Search News

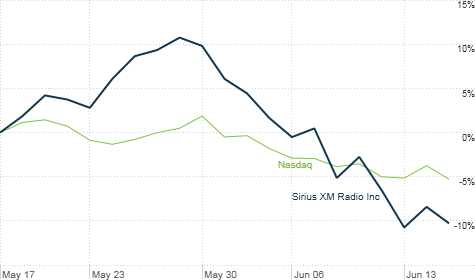

Sure, the broader market has had a rough month. But Sirius XM has taken a bigger hit than the Nasdaq. Pandora hype may have something to do with it.

NEW YORK (CNNMoney) -- Pandora is a great service. But after the euphoria fades from Wednesday's stellar debut, it may become a lousy stock.

Shares of the online radio king surged as much as 63% from its offering price to $26 at one point. The stock slipped from that peak, but at midday it was trading at around $18.50. At that price, Pandora's market value was about $3 billion.

That seems a bit crazy. Pandora (P) is not profitable. It had revenue of about $137.8 million last year, which means it's trading at 21 times trailing sales.

Compare that with satellite radio giant Sirius XM (SIRI), which is actually expected to eke out a profit in 2011. Sirius XM trades at just 2.7 times last year's sales.

Sure, Pandora is growing much more rapidly right now. Sales in the first quarter were up 136% from a year ago, compared to 9% revenue growth for Sirius XM.

But even if you assume Pandora can grow at a 136% clip for the whole year, that would mean it would finish this year with sales of about $325.4 million.

So Pandora is still trading at a heady valuation of more than 9 times its 2011 revenue run rate. Sirius XM, on the other hand, trades for just 2.5 times estimated 2011 sales.

Now don't get me wrong: Sirius XM is hardly a screaming bargain.

David Bank, an analyst with RBC Capital Markets, said that Sirius XM is still an expensive stock regardless of how much pricier Pandora is right now.

But there's no denying that Sirius XM has suffered while investors trip over themselves to gush about Pandora.

It may be coincidence -- or the mere fact that the entire market has sunk this month on fears about the broader economy -- but since the Pandora hype machine (not to be confused with another popular online video service) began in earnest, Sirius XM shares have taken a huge hit.

Pandora said on June 3 that it expected to price its shares between $7 and $9. Its road show began soon after that. Since then, Sirius XM stock is down 15%, compared to just a 4% drop for the Nasdaq.

But analysts said it's a mistake to think that Pandora will make Sirius XM irrelevant.

"Let's not get emotional or overreact. Pandora is not going to wipe Sirius XM out," said Martin Pyykkonen, an analyst with Wedge Partners in Denver who follows Sirius XM and started coverage of Pandora Wednesday.

Pyykkonen thinks that Sirius XM has a more sustainable business model than Pandora. He said that Pandora's biggest selling point -- its algorithm -- may also drive people away.

As a Pandora user, he finds he often listens to a certain channel every now and then to discover new artists -- and then goes to Apple's (AAPL, Fortune 500) iTunes to actually buy their music. I do the same thing.

That's not good for Pandora's chances to make money when you consider that the majority of its users are not paying for the subscription service. If Pandora is going to rely on ads, it better keep users (to use a terrible buzzword) "engaged."

After all, the main reasons Facebook is now attractive to marketers and may one day go public with an octillion dollar market valuation is because it's so (to use yet another bit of social media jargon) "sticky."

Still, John Tinker, an analyst with Maxim Group in New York who also covers Sirius XM and launched coverage of Pandora Wednesday, said he actually likes both stocks.

But he conceded that Sirius XM has a key advantage. It offers a service that people will want to pay steady monthly fees for. In that vein, it's more like pay cable TV, which is more lucrative than basic broadcast TV despite smaller audiences.

"Sirius XM has exclusive products," Tinker said. "There's a reason Sirius XM is spending big money on Howard Stern, the NFL and other programming. Users are comfortable paying for it."

And while Pandora has emerged as a leader in the burgeoning world of apps, it's not clear if Pandora can supplant Sirius XM in the mobile device that matters most for music: the car. Until Apple figures out a way to turn your iPhone or iPad into a teleportation device, the horseless carriage isn't going away.

"Ultimately the secret to Sirius XM's success is its relationship with the auto makers," RBC's Bank said. "Pandora has a lot of work to do there. That's the powerful head start that Sirius XM has."

The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()