Search News

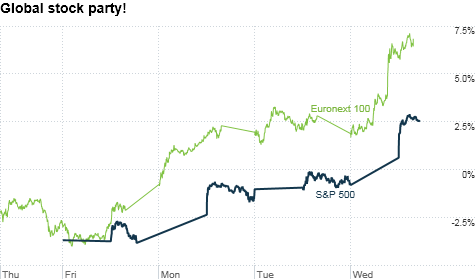

Stocks in the U.S. and Europe have surged as the Fed and other central banks took a bold move to inject liqudity into the global markets. But can the rally last?

NEW YORK (CNNMoney) -- I wrote in yesterday's column about how the market wanted the European Central Bank to do something. It looks like the ECB listened.

And the Federal Reserve. And the central banks of Japan, England, Canada and Switzerland. The coordinated effort to inject more liquidity into the markets has investors giddy with excitement. Stocks in the U.S. and Europe surged Wednesday.

Heck, the People's Bank of China stepped in with a separate easing initiative Wednesday, cutting the reserve requirement ratio for Chinese lenders for the first time since the end of 2008.

It seems like the Little Green Men's Bank of Mars is the only central bank in the solar system that didn't announce a major stimulative step Wednesday. I guess they're still more worried about inflation than a credit crunch.

In all seriousness, the moves by the Fed and its developed world companions -- as well as China's surprise action -- can be interpreted in two ways. On the one hand, the news is good because it shows central bankers really "get it."

They understand that the problems in Europe are -- like certain body parts of Teri Hatcher on a famous "Seinfeld" episode -- real and spectacular. Monetary policymakers are going to do whatever they can to keep the eurozone afloat and also prop up the world's biggest banks.

Is it mere coincidence that the Fed took such a bold step a day after Standard & Poor's downgraded the credit ratings of several large banks -- including the U.S. Big 6 of Bank of America (BAC, Fortune 500), Citigroup (C, Fortune 500), JPMorgan Chase (JPM, Fortune 500), Goldman Sachs (GS, Fortune 500), Morgan Stanley (MS, Fortune 500) and Wells Fargo (WFC, Fortune 500)?

Investors have been pounding bank stocks mercilessly as of late. BofA in particular has been rocked. Shares of BofA hit a new multi-year low Tuesday and briefly dipped below the psychologically important $5 level in after hours trading following the S&P downgrade.

So the fact that banks around the globe now should have an easier time of tapping short-term funding in the credit markets thanks to the Fed is unquestionably encouraging. But it's not the long sought after magic bullet solution.

"When you look at what all the central banks are doing around the globe, creating more liquidity is significant but it's not going to solve the world's problems," said David Hefty, CEO and co-founder of Hefty Wealth Partners in Auburn, Ind.

Still, Hefty noted that it is telling that central banks seem to realize that they have to show investors they are not going to sit idly by and that they are willing to cooperate.

"The message is they recognize the severity of the problem and they are committed to working together. We hadn't really seen that commitment before," Hefty said.

At the same time, one has to wonder if investors are too blinded by the liquidity sugar rush to consider that the deluge of central bank news is really a sign of just how dire the issues in Europe are right now.

The U.S. economy actually doesn't look so terrible in comparison to Europe. It's still sluggish but it doesn't seem to be on the verge of a double dip. In addition to the Fed news, there were better-than-expected reports about jobs and manufacturing Wednesday.

Still, the Fed is acting like it needs to prevent another 2008. That's telling.

And the China reserve requirement cut is particularly striking. China still has inflation and asset bubble problems to contend with. But its central bank decided that it needed to stop tightening now even though it boosted the reserve requirement ratio as recently as June and also raised interest rates in July?

That could mean that China is really concerned the European mess could crush demand for Chinese exports.

Europe is a huge trading partner for China -- so much so that many European leaders have been hoping that China will actually invest in the new and improved, leveraged up bailout fund that the EU unveiled last month.

China may not want to go so far as buying up more bonds issued by the European Financial Stability Facility.

But the loosening of the reserve requirements may be China's way of throwing Europe and the rest of the world a bone and showing that it's willing to do its part in the Great Easing.

Jeffrey Bergstrand, a professor of finance with the Mendoza College of Business at the University of Notre Dame, said he expects China to cut the reserve requirement ratio further in the coming months. Interest rate cuts are likely as well.

"Clearly, the concern is that Western Europe is on the precipice of recession and the U.S. will remain sluggish. That will hurt China," Bergstrand said. "There needs to be more stimulus."

The Fed and People's Bank of China appear to be hinting that more monetary stimulus will be in the offing. So you can expect more big market pops on that news.

But don't fool yourself into thinking that it's a real solution. Many investors still think the ECB needs to buy a much larger chunk of bonds of troubled countries to help Europe. The ECB, unlike the Fed, has been reluctant to do a major round of so-called quantitative easing.

"There is the illusion of progress. The enthusiasm will be short-lived primarily because the philosophy of the Fed and ECB are still against each other," said Jeff Sica, president and chief investment officer of SICA Wealth Management in Morristown, N.J. "Any coordinated efforts will be slow and painful."

It's worth nothing that while bond yields in Italy and Spain fell Wednesday, they still remain uncomfortably high. It will take more than a turkey baster injection of cheap dollars from the Fed to change that. So some think investors should enjoy the big moves up while they can.

"This rally could last through the end of December. But the reality is that we still have a problem. It's a four letter word called debt," said T. Doug Dale, advisor with Security Ballew Wealth Management in Jackson, Miss. "Central banks are providing liquidity. It's a Band-Aid but it's by no means a fix."

Best of StockTwits: For some bizarre reason, tweeters wanted to yak about that big market rally Wednesday. Go figure.

firstadopter: Day before options expiration or last day of month for hedge-funds. Fed knows exactly what they are doing to inflict max pain to shorts.

I don't tend to go for the conspiracy theory stuff. But the timing is certainly fishy.

The_Real_Fly: Christmas come early. Lights out for the bears. See you in January.

Ho ho ho. It looks like the Santa Claus Rally is here. But watch out in 2012?

sunshinetrader: From oversold to overbought in three days - it never gets boring.

Ain't that the truth! It's exhausting. But better this than days where we're left wondering if the Dow is down 25 measly points due to "profit taking." News beats no news any day of the week.

The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: