Search News

NEW YORK (CNNMoney) -- Big federal spending cuts are on the way. That's pretty clear. Whether they total $1 trillion, $2 trillion or $3 trillion is anybody's guess. But make no mistake -- they are coming.

The cuts -- tied to an increase in the debt ceiling -- are virtually guaranteed to be some of the biggest in history. But will they hit the economy at a particularly bad time?

The unemployment rate stands at 9.2%. The government's jobs reports for May and June were dismal. The housing market is not exactly vibrant. In fact, it's terrible.

The spending cuts will be phased in over the next decade or so. What remains unclear is how quickly.

There is a danger in cutting too much too soon, according to Mark Zandi, chief economist at Moody's Analytics, who favors big spending cuts so long as they don't take effect for a few years.

"I wouldn't add to cuts this year or next, given the fragile economy," Zandi said. "There is already plenty of restraint on the books."

Martin Baily, a senior fellow at the Brookings Institution and chairman of the Council of Economic Advisers during the Clinton administration, said the United States needs to get long-term costs under control, but not all at once.

"If we did make significant cuts over the next few years, it would put a drag on the recovery," Baily said.

The cuts are likely to be focused on non-security discretionary spending, a small section of the budget that includes funding for food inspectors, the FBI and education grants, among many other programs and services people associate with government.

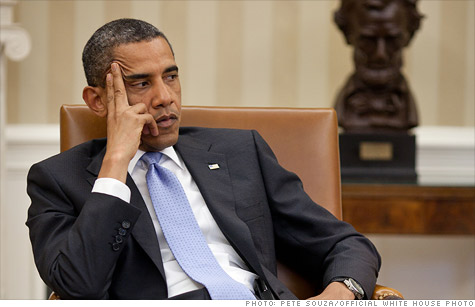

Obama said Monday that the expiring 2009 Recovery Act has already provided a glimpse into a future filled with spending cuts.

"We've seen that federal support for states diminish, you've seen the biggest jobs losses in the public sector -- teachers, police officers, firefighters losing their jobs," Obama said during a press conference.

To counter the spending cuts in any debt ceiling deal, Obama said he would push for a series of measures that would boost job creation in the short-term. Another payroll tax holiday, an infrastructure bank and free trade deals are all on the table, he said.

There are ways to structure the cuts that will mitigate their impact on the larger economy, according to Douglas Holtz-Eakin, president of the center-right American Action Forum and former director of the Congressional Budget Office.

Holtz-Eakin said that just like the budget plan passed earlier this year by House Republicans, legislation could be written in a way that would keep direct government purchases at a relatively high level.

"I quite frankly live for the day we would have a Congress that would cut spending so quickly it would endanger the recovery," Holtz-Eakin said. "I've never seen one of those." ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Latest Report | Next Update |

|---|---|

| Home prices | Aug 28 |

| Consumer confidence | Aug 28 |

| GDP | Aug 29 |

| Manufacturing (ISM) | Sept 4 |

| Jobs | Sept 7 |

| Inflation (CPI) | Sept 14 |

| Retail sales | Sept 14 |