Search News

NEW YORK (CNNMoney) -- If Congress doesn't extend unemployment benefits in the next few weeks, millions of jobless Americans will find themselves without a vital safety net in 2012.

That's a good thing, some economists say.

Lawmakers must decide by the end of the year whether to once again extend the deadline to file for unemployment benefits. If they don't, up to 5 million people will stop getting checks next year, according to the Labor Department.

The federal government has provided the unemployed an unprecedented amount of support during the Great Recession. The jobless can receive up to 73 weeks of federal extended unemployment benefits once their state checks, which last up to 26 weeks, run out.

This far surpasses the previous record for unemployment benefits, which totaled 65 weeks during the recession of the mid-1970s.

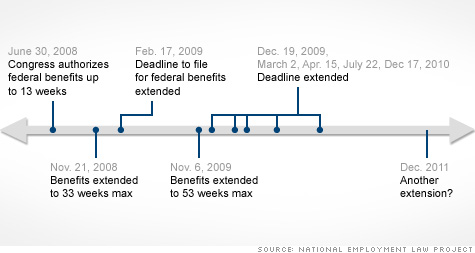

Federal benefits have been lengthened or extended eight times since they were first authorized in June 2008. Some 17.6 million Americans have collected federal benefits over the past four years at a cost of nearly $185 billion to taxpayers.

Extending them for another year is estimated to cost another $44 billion.

But maintaining this safety net keeps the unemployment rate higher than it should be, according to some economists. That's because people can afford to be choosier about taking jobs when they are receiving a regular check. Others may have dropped out of the labor market -- to go back to school, for instance -- but don't because they want to keep collecting a check.

The recent benefit extensions have raised the unemployment rate for men by about 1.2 percentage points, Shigeru Fujita, a senior economist at the Federal Reserve Bank of Philadelphia, wrote in a paper earlier this year. Others have estimated that it elevates the rate by as much as 2 percentage points.

Extending jobless benefits allows people to put off difficult choices, such as moving to another state to find work, switching industries, getting retrained or accepting lower salaries, said Chris Edwards, an economist with the Cato Institute, which advocates for a limited government role.

"It does demotivate people from making tough decisions that they need to make," he said, adding that the economy will recover when Americans "adjust to the new reality. The faster they adjust, the better off we all are."

That theory, however, doesn't sit well with many of the unemployed and their supporters. They say they'd much rather work, but they simply can't find anyone willing to hire them.

"I don't know anybody who enjoys being on unemployment," said Cathy Kytola of Grand Junction, Colo., who was laid off from a data entry position in September 2010. "It's not fun. It's stressful."

Kytola, a 33-year-old married mother of two, said she is applying for a wide range of jobs but can barely land an interview. The family was forced to turn to food stamps and charity programs to stay afloat since her husband has only been able to find sporadic work at a car wash.

No matter what Congress does, Kytola will exhaust her benefits in February. Once that happens, her family will fall into a "devastating downward spiral" since they depend mainly on her benefits to pay the rent and other expenses.

Now is not the time to cut off unemployment checks, say advocates of those who are out of work. Though the federal response is unparalleled, so is the economic downturn, which has produced a record period of long-term joblessness. Also, Congress has never cut back federal benefits when the unemployment rate was higher than 7.2%. It now stands at 8.6%.

Jesse Rothstein, who served as the chief economist in the Department of Labor last year, estimates that extended benefits raises the jobless rate by only .5 percentage points at the most. And more than half of that increase is because people must continue to look for work to receive their checks. If they stopped getting benefits, many would just drop out of the labor force completely.

"You want people to be able to survive until the labor market recovers enough so they can find new jobs in a reasonable length of time," said Rothstein, now an economics professor at University of California, Berkeley.

Those on unemployment benefits say they are barely surviving. Kevin Kalmes, who lost her $75,000 job in an assembly facility in March 2010, had to surrender her cars and stop paying the mortgage on her Chicago home to get by on $1,300 a month.

She'll soon exhaust her federal extended benefits and will have to consider moving in with her sister in Florida just to keep a roof over her head.

"At the end of this month, I won't be paying any bills," said Kalmes, 60. "It's absurd for people to say that I'd rather stay in my situation than get a job."

While economist Bruce Yandle thinks the unemployed need a safety net, he feels it should not go on indefinitely because it does dissuade people from taking jobs. He advocated more of a middle-of-the-road solution: Give the jobless extended benefits, but make sure there is a firm cut-off date. Also, have their payments diminish over that period.

"This is the time to be creative and come to grips with the disincentive effects of unemployment benefits," said Yandle, an adjunct professor at the Mercatus Center at George Mason University.

Do you receive unemployment insurance? Have you not been looking for a job as hard because you are getting benefits? Email mailto:realstories@cnnmoney.com with your contact information and you could be contacted for an upcoming story or video. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Latest Report | Next Update |

|---|---|

| Home prices | Aug 28 |

| Consumer confidence | Aug 28 |

| GDP | Aug 29 |

| Manufacturing (ISM) | Sept 4 |

| Jobs | Sept 7 |

| Inflation (CPI) | Sept 14 |

| Retail sales | Sept 14 |