge: the end of the Federal Reserve's quantitative easing program in June, $100-a-barrel oil prices and the resurgence of European sovereign debt issues.

"I haven't felt this uncomfortable with the market since October 2008," said Kevin Rendino, a value-oriented portfolio manager with large money management firm BlackRock.

And that's helped defensive sectors, such as health care and utility stocks, outperform the broader market.

The Healthcare SPDR (XLV) exchange traded fund and the Consumer Staples SPDR (XLP) are up more than 7.4% this month, while the Utilities SPDR (XLU) has gained a more modest 5.2%. Compare that with the S&P 500 (SPX), which is down 1.5% so far in May.

What a difference a year makes. For all of last year, health care and utility stocks rose 1.5% on average, while the S&P 500 advanced 13%.

"The economic data has weakened, and that has translated into a more defensive market," said Quincy Krosby, chief investment strategist with Prudential Financial.

And bullish sentiment among financial advisors fell to a reading of 46.4% last week, according to Investors Intelligence. That's the first time the gauge has been below 50% since August 2010 - the same month that Fed chief Ben Bernanke announced the current quantitative easing program.

"We have been telling clients to pull back, and shift the weight of their portfolios into less risky stocks," said Kate Warne, market strategist with Edward Jones.

Value investing focuses on stocks that have dividend and yield potential, which "will help cushion your portfolio if this summer's slowdown isn't just some transitory soft patch," Krosby said.

Rendino said he is overweight in healthcare stocks because of their consistent earnings and sales potential, and their relatively high yield. In particular, he likes pharmaceutical giant Merck (MRK, Fortune 500), which has a yield of 4.1% based on its current stock price's annual dividend of $1.52 a share.

Rendino also likes General Electric (GE, Fortune 500), which has a more modest yield of 3.1%, but he expects GE will restore its dividend back to its historical levels.

Don't just look for raw yield when seeking out value stocks, warn fund managers. If a stock has an extremely high yield, it could be a sign that the market expects that company to cut its dividend in the near future. That's what happened during the financial crisis, when many financial stocks traded with yields above the 10%-to-15% range.

Warne and Rendino both believe dividends will play an increasing role in investing this year. Large corporations continue to sit on near record amounts of cash, and companies such as Intel (INTC, Fortune 500) and Macy's (M, Fortune 500) have announced dividend increases in recent weeks.

"Companies have been cautious with figuring out what to do with all this cash on their balance sheets," Warne said. "Some have used it for mergers, but others are returning it to shareholders."

Nearly the entire financial sector, including JPMorgan Chase (JPM, Fortune 500) and Wells Fargo (WFC, Fortune 500), increased their dividends last month. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: