Search News

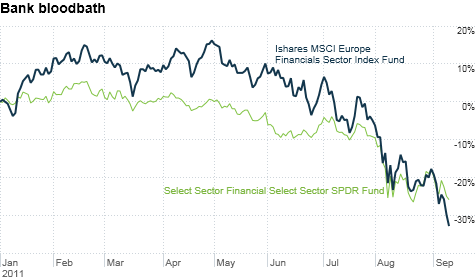

As awful as 2011 has been for big U.S. financial stocks, European banks have peformed even worse.

NEW YORK (CNNMoney) -- The top grossing film at the box office this past weekend was a movie called "Contagion." It's a horror story. But no, it's not about the European debt crisis.

Stocks plunged in Europe Monday. Fears of a potential Greek default continued to scare investors following reports that German banks were preparing for such a possibility.

The dollar rallied against the euro and investors also flocked to U.S. Treasury bonds. And while stocks on Wall Street actually managed to stage a late-day rally, experts said the worst is not yet over in Europe.

Alex Bellefleur, financial economist with Brockhouse Cooper in Montreal, said there are only two ways out of the sovereign debt mess plaguing the continent.

The first is for European leaders to agree to issue a single, unified debt security, or so-called euro bond. That could help reduce cripplingly high interest rates in Portugal, Ireland and Greece and put less pressure on Italy and Spain too.

That doesn't appear likely as "stronger" nations in Europe such as Germany, France and The Netherlands may object to higher bond yields for their countries just to ease the burdens of Greece and the other PIIGS of Europe.

The second resolution is letting Greece default, Bellefleur said. And that won't be pretty, especially for major banks in Europe that are already getting shellacked.

The iShares MSCI Europe Financials Sector Index Fund (EUFN), which includes France's Societe Generale and BNP Paribas, Italy's UniCredit and Intesa and many other hard-hit European banks, has plunged nearly 14% in just the past week. The fund is down more than 30% this year.

"There is no way you can have a sovereign nation default and have it not impact confidence in the financial system," said Bellefleur. "A country going broke is obviously a pretty serious thing."

But will Greece default -- or to take it a step further, even exit the eurozone and bring back the drachma?

It's still unclear.

Greece is trying to prove to the so-called troika that it's relying on for funding -- the International Monetary Fund, European Central Bank and European Union -- that it will meet requirements to get its next round of financing (about $11 billion) as part of last year's bailout package. Greek officials are expected to meet with members of the troika later this week.

"Greece came up with a new tax on real estate that could help raise some money. I think Greece is doing everything it can," said Andrew Busch, global currency & public policy strategist with BMO Capital Markets in Chicago.

But the market remains skeptical. Even if Greece gets its next round of financing, that won't solve the many problems facing the eurozone. There are rumors about French banks getting downgraded by credit rating agencies. Last week's surprise resignation of a key ECB official also has spooked investors.

"The market has made up its mind. The euro will continue to weaken," said Ashraf Laidi, chief executive officer of Intermarket Strategy Ltd, a London-based research firm. "If it's not Greece, it's France or Italy or something else."

That said, Bellefleur thinks it may be time for Europe to bite the bullet and get a Greek default over with already. He said that even though this would create more chaos in the short-term, it's better to rip the Band-Aid off now as opposed to letting the wound that is Greece fester for another several months or years.

"Let Greece default and then work on trying recapitalize the European banks. At least then there would be a roadmap and no more uncertainty about when a default might happen," he said.

It may not be that simple though. Robert Tipp, chief investment strategist for Prudential Fixed Income in Newark, N.J., said that a Greek default now would create a contagion, a disorderly series of events that would likely make matters much worse for the remaining four PIIGS.

"If Greece was isolated and not part of a monetary union, then all else being equal, a default would be for the best. Investors could get on with their lives," Tipp said. "But the fact is that the other European sovereigns are having credit spreads widen. A handful of them are at unsustainable or barely sustainable levels."

The good news, if you want to call it that, is that U.S. banks don't have nearly as much exposure to the most troubled parts of Europe as their counterparts across the Atlantic.

Matt Lloyd, chief investment strategist at AAM, a money management firm in Monument, Colo., said he thinks U.S. financials are better prepared for (and protected against) volatility in Europe than they were three years ago for the mortgage collapse and bankruptcy of Lehman Brothers.

But that's little consolation to investors. Bank stocks in the U.S. are plunging as well. And based on how U.S. stocks have been reacting to Europe as of late, it's clear that any economic disruption created by a default in Greece would have massive ripple effects on the U.S. as well. Our economy is simply too weak as it is to absorb another major credit shock.

"Clearly, things are moving quickly. The bigger issue is whether this spreads," said BMO's Busch.

Oliver Pursche, co-manager of the GMG Defensive Beta Fund (MPDAX) in Suffern, N.Y., agreed. He said that while it would be nice to finally get Greece out of the headlines, default isn't the way to do it.

"This is a story that keeps on giving. We've been talking about Greece for well over two years. The market is still trying to wrap its head around why Greece is resisting the changes that are necessary," he said. "But no Greek default is the most desirable solution."

The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: