Search News

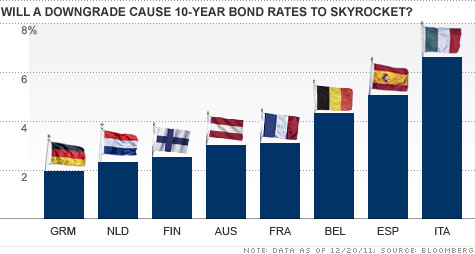

Bond rates remain low in several European nations. But a downgrade of France could cause yields to move closer to the levels of Italy and Spain.

NEW YORK (CNNMoney) -- The S in S&P stands for Standard. But it might as well be Scrooge if the credit rating agency goes ahead and downgrades the sovereign debt of France and other European nations in the next few days.

A change to France's ratings could have huge ripple effects. It may be far more troublesome than when S&P stripped the U.S. of its AAA rating back in August after the debt ceiling debacle in Congress.

For one, the U.S. was only lowered one notch -- to AA+. But Standard & Poor's, which put France and 14 other members of the eurozone on watch for a downgrade earlier this month, has said that France could have its rating cut by two levels.

What's more, the credit rating of the European Stability Financial Facility, the bailout fund that will hopefully keep conditions from worsening in Spain and Italy, depends largely on the ratings of the EFSF's biggest backers: France and Germany. S&P put the EFSF -- as well as the entire European Union -- on notice for a downgrade a few weeks ago too.

Still, some investment strategists believe the likelihood of a rating cut by S&P (sort of the opposite of a Christmas miracle) is factored into the markets at this point.

"Downgrades may be priced in and we'll muddle through them somehow," said Andrew Fitzpatrick, director of investments with Hinsdale Associates in Hinsdale, Ill. "European policymakers and the ECB are willing to take measures to prop up the European markets."

But as much as some market bulls might like to think that a downgrade is already baked into stocks and bonds, I'm not so sure it's wise to assume that's the case.

When S&P downgraded Uncle Sam, that was widely anticipated. But stocks still plunged on the announcement. The good news though was that the bond market didn't blink.

Long-term Treasuries, despite a lot of hyperbole in the mainstream media about how a downgrade would lead to higher interest rates for consumers, fell after the ratings cut. Investors bought more Treasuries.

Fixed-income investors essentially gave S&P the middle finger and said, "We don't care what you think. We still believe U.S. Treasuries are safe."

That may not happen in France or the rest of Europe. Stocks could plunge and bond yields may also rise.

While long-term rates are down from panic levels of a few weeks ago, they have been creeping higher in France over the past few months. That's happened in Austria, which is also rated AAA, and Belgium, which was downgraded by S&P in November and Moody's last week.

Because investors are increasingly nervous about the debt loads of most European nations -- Germany and the Netherlands seem to be the two notable exceptions -- a rating cut could be a self-fulfilling prophecy.

It could put more pressure on nations struggling with rising interest rates since bond investors may have yet another reason to flee nations like France, Spain, and Italy en masse for the relative safety of Germany and the Untied States.

The other big difference between the S&P downgrade of the U.S. and a possible rating cut for France is that the other two ratings agencies are also souring on Europe.

In addition to the aforementioned Moody's downgrade of Belgium's credit rating, Moody's also recently lowered the ratings on French banks BNP Paribas, Credit Agricole and Societe Generale.

And the third major rating agency, Fitch, also noted in an outlook Tuesday that the worst is not over for Europe either.

Fitch warned that "the worsening of the eurozone crisis since July constitutes a significant negative shock to the region's economy and financial sector with adverse consequences for sovereign credit profiles across the region." Fitch also recently downgraded several large global banks.

Still, one market expert thinks that a downgrade won't matter much. The mere fact that investors are already differentiating between French and German bonds may mean that any market pain will be short-lived.

"The bond market is already telling us that many of the AAA-rated countries in Europe do not really deserve AAA ratings. There may be an immediate knee-jerk negative reaction to a downgrade but a shock is only a shock the first few times it happens," said Randy Frederick, managing director of trading and derivatives at Charles Schwab in Austin.

"The market may finally be getting to a point of crisis exhaustion," he added.

I'd love to believe that's true. But the ratings agencies -- like the financial markets -- don't appear to be exhausted by the European debt crisis yet. They're tired of watching European leaders hold one summit after another and tiptoe toward a solution.

A credit downgrade would be painful, but it might be the kick in the pants that Europe needs to finally realize that more action and less talk is needed.

Best of StockTwits: AT&T (T, Fortune 500) finally read the writing on the wall and abandoned its bid for T-Mobile. StockTwits users are busy trying to figure out what's next.

nanotech The $3B + $1B other expenses = $4B comes out to 67.5 cents per $T share. Hooray for $S ...and for consumers, competition is good!

I know that AT&T was making the argument that the merger would boost competition. But I'm with you. This is good news for Sprint (S, Fortune 500). And consumers. And as you'll see from this video I did today, cell phone tower stocks as well.

mapleleafnj: The dividend alone will keep this from tanking, too many investors looking for yield, 1.72 cant beat it $T.

I agree 100%. I wrote about that very fact a few weeks ago.

rannyran: $T officially drops its bid for Tmobile - not surprising...Queue $S $CMCSA $GOOG I think they will all be in play for TMobile now.

Very interesting. Sprint might make sense since it arguably does need to bulk up in the war against Verizon (VZ, Fortune 500) and AT&T. But there's that thorny issue of different networks.

However, I don't think Comcast (CMCSA, Fortune 500) would make a play for T-Mobile after selling spectrum to Verizon.

And I'd imagine Google (GOOG, Fortune 500), which seems to be the new Microsoft (MSFT, Fortune 500) when it comes to regulators, would have a tough time buying T-Mobile. Not sure the FCC would be thrilled with Google owning a smartphone maker (Motorola Mobility (MMI)) and a wireless carrier.

tradefast: Stifel Nicolaus expects $T to buy $DISH.

That could happen. But I wouldn't hold my breath. Rumors about Ma Bell buying Dish Network (DISH, Fortune 500) have been around for years. In fact, I wrote about some of the chatter back in December ... of 2005!

The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: