Search News

FORTUNE -- Carl Icahn is so famous for corporate combat and agitating for change at the companies he invests in that it can obscure an enviable record: 25.3% annual returns, he says, since 1990. Icahn, 75, continues to go his own way, announcing in March that he is returning the stakes of all the outside investors in his hedge fund. He says he's uncomfortable exposing investors to "another 2008." Icahn is still investing his own money -- and finding opportunity, as he explains in this edited interview.

FORTUNE: Why did you decide to return all of the money from outside investors in your hedge fund, and close the fund to new investors?

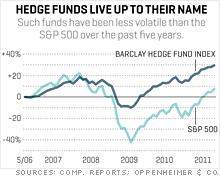

Carl Icahn: In 2008 people who invested in hedge funds needed capital badly but many of the funds would not return their money. However I gave money back to any investor who requested it. It was the bottom of the market and a pretty tough time. I thought I would be hurt returning the money but, ironically, it turned out quite well. I didn't want to sell stock held by the fund, so I put up over $500 million of my own money to replace the investors who exited. This turned out to benefit all remaining investors in the fund. In 2009 our fund was up 33%, in 2010 it was up 15% and this year through March the fund was up 10%. Even with the drop in 2008, if you invested on the first day the fund was opened on a net basis you were up 55%. Within the next few years I am concerned we might well see another 2008. It might sound corny, but losing money for people who are not used to market turmoil bothers me more than losing for myself. I am hardened to it. My view is they don't need to go through it again, and it will happen again.

What is your outlook for equity prices and the economy?

Too many people are saying everything is great in the market. However, I believe if we do not instill confidence in business, and the administration is not doing this, we might well have major problems ahead. Today the market is up because of the policies of the Federal Reserve. A great deal of money is available at artificially low rates. This helps earnings and the market because it lowers debt-service costs and more importantly, produces speculation in stocks, but these low rates cannot last forever. Additionally, earnings comparisons are up because CEO's have gotten rid of excess costs, something they should have done years ago, but what can they do for an encore?

I am also very concerned with the specter of inflation. Our country has been enjoying cheap commodities and finished products from Asia but as the middle class continues to grow in Asia, there will be competition for cheap goods and the bargain basement prices the U.S. consumer has enjoyed will end. Inflation will follow, forcing interest rates higher, which will decrease earnings.

Higher interest rates will also stop the artificial flow of capital into the equity markets. Earnings will also be negatively affected because of our high unemployment and the lack of demand for products which will no longer be cheaply priced. Lack of demand will also result when low cost capital is no longer available to the consumer. I am not predicting a collapse in the next week or even month. However, once our huge retirement funds are no longer forced into the equity market because today's low interest rates give them no alternative, I am very concerned that our markets will go into another major downturn, possibly within the next two years.

Thoughts on corporate governance?

Many U.S. companies are very poorly run and non-competitive because corporate governance in the United States is, to a large extent, dysfunctional. Boards don't hold managements accountable and corporate elections for the most part are travesties. Proxy fights are extremely difficult to conduct, let alone win. Managements have become mediocre and lackluster, for the most part. It is no wonder we find it more and more difficult to compete in the global economy. Interestingly, our companies have great assets and a willing labor force at their disposal.

Where managements can be made accountable or replaced, companies blossom and great profits can be earned. That is why activism is so profitable. At the risk of being immodest, I can simply point to my record to prove this point. Since 1990, our annualized return has been 25.25%. The biggest reason for our record returns over the years is the fact that we become actively involved in most of the companies we invest in. Some of our best results outside of the hedge fund came from companies in which we were actually able to gain control. A few examples are:

National Energy -- in 1998 to 2003 we purchased the debt of Trans Texas, Panaco and National Energy for a total of approximately $265 million. All three went into bankruptcy and we re-structured and merged them. We cut their overhead and changed management and sold this company in 2006 for $1.5 billion.

Stratosphere Casino is another example where we purchased a company out of bankruptcy for $325 million in 1997. Again we cut costs, purchased land around the hotel along with several other small casinos. In 2007 we sold the entity for a profit of approximately $1 billion.

Other examples are Phillips Services and Viskase (VKSC). Even where we did not get control, our active presence produced meaningful results. Activism works but unfortunately our laws protect incumbent managements. These laws should be changed or we'll lose our ability to compete with emerging markets, create more jobs and rebuild our economy.

What is your favorite company?

Icahn Enterprises (IEP). (IEP, Fortune 500) The company sells at approximately $41.45 per share and has a war chest of over $1 billion in cash and $2.8 billion in securities. Earnings for the first quarter ending March 31st were $2.68 per share. It also owns 76% of a major automotive company called Federal-Mogul which I believe is also undervalued (selling at approximately $20.50 per share.) We purchased Federal Mogul's debt and helped restructure the company in bankruptcy. We replaced inept management with Jose Maria Alapont who proceeded to reduce costs by over $400 million without affecting revenue. Federal-Mogul is a global supplier of powertrain and safety components, serving manufacturers of light and commercial vehicles as well as the worldwide aftermarket. The company has leading technology within its product segments, having filed over 2,200 patents in the last five years, and has some of the best and most recognized brands in the automotive industry, including, Champion, Wagner and Moog. Because of its diversification, Federal-Mogul continued to generate strong cash flow during the downturn and saw a 33% increase in EBITDA between 2009 and 2010. Additionally, the company is well-positioned to take advantage of the explosion in demand for auto parts in Asia and other emerging markets.

IEP also owns controlling positions in a number of other companies, including American Railcar, Viskase, Westpoint International, PSC Metals and Tropicana Entertainment (TPCA). We have driven significant cost and operating improvements in these companies since acquiring them, and most are doing quite well. For example, American Railcar's backlog has more than quadrupled since the end of 2010, Viskase is running at full capacity and pursuing an aggressive growth plan in Asia, and PSC Metals is on track for over $1 billion in revenues in 2011 based on first quarter results, a 40% improvement over 2010. But the market has not always appreciated IEP's underlying asset value. Even if you value Federal-Mogul and American Railcar at current market prices, and IEP's other companies and assets at book value, I believe IEP stock sells at a discount to its break-up value, which means you're getting the Icahn team at a negative value.

It is my present intention to use IEP, with its large war chest, as my major vehicle to acquire interest in what I consider to be undervalued companies. In circumstances where we can obtain fair value, I intend to use IEP partnership units, in addition to its cash, as a currency in making these acquisitions. Hopefully these acquisitions will be as profitable as the ones outlined above. However, there is one thing you can be sure of: Managements of the companies we acquire will be held accountable.

Why are you so attracted to biotech?

Biotech is great for activists. On one side you have big pharma with plenty of cash and few large molecular compounds. On the other you have Biotech with large molecular compounds and with not enough cash. They are generally run by individuals who are intelligent but do not have the management skills to run a company, and they definitely do not want to see their companies purchased by big pharma, even though the drugs they own often desperately need capital for development. In most instances our involvement in Biotech has made a great deal of money for all shareholders. Examples of this over the past few years have been Imclone, Biogen (BIIB, Fortune 500), MedImmune, and Genzyme.

You just completed a proxy fight at software-maker mentor graphics. What was the attraction?

This may be the beginning of a massive change in the power of activism: We won a proxy battle with 76% of the vote! That margin is very unusual. Mentor makes software for chipmakers. It should be merged with partners that make software in different areas. But even if the company cannot be sold we strongly believe it should cut costs. SG&A at the company is $500 million -- extremely high for a company with $900 in revenue.

What are your failures?

Recent failures include:

Blockbuster -- At Blockbuster the industry went through a secular change, and we fell into a value trap. The change for Blockbuster happened more quickly than I thought.

WCI -- At WCI we thought multifamily prices were close to a bottom, and we were buying it at a fair price. But they kept falling. There is nothing you can do when a tsunami hits, no matter how good your model. Luckily, these two companies were only a small percentage of our portfolio.

Do you find well-run companies that are also good investments?

There are many good companies, and they may be cheap. Some are good but simply overleveraged. Take Chesapeake Energy, run by Aubrey McClendon, as an example. He's brilliant, but we felt that the company's stock was undervalued because the company was overleveraged, and wearing our activist cap, we were not shy about mentioning this to him. He told the world he would de-leverage and he did. The stock went up as a result and today is 50% higher than several months ago. ![]()

Carlos Rodriguez is trying to rid himself of $15,000 in credit card debt, while paying his mortgage and saving for his son's college education.

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: