Search News

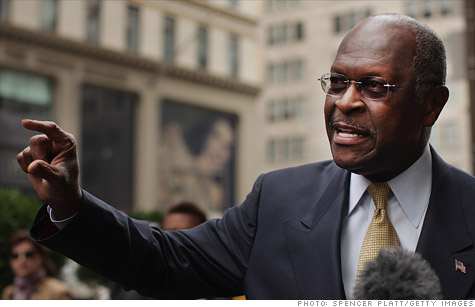

Republican presidential candidate Herman Cain has a radical idea to reform the tax system. But experts say his 9-9-9 plan will help the rich, and hurt the poor.

NEW YORK (CNNMoney) -- Herman Cain has a plan to radically reform the nation's tax system and make things a lot simpler for taxpayers.

Problem is, it could end up adding to the deficit and shifting the tax burden away from the wealthy and onto the poor, according to some leading tax experts.

Cain, who's recently moved up in the polls to become one of the leading Republican presidential candidates, is basing much of his campaign on what he calls the 9-9-9 plan, which would get rid of almost all current taxes and replace them with a 9% flat tax on income, a 9% flat corporate tax and a 9% national sales tax.

Cain claims his system would raise as much tax revenue as the current complex system of federal income tax, corporate taxes and payroll taxes. And he believes his plan could bring in additional revenue by boosting economic growth.

Tax experts from various nonpartisan think tanks say without seeing more details of the plan than Cain has released thus far, they can't say for sure whether the system would match current tax collections, or add to the deficit.

"It is theoretically possible it could be revenue neutral, if you literally taxed all of consumption," said Diane Lim Rogers, chief economist with the Concord Coalition, a think tank that focuses on reducing the federal deficit.

Other experts doubt Cain's proposal would be able to raise as much revenue as the current system, even with the addition of the sales tax.

"That's a big revenue hole you have to fill," said Joe Minarik, director of research for the Committee for Economic Development, referring to the significantly lower rates for income, payroll and corporate taxes. "A 9% sales tax is relatively muscular. It will raise a lot of money But my guess is you'll probably be revenue short."

But what is far more clear, according to the experts, is that the wealthy would end up paying less than under the current system, and the poor would end paying more.

About 22% of taxpayers, primarily low-income earners, pay no taxes and even get money back from tax credits, according to Roberton Williams, senior fellow for the Tax Policy Center. Credits they get for things like having children and the earned income tax credit offset the money they own in payroll taxes. And since they'd be paying a 9% sales tax under Cain's proposal, their dollars won't go as far.

"For the bottom end it's certain to be a tax rise of substantial proportion," he said.

The effective tax rate for the top 1% of wage earners is about 18%, Williams said, so a flat rate of 9% would mean a substantial reduction for most, even with the addition of a 9% sales tax on purchases. The wealthy are far less likely than low- or middle-income wage earners to be spending all of their earnings on purchases that would be subject to the sales tax.

"Every change in the tax system shifts who pays how much. If you're trying to be revenue neutral, there's always going to be winners and losers," said Williams.

But Cain's chief economic advisor, Rich Lowrie, said that low-wage earners would be better off with the 9-9-9 plan because some of the government assistance they now receive quickly falls away as they start to earn more, which he said prevents upward mobility, creating what he calls a "poverty trap."

He also said the sales tax would not increase costs for consumers, because lower corporate taxes would lead businesses to cut prices in order to stay competitive.

And he said the plan would also include some tax breaks in inner cities, details of which are still being worked out.

"We did focus a lot on how do you address the poverty problem," he said. "Clearly, the current system is not working. The advocates of the present system haven't been able to show results for 40 years," Lowrie said. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Latest Report | Next Update |

|---|---|

| Home prices | Aug 28 |

| Consumer confidence | Aug 28 |

| GDP | Aug 29 |

| Manufacturing (ISM) | Sept 4 |

| Jobs | Sept 7 |

| Inflation (CPI) | Sept 14 |

| Retail sales | Sept 14 |