Search News

Cut those taxes.

NEW YORK (CNNMoney) -- Every Republican presidential hopeful has a plan to cut taxes.

But one candidate's plan has been described as so aggressive that it would blow a hole in the federal budget, lead to huge deficits and give the richest Americans a gigantic tax break.

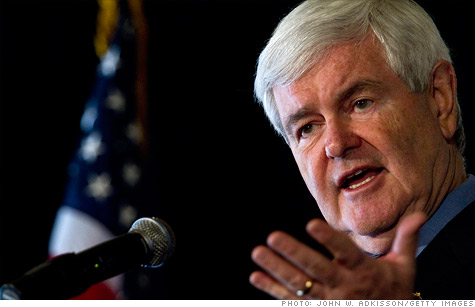

That candidate is current frontrunner Newt Gingrich.

According a new analysis, Gingrich's tax plan would reduce government revenue by a staggering $1.3 trillion -- or 35% -- in 2015, the first year the plan could be fully implemented.

"It's mind boggling. It's a very large tax cut," said Roberton Williams, a senior fellow at the non-partisan Tax Policy Center, which performed the analysis.

What would Gingrich's plan do?

Gingrich wants to add to the current tax code by putting an optional 15% flat tax on income in place, with a $12,000 per-person deduction. And Gingrich would like to eliminate the estate and capital gains taxes.

For businesses, Gingrich wants to reduce the corporate tax rate from 35% to 12.5% -- a move that would take the rate from one of the highest in the industrialized world to one of the lowest.

All those tax cuts mean the federal government would take in much less money. In order to balance the budget -- or get even remotely close -- government spending would have to be slashed by huge amounts.

And that, as the current Congress has made clear, is near impossible.

The super committee, for example, was trying to find $1.2 trillion in savings over a ten-year period. They failed. The Gingrich plan would create a gap of $1.3 trillion in just a single year.

"This plan means big deficits," Williams said. "Or huge forced spending cuts. Or both."

But taxes would definitely go down. A lot.

A full 70% of Americans would pay lower taxes under the Gingrich plan, according to the analysis, an average savings of over $7,000 compared to current policy.

The highest-income individuals would see the greatest benefit. A full 99.9% of Americans with more than $1 million in income would get a tax cut. The average savings: $613,000, for an after-tax income boost of 28.7%.

The tax rate paid by those individuals would fall to 11.9%, a reduction of almost 20%. Meanwhile, Americans making less than $100,000 would see their rates drop by between 0.5% and 3.1%.

Peter Ferrara, an independent economic adviser to Newt Gingrich responded that the Tax Policy Center does not take economic growth into account, and that the plan is part of a larger effort to balance the budget in 10 years. The campaign intends to release its own analysis in a few weeks.

The Gingrich tax plan was not heavily scrutinized when first released, but as the former long-shot candidate's fortunes have improved, his plans for the economy have received more attention.

The plan is similar in some respects to that of Texas Governor Rick Perry, but Gingrich's proposed rate cuts go even further.

For example, Perry would add a 20% optional flat tax and cut the corporate rate to the same level, while Gingrich wants to take the flat tax down to 15%, and the corporate rate to 12.5%.

Similar to the plan proposed by Rick Perry, taxpayers would be able to choose whether to pay the flat tax, or file under the existing tax code.

Both Perry and Gingrich have touted their optional flat taxes as a way to simplify the tax preparation process.

But tax experts have thrown cold water on that idea -- arguing that adding an additional tax option would necessitate the preparation of multiple returns to ensure the lowest rate.

"It's not tax reform," Williams said. "As long as you leave the old code in place, you're not doing tax reform. This would absolutely make it more complex."

And if Gingrich survives the primary process and emerges as the Republican nominee, his tax plan could provide ammo for the White House, which has signaled in recent days that income inequality will be central to its general campaign message.

After all, the top 1% of earners would get a tax break of more than $340,000 under Gingrich's plan, even if you assume the Bush tax cuts are extended. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Latest Report | Next Update |

|---|---|

| Home prices | Aug 28 |

| Consumer confidence | Aug 28 |

| GDP | Aug 29 |

| Manufacturing (ISM) | Sept 4 |

| Jobs | Sept 7 |

| Inflation (CPI) | Sept 14 |

| Retail sales | Sept 14 |