Search News

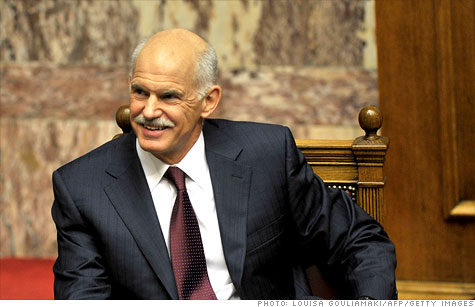

Outgoing Greek Prime Minister George Papandreou.

ATHENS, Greece (CNN) -- Greek Prime Minister George Papandreou has said he is confident of a positive outcome by the end of Tuesday, a spokesman said, as thorny discussions continue on forming a new government.

Papandreou has asked members of the Cabinet to have their resignations ready following a Cabinet meeting Tuesday morning, spokesman Vasilis Papadimitriou in the prime minister's office told CNN.

But Papandreou and the main opposition leader Antonis Samaras are still discussing who might lead the new government, Greek state broadcaster ERT reported.

Among those rumored to be a contender for the job is Lucas Papademos, a former vice president of the European Central Bank and ex-governor of the Bank of Greece, who is currently a visiting economics professor at Harvard University.

Greek debt crisis: Shades of Argentina

Meanwhile, European finance ministers meeting in Brussels announced Monday that they have already requested assurances in writing that Greece's government-to-be will stick to austerity agreements made by the outgoing government.

According to ERT, Greek Finance Minister Evangelos Venizelos told the Cabinet meeting that those expected to sign will include the new prime minister, the new finance minister, party leaders Papandreou and Samaras, and the current governor of the Bank of Greece, George Provopoulos. Without this letter, the broadcaster said, the next tranche of bailout money from a 2010 deal will not be released.

Political turmoil in Greece last week led to wide uncertainty in financial markets in Europe and beyond.

But government spokesman Ilias Mosialos announced Monday that a new prime minister would be named, hours after Venizelos told reporters that the tense economic situation in Athens had changed dramatically over the weekend and that there was cause for optimism.

"After a difficult week, we have now a new political situation, a new political frame in Greece," he said in Brussels, where finance ministers to eurozone countries were meeting.

"We have a new government of national unity and of national responsibility. This is the proof of our commitment and of our national capacity to implement the program and to reconstruct our country."

Eurozone finance ministers assembled in Brussels to discuss the Greek debt crisis and sweeping political shuffle, but their focus extended beyond Greece to include other, bigger ailing European Union economies and approaches to shoring up the EU bailout fund, which is slated to launch in the coming months.

"We welcome the intention of Greece to form a national unity government," Euro Group President Jean-Claude Juncker told reporters after the EU finance ministers' meeting. But he reiterated EU expectations that all political parties in governing roles in Greece remain dedicated to adhering to austerity measures and keeping the common currency, the euro.

"We underlined the importance of sustained cross-party support for the program in Greece," said Juncker, who is also prime minister of Luxembourg, home to one of Europe's best-known banking centers.

"In this context, we asked the new Greek authorities to send a letter, co-signed also by the leaders of the two main parties of the incoming coalition government, reaffirming their strong commitment," he said.

On Sunday, Greek President Karolos Papoulias announced that Papandreou would step down from his post as prime minister -- so long as a controversial 130 billion euro bailout deal cobbled together late last month is approved.

New elections will be held after the bailout is implemented, most likely on February 19, Venizelos said.

The formation of a new government could close one chapter in Greece's long-running, tumultuous political and economic saga, as Papandreou had become a lightning rod for critics of his leadership of the heavily indebted southern European nation.

Greece's turmoil is far from over.

The bailout, the second it has received from the European Union and International Monetary Fund, comes with a hefty price tag -- the imposition of additional austerity measures that include slashing government jobs, privatizing some businesses and reducing pensions.

It also comes at a time when Greece's economy -- and to some extent the global economy -- is staggering.

Though Greece ranks 32nd in terms of gross domestic product, experts say it wields a disproportionate influence internationally. Economists worry that a Greek default on its debt could pull down larger European economies, particularly those of Italy and Spain, as well as struggling Portugal and Ireland.

But German Finance Minister Wolfgang Schaeuble told reporters in Brussels that Italy's woes do not warrant the same level of concern as the Greek crisis.

"Italy's actual numbers don't justify this nervousness in the markets," he said. "Italy definitively announced a plethora of measures at the meeting of the heads of state and government on the 27th of October that have the wherewithal to win back new trust for Italy in the markets, if they are implemented."

CNN's Diana Magnay, Jim Boulden and Andrew Carey in Athens and Matthew Chance and Hada Messia in Rome contributed to this report. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: