Search News

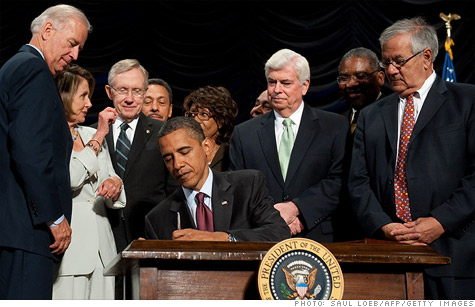

President Obama signs the Wall Street reform law on July 21, 2010. Law namesakes Christopher Dodd and Barney Frank are standing on the right.

WASHINGTON (CNNMoney) -- A year after Congress enacted the most sweeping changes in financial regulation since the 1930s, Wall Street is still waiting for the full impact.

Lawmakers narrowly passed the reforms in the Dodd-Frank Act to strengthen consumer protection, rein in complex financial products and head off more bank bailouts.

A year later, there's a new process in place to wind down failing firms and avert bailouts, and the new Consumer Financial Protection Bureau is launching to regulate credit cards and mortgages among other financial products.

But no one knows whether the federal government will truly allow firms to fail. And no one knows how effective the new consumer bureau will be, especially lacking a Senate-confirmed director.

There are other big question marks: Regulators have yet to detail new rules reining in derivatives, credit rating agencies and nonbanking financial firms that played a role in the financial crisis that crippled the U.S. economy.

Even if regulators come out with new rules, Republicans in Congress have balked at funding those agencies, which have not been able to beef up enforcement teams that would go after rule-breakers.

But although progress has been slow, some important safeguards are about to go into effect. And some financial firms aren't waiting for the new rules to kick in to change their way of doing business.

For example, a crackdown on banks that make speculative bets with their own money has prompted Goldman Sachs (GS, Fortune 500), Morgan Stanley (MS, Fortune 500) and JPMorgan Chase (JPM, Fortune 500) to plan to shut or cut loose their proprietary trading desks.

"I think there has been more progress than people think," said former Assistant Treasury Secretary Michael Barr, a professor at the University of Michigan who helped shape the reforms. "I think the financial system is significantly more resilient than it was two years ago."

Some of the Dodd-Frank provisions that have kicked into place:

Too big to fail: The Federal Deposit Insurance Corp. now has a mechanism to take down giant failing financial firms that threaten the financial system --- an effort to put an end to the concept of "too big to fail."

But the big question lingers: will the federal government truly turn the lights off at a firm whose failure could, once again, threaten an already weakened economy?

"It's one of those things they (critics of the law) won't really believe until one fails and the government does not step in," said a top Treasury official in a briefing with the media last week.

Extra cushions for big banks: A global panel of regulators this week deemed 28 global banks as so big and important that their failure could threaten the economy. Those global banks will have to create "living wills," and keep extra thick capital cushions on hand to help them weather another financial crisis.

Earlier this year, the Fed released new rules that would require the biggest 35 U.S. banks to submit their annual capital plans for review.

Deposit Insurance: The FDIC also permanently raised the amount protected in an individual's bank account to $250,000 from $100,000, carrying through on a change initiated during the financial crisis.

Say on pay: Shareholders have been holding non-binding votes on executive pay and generous packages for executives who part ways with the company.

Consumer Financial Protection Bureau: The new independent agency launches Thursday and will wield powers regulating mortgages and credit cards. The agency will be able to police the largest banks to make sure they're abiding by consumer rules.

However, until a director is in place, the bureau will lack new powers critical to preventing the next financial crisis. These include regulating the non-banking firms that originated hundreds of millions of dollars in subprime mortgages during the height of the boom to families who couldn't afford them.

The bureau also can't deem financial products abusive.

Credit scores: All consumers have been able to get one free credit report a year from the credit rating agencies. But now consumers denied credit or offered credit on unfavorable terms can get a copy of their actual credit score.

Swipe fees: On Oct. 1, swipe fees that the biggest banks charge retailers when customers use debit cards will be capped at around 21 cents, about half of the current average swipe fee of 44 cents.

There are still lots of rules left to hashed out.

Derivatives: Regulators have delayed, until the end of the year, the bulk of a crackdown on the $600 trillion in complex financial products that posed such a threat to the financial system. Regulators have big decisions to make, such as figuring out which swaps will need to be "cleared," or settled up with, and figuring out who needs to post collateral when making bets.

They also are in the midst of carving out exemptions for businesses such as airlines and farmers that use swaps to spread the risk of a massive price increases in resources such as fuel.

Ban on speculative bank trades: Regulators have until next year to carry out a new rule that bans banks from owning big stakes in hedge funds and speculating with their own money. Named for former Federal Reserve Chairman Paul Volcker, the rule gives regulators leeway in figuring out what's considered proprietary trading or trading on banks' own accounts.

Credit rating agencies: New laws left the Securities and Exchange Commission in charge of cracking down on rating agencies whose acquiescence on mortgage-backed securities helped fuel the crisis. Regulators are still working on rules that would force those agencies to tell regulators more about how they come up with ratings.

Skin in the game: Regulators are considering exempting banks from a requirement that they hold at least 5% of securities tied to mortgages, but only when mortgages are considered safe because the buyers made a 20% down payment.

Proxy access: The provision that would have allowed investors to more easily nominate their own candidates to the boards of publicly traded companies is delayed while it's being challenged in court. A decision is expected soon. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Latest Report | Next Update |

|---|---|

| Home prices | Aug 28 |

| Consumer confidence | Aug 28 |

| GDP | Aug 29 |

| Manufacturing (ISM) | Sept 4 |

| Jobs | Sept 7 |

| Inflation (CPI) | Sept 14 |

| Retail sales | Sept 14 |