Search News

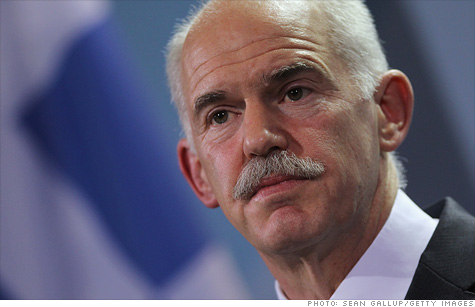

Greek Prime Minister George Papandreou is pushing for a coalition government as he seeks support for the nation's controversial bailout package.

(CNN) -- Greek Prime Minister George Papandreou said Saturday he will do what it takes to form a coalition government and push through a controversial international bailout package.

He met with President Karolos Papoulias on Saturday to seek permission to form a coalition, hours after winning a vote of confidence by a narrow margin, and has begun talks with smaller parties on forming a government.

The president summoned party members ahead of a Cabinet meeting set for Sunday.

The vote of confidence gives Greece's stricken economy some breathing room -- and may reassure international markets sent into a tailspin by political turmoil in Greece -- but many questions remain unanswered.

he 153-145 confidence vote victory came minutes after Papandreou announced that he would seek a coalition government, but it was not immediately clear who would lead it.

Reports have named current Finance Minister Evangelos Venizelos as a possible successor as caretaker prime minister. Venizelos said Friday night he wanted to see a temporary three-month government that would push through all the necessary legislation through February.

Elections would be likely to follow. Speaking briefly after his meeting with Papoulias, Papandreou said he would take the necessary actions to form a wider cooperation government.

He said implementing a controversial bailout package reached October 27 was a priority, to ensure Greece stayed in the euro, the single currency used by the 17 nations in the euro zone.

European leaders warned this week that although they wanted Greece to stay in the euro, they considered saving the currency more important, amid fears that the Greek crisis could spread to other European countries and beyond.

In forming Greece's new government, Papandreou's Socialist PASOK party is likely to seek the support of a number of smaller parties, on either the left or the right, after the main opposition leader Antonis Samaras made it clear he did not want to be part of a coalition.

Samaras will meet Sunday with Papoulias. Samaras has called for a transitional government for six weeks, followed by elections. Papandreou argued it would be disastrous if elections were to be held immediately, because that would leave the latest bailout deal "up in the air."

The deal would wipe out €100 billion in Greek debt, half of what it owes. It comes with a promise of €30 billion from the public sector to help pay off some of the remaining debts, making the whole deal worth €130 billion (U.S. $178 billion).

But the package comes with strings that would require Greece to slash government jobs, privatize some businesses and reduce pensions.

Antonis Papagiannidis, editor of Greece's Economic Review, told CNN such austerity measures ran the risk of deepening Greece's recession.

Meanwhile, Greece's fierce party politics mean it is difficult to know what will come next following the confidence vote, he said.

"Everybody is a little confused, while at the same time the clock of the markets is ticking, tick tock," he said. "Some sort of all-out disaster is still looming right round the corner."

Papandreou's narrow victory Saturday is expected to mean that Greece will get its next installment of money from a separate international agreement brokered in May 2010, allowing it to pay its bills next month and avoid immediate default.

That €8 billion payment had been threatened when Papandreou announced earlier this week that he would take the bailout package to the Greek people through a national referendum, a move he retracted Thursday.

He came under enormous pressure from international leaders, many of whom were meeting for the G-20 summit in Cannes, France, to act to restore stability in Greece.

Though Greece ranks 32nd in terms of gross domestic product, experts say it wields a disproportionate influence on world markets; economists fret that a Greek default could drag down larger European economies, in particular those of Italy and Spain, as well as struggling Portugal and Ireland.

Although Italy's finances are in much better shape than those of Greece, it has a huge pile of debt and borrowing costs for the Italian government rose to a euro-area high of 6.43% Friday.

Tens of thousands of opposition party demonstrators turned out in central Rome Saturday to voice their opposition to the government of Italian Prime Minister Silvio Berlusconi, after he said Italy had agreed to let the International Monetary Fund "certify" its reform program, a step designed to boost investor confidence.

But he faces a vote of confidence as soon as next week amid criticism of his handling of Italy's economy -- and analysts say he may no longer have the support of a majority in parliament.

A crucial vote on budget reform measures is expected in Rome on Tuesday.

During the hours of debate ahead of the confidence vote in Athens, Papandreou reiterated an appeal for approval of the international bailout package that the country has been offered, calling it "a huge chance, and perhaps the last one, to rebuild a country with new and strong foundations."

Papandreou insisted that he has no great desire to maintain his grip on power. "The last thing I care for is the chair," he said. "I don't care if I never get elected again."

He defended his leadership, accusing previous governments of miring the Greek economy in debt. "Those days, you could borrow money easily, and now that's why the Greek people have to pay back for it," he said.

Papandreou said he now wanted "to turn the page over and move forward."

-- CNN's Jim Boulden in Athens and Matthew Chance and Hada Messia in Rome contributed to this report. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: