Search News

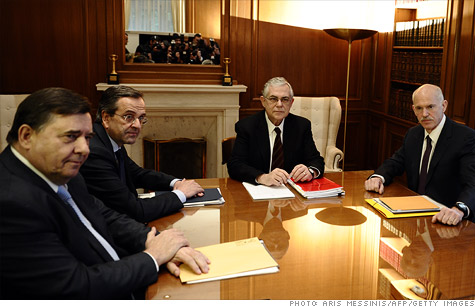

Greek Prime Minister Lucas Papademos meets with officials from the nation's main political parties to hammer out reforms needed to secure more bailout money.

NEW YORK (CNNMoney) -- Greek political leaders were meeting Wednesday to hammer out an agreement on austerity reforms as the nation scrambles to avoid a default.

Prime Minister Lucas Papademos and the leaders of Greece's governing coalition are debating a draft of reforms aimed at cutting public spending, including layoffs, minimum wage reductions and pension reforms.

Greece needs to finalize the austerity program soon to pave the way for a second bailout of €130 billion from the European Union, International Monetary Fund and European Central Bank. Without these funds, Greece could miss a €14.5 billion bond redemption in March.

If the leaders can agree to the austerity measures, Papademos is expected to call a cabinet meeting, followed by a vote in the Greek parliament.

The negotiations were postponed twice this week amid political wrangling and protests by Greek labor unions. But the pressure to reach a deal was on after finance ministers from the 17 nations that use the euro announced plans to hold an impromptu meeting Thursday.

The finance ministers will discuss the situation in Greece, according to a spokesman for Eurogroup president Jean-Claude Juncker.

"The president has decided it is the right time," for the ministers to meet, the spokesman said. "Discussion is needed now."

Papademos announced Sunday that party leaders had agreed on the "main elements" of the program, including a plan to reduce public spending by 1.5% of gross domestic output this year.

Greece, which owes some €330 billion, has come close to default before.

The nation has struggled to follow through on austerity measures and economic reforms that were a condition of its 2010 bailout package. But the Greek economy has been in recession for years and many analysts warn that additional austerity could make the situation worse.

Greece has been criticized by top EU leaders for its lack of progress on reforms aimed at making the nation's economy more competitive.

"Greece hasn't done up till now what the IMF has asked it to do," German Finance Minister Wolfgang Schaueble said in an interview with CNN's Diana Magnay. "No more promises, now they have to deliver."

On Monday, Papademos and Greek Finance Minister Evangelos Venizelos met with officials from the EU, IMF and ECB, collectively known as the troika.

In a statement issued after the meeting, Venizelos said the Greek people face a "dramatic and acute dilemma."

The austerity reforms under discussion will have "very high social costs," he said. But if negotiations fail, that would bankrupt the country and lead to "even greater sacrifices," he warned.

"The finalization of the new loan agreement and receipt of money is vital for the salvation of Greece," said Venizeols.

Meanwhile, Greece appears close to a deal with its creditors in the private sector to write down a portion of the nation's debt.

The agreement, which would result in significant losses for bondholders, is intended to help reduce Greece's debts to 120% of GDP by 2020, from about 160% currently.

The worsening Greek economy has raised calls for the nation's creditors in the "official sector" to provide some relief.

The European Central Bank, which holds an estimated €30 billion to €45 billion of Greek debt, is under pressure to forego profits on those bonds, as are individual euro area central banks.

The ECB is reportedly considering a plan to swap its Greek bonds, which the bank bought at a discount, for securities issued by the European Financial Stability Facility. The ECB would reportedly not suffer a loss on the transaction, but the move could help save Greece €11 billion.

-- CNN's Elinda Labropoulou contributed reporting from Athens and Per Nyberg contributed from London. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: