Search News

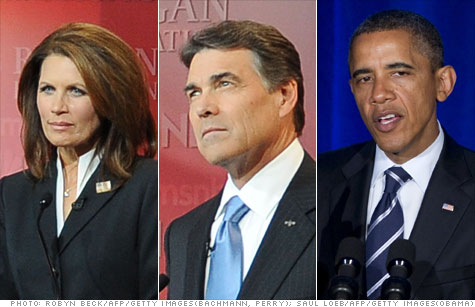

Class warfare on the campaign trail: Presidential candidates have different views on who should pay more taxes.

NEW YORK (CNNMoney) -- Both Republican presidential candidates and President Obama think many Americans aren't paying their fair share of income tax.

They just have very different ideas of who should be paying more.

It's class warfare, Election 2012-style.

As they criss-cross the country on the campaign trail, several GOP contenders have highlighted the fact nearly half of households don't pay any federal income taxes.

Meanwhile, back in Washington D.C., Democrats are pushing a tax surcharge on millionaires. The so-called Buffett Rule, named after billionaire Warren Buffett, is intended to ensure that the rich pay a higher percentage of their income in federal income and payroll taxes than those who make less.

At issue for the Republicans is the fact that an estimated 46% of Americans don't owe any federal income tax. That's because many of them earn so little that the standard deduction and personal exemption absolve them of liability.

Two GOP candidates -- Minnesota Rep. Michele Bachmann and Texas Governor Rick Perry -- have called for more people to fork over at least some of their earnings to the federal government.

"Everyone should pay something because we all benefit," Bachmann said on a campaign stop this summer. "We need to broaden the base so that everybody pays something, even if it's a dollar."

And when Perry announced he was entering the 2012 election, he blasted "liberals" who want to raise taxes.

"We're dismayed at the injustice that nearly half of all Americans don't even pay any income tax," he said.

A few days later, asked about changing the nation's entitlement mindset, Perry repeated that statistic and said: "One of the ways is [having] as many people as possible to be able to be helping pay for the government that we have in this country."

"Having more people who are outside of the wagon pulling it ... than having all the rest of us that are paying taxes pulling that wagon [is] one of the real answers. And that is a form of personal responsibility," he continued.

Asked for elaboration on his statements, a Perry spokeswoman said the candidate wants to increase the number of taxpayers by having more of the unemployed return to work. Also, he wants to boost the economy so more people earn enough to be subject to tax.

"The issue is to generate wealth within our population so that people are contributing to our tax system," said Catherine Frazier, a Perry spokeswoman.

The Bachmann campaign did not return calls seeking comment.

One issue that unites the Republican candidates is that they don't want to raise taxes. And they are opposed to Obama's plan to ask the wealthy to pay more.

The president, however, has said he supports Senate Democrats' proposal to add a 5.6% surtax on income over $1 million.

"What's true is we've also got to rein in our deficits and live within our means, which is why this jobs bill is fully paid for by asking millionaires and billionaires to pay their fair share," the president said in a news conference last week. "Some see this as class warfare. I see it as a simple choice."

Putting politics aside, many economists think that broadening the tax base is a good idea, said Roberton Williams, a senior fellow at the nonpartisan Tax Policy Center, which is an oft-cited source for the statistic that nearly half of households don't pay tax.

But usually, they want to see more income subject to tax, not necessarily more taxpayers, he said. That could involve getting rid of certain deductions and loopholes, which lower the tax liabilities of people across the income scale.

This year, Williams estimates that 75 million households, or 46%, will not pay any federal income tax. Half make so little that the standard deduction and personal exemptions eliminates their liability. Nearly two-thirds of households that pay no tax make less than $50,000.

Most of these households, however, do pay federal payroll taxes to support the Social Security and Medicare systems. Of those that pay neither income nor payroll taxes, the majority are elderly.

The wealthy, however, are the main beneficiaries of the nation's tax code, Williams said. While they still pay some tax, their liability is greatly lowered by various tax rules, particularly the 15% rate on capital gains.

Few of the Republican candidates have laid out specific plans to reform the tax code. But depending on how they do it, they could end up socking the rich with bigger bills.

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Latest Report | Next Update |

|---|---|

| Home prices | Aug 28 |

| Consumer confidence | Aug 28 |

| GDP | Aug 29 |

| Manufacturing (ISM) | Sept 4 |

| Jobs | Sept 7 |

| Inflation (CPI) | Sept 14 |

| Retail sales | Sept 14 |