Search News

NEW YORK (CNNMoney) -- The Federal Reserve's latest round of stimulus ends on June 30, but economists think it's no big deal.

The end of the policy, known as the second round of quantitative easing, or QE2 for short, is likely to have little effect on financial markets or the pace of the recovery, they say.

"I don't think the end of QE2 will have any significant immediate impact on interest rates, stock prices, jobs or the broader economy," said Mark Zandi, chief economist with Moody's Analytics.

Investors will be waiting to see what the Fed says about the end of QE2 at the conclusion of its latest policy meeting later Wednesday.

The Fed is expected to maintain the status quo. Interest rates should remain at their currently low levels, and few expect Fed chairman Ben Bernanke to call for another round of stimulus, or so-called QE3.

In November, the Fed embarked on its controversial QE2 policy of gradually buying $600 billion in Treasuries as a way to boost the economic recovery. The program has been credited with boosting stocks and steering the U.S. economy away from a deflationary spiral.

At the same time, QE2 has been criticized for artificially weakening the dollar and boosting inflation too much -- taking a bite out of the purchasing power of American companies and consumers.

While the jury is still out on whether QE2 helped or hindered the recovery, there are a variety of reasons behind economists' indifference to its end. For one, Wall Street has had the program's June deadline penciled in on its calendar since November.

"Obviously, we know and have known for a long time that QE2 was going to end in June. It should be priced into financial markets," said Paul Ashworth, U.S. economist with Capitol Economics.

Ashworth also pointed out that from a business' perspective, it doesn't matter much that the Fed will stop buying additional Treasuries on June 30 as long as monetary policy stays accommodative while economic growth is still slow.

And that's exactly the Fed's intention. In his last two speeches, Bernanke indicated that given the recent soft patch in the economy, the Fed plans to maintain its balance sheet at its current levels. Most believe the Fed is still a long way off from raising interest rates or tightening monetary policy.

That means conditions are still going to remain attractive for businesses and individuals who want to lend and borrow money, at least in the near term.

"It's not like we turn on a dime on June 30th, and then [lack of] stimulus suddenly becomes a drain on the economy," said Liz Ann Sonders, chief investment strategist with Charles Schwab. "The Fed plans to keep its balance sheet where it is for quite some time."

Rather than focusing on QE2's end, investors have bigger fish to fry, as they sort through a mixed bag of other economic news.

Big businesses are still keeping cash on the sidelines, as fear about the economy runs high. Europe's debt crisis is flaring up again and Congress continues to dawdle on raising the debt ceiling, neither of which spark much confidence going forward.

That said, with the Fed staying in neutral for a while, investors and businesses will finally be able get a purer picture of how the U.S. economy looks, without government aid.

But that is valuable and could clear up uncertainty, said Joseph LaVorgna, chief U.S. economist with Deutsche Bank.

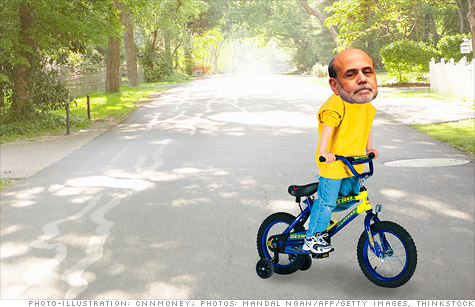

"In some ways, QE2 was training wheels for the economy when we entered a soft patch last year," he said. "Now we're going to finally see if the economy can stand on its own. I think it will." ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Latest Report | Next Update |

|---|---|

| Home prices | Aug 28 |

| Consumer confidence | Aug 28 |

| GDP | Aug 29 |

| Manufacturing (ISM) | Sept 4 |

| Jobs | Sept 7 |

| Inflation (CPI) | Sept 14 |

| Retail sales | Sept 14 |