Search News

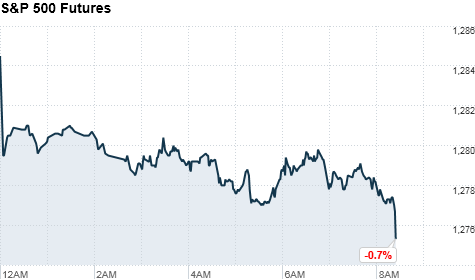

NEW YORK (CNNMoney) -- U.S. stocks were headed for an early sell-off Wednesday, with futures falling sharply after disappointing manufacturing and inflation data.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were all about 1% lower ahead of the opening bell. Futures measure current index values against perceived future performance.

It could be a rocky day on Wall Street. In addition to the U.S. data released before the bell, news that European officials failed to reach an agreement on bailing out Greece could also keep investors skittish.

"I think we've reached a turning point and are going to keep seeing a general trend to the downside, due to weak economic data and the end of quantitative easing," said Manoj Ladwa, a trader at ETX Capital.

This weakness in the market will likely last for the next few months, and could even extend to the end of the year, he said. "Unless the Fed embarks in QE3 -- which is unlikely -- it's likely that the assets that benefited most from quantitative easing, like equities, will head lower once it ends."

U.S. stocks rallied Tuesday, with all three major indexes ending higher than 1%, following better-than-expected data on retail sales and Bernanke's call to Congress to free the debt ceiling. Stocks posted their best performances since April 20.

Economy: Consumer inflation picked up more than expected last month, with growth driven by increased food prices, the government reported Wednesday.

The Labor Department's consumer price index rose 0.2% in May. Economists polled by Briefing.com expected consumer inflation ticked up by 0.1% in May, down from the 0.4% rise in the previous month.

Meanwhile, the Empire State manufacturing index declined by 7.8 points, while economists were forecasting an increase of 10 points.

Also due Wednesday are the Federal Reserve's industrial production and capacity utilization reports.

Companies: Shares of Carnival Corporation (CCL) slipped more than 2% in premarket trading, after the cruise-line operator lowered its fiscal 2011 earnings outlook earlier this week -- leading some analysts to cut their price targets for the company.

Scotts Miracle Gro (SMG) cut its full-year forecast as well, sending shares of the lawn-care product maker more than 5% lower before the market open Wednesday. The company said continued bad weather has led to lower consumer demand.

Meanwhile, Owens-Illinois (OI, Fortune 500) lowered second-quarter earnings per share guidance to below the previous year's level -- after originally forecasting earnings per share to be unchanged. The cut came amid rising manufacturing costs, the company said. Shares of Owens-Illinois dropped 5% in premarket trading.

Internet radio site Pandora will begin trading Wednesday on the New York Stock Exchange under the ticker symbol "P." Late Tuesday, Pandora priced its initial public offering at $16 a share.

World markets: Reports that eurozone leaders failed to reach an agreement about a bailout package for Greece pressured world markets on Wednesday.

In addition, Moody's issued a warning that it is reviewing the debt and deposit ratings at three French banking groups for possible downgrade.

European stocks fell in morning trading. Britain's FTSE 100 lost 0.2%, the DAX in Germany slipped 0.4% and France's CAC 40 dropped 0.5%.

Asian markets ended the session mixed. The Shanghai Composite fell 0.9% and the Hang Seng in Hong Kong dipped 0.7%, while Japan's Nikkei edged higher 0.3%.

Currencies and commodities: The dollar gained against the euro, the Japanese yen and the British pound.

Oil for July delivery slipped 41 cents to $98.96 a barrel.

Gold futures for August delivery fell $7.30 to $1,517.10 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 3.09% from 3.10% late Tuesday. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: