Search News

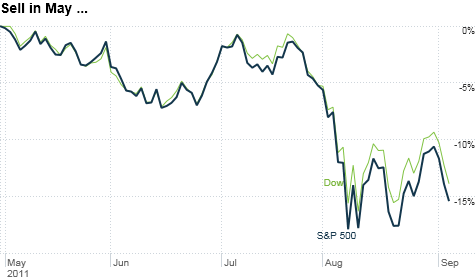

Stocks got slammed during the summer and the turmoil has extended into September as investors continue to fret about the fiscal health of Europe and the U.S.

NEW YORK (CNNMoney) -- With apologies to Louis Armstrong:

I see few stocks in green. Oil is in red too. I see their values shrink. For me and for you. And I think to myself: What a terrible world.

I see dark skies over the U.S. and Europe. To safety in bonds we take flight. The VIX is on fire. Each day and every night. And I think to myself: What a terrible world.

Yup. The market volatility that defined August is sadly still with us in September. So much for the unofficial end of summer being the end of summer market madness.

The month got off to a lousy start after last week's bleak jobs report. (How ironic that there was a net gain of zero jobs on the last trading day before Labor Day.)

Stocks continued to plummet in Europe Monday and here in the U.S. Tuesday as worries persist about the fragile health of virtually every developed market economy.

With stocks tanking, the yield on the 10-year U.S. Treasury sunk to a record low of about 1.91% and gold prices were back near $1,900 an ounce as investors fled to so-called "quality" assets.

And don't forget the VIX (VIX). Wall Street's so-called "fear gauge" shot up nearly 12% to just under 40 on Tuesday afternoon. Anytime the VIX is above 30, that's a sign of intense unease.

What a terrible world indeed.

So is there any hope that the recent market turmoil, now entering a potential fifth month of losses, may finally be drawing to a close? Not really.

"Unfortunately, I don't expect the volatility to end anytime soon," said Bill Stone, chief investment strategist with PNC Wealth Management in Philadelphia.

"This is a continuation of fear about the global economy. A lot is emanating from Europe. Throw in the anemic growth in the U.S. in the first half and you can see why investors have a constant case of the jitters," Stone added.

In other words, there's not a heck of a lot of "new" news to justify the sell-off Tuesday. But that doesn't make it any less frightening.

Uri Landesman, president of New York hedge fund Platinum Partners, thinks that market volatility is likely to continue throughout September.

Landesman said he's hopeful that strong earnings could help get stocks back on track, but the next batch of quarterly reports won't start hitting the tape until early October. Buckle up.

"I don't expect to see a break until earnings come out in the next few weeks. It could be a very volatile period over the short-term. There is peril out there," he said.

Still, it's not all doom and gloom. Landesman said that he still does not think that the current debt woes facing Europe and the U.S. are as bad as other financial problems of yesteryear.

"I've been doing this for more than 25 years and I've lived through the 1987 crash, the tech bubble bursting and Lehman," he said. "Could this be the fourth major crisis? It could. But my guess is that it isn't."

Stone agreed. He stressed that he thinks the U.S. will avoid another recession. And if that is the case, investors can't continue to ignore the strength in Corporate America. Many businesses have healthy balance sheets and are using their cash to increase dividends.

Landesman added that the market seems to take turns between paying too much attention to every twist and turn in Europe and cavalierly dismissing the threat that the continent's debt crisis poses to the global markets. Right now, he thinks the pendulum has swung too far to the euro-obsession side.

"When people are too focused on what's happening on Europe, I tend to think it's a buying opportunity. We're closer to the bottom than a top," he said.

Landesman said that he's hopeful that Europe's serious fiscal challenges will finally serve as a wake-up call

'The good news about real trouble is it should motivate governments and central bankers to take meaningful steps that are necessary," he said.

Hopefully, he's right. But Stone said that until European leaders prove to investors that they can come up with a real solution for the debt problems plaguing the pentagon of PIIGS (Portugal, Ireland, Italy, Greece and Spain) then there is no reason to get overly excited about stocks.

Paul Nolte, managing director of Dearborn Partners, an investment firm in Chicago, added that for the time being, it's best for investors to stick with what's working. He said investors should not try and call the bottom.

Nolte said he still likes bonds and dividend-paying stocks in industries that offer high yields, such as utilities and health care. Even as the broader market is down for the year, the Health Care Select Sector SPDR (XLV) exchange traded fund and Dow Jones Utilities Average (DJU) are still in positive territory for 2011.

"When will all of this volatility change? When it changes," Nolte quipped. "I hate to say it, but it's hard to predict when the market will turn. Investors have to stay defensive."

Welcome back to solid ground my friend. Vacation was fantastic. And sorely needed. But it's nice to be back. With that in mind, I figured I'd hit the ground rolling with another nonsensical pop culture challenge!

The fact that gold is again near $1,900 an ounce got me wondering if it would soon hit $2,000. That brought the following song lyric to mind. "How's it goin' 2000 man?" So I asked my Twitter followers (now more than 10K strong ... woo-hoo!) to name that tune.

The answer is "He's Simple, He's Dumb, He's the Pilot" by the lo-fi geek rock (and sadly broken up) band Grandaddy. The winner is Eric Hellweg, who is now the editor of the Harvard Business Review online. In a former life, Eric and I took turns writing the Tech Biz column for CNNMoney.

Eric's a great guy and I do not hold any lingering resentment about losing a bet to him in 2004 after his Red Sox defeated my Yankees in the playoffs. None. Even though the Sox came back from a 3-0 hole and went on to the World Series.

I'm not bitter. Not at all.

But Eric, how about that two-and-a-half game lead for the Bronx Bombers?

The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: