Search News

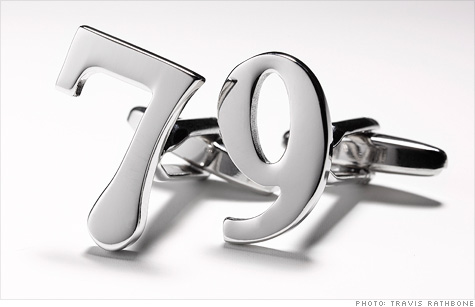

When it comes to investment performance, 79% of fund managers have returns that don't shine.

(MONEY magazine) -- They may dress better than average, but they usually don't invest that way: Last year 79% of large-cap fund managers trailed the Standard & Poor's 500-stock index, says Morningstar -- the worst showing since 1997.

Why? Annual expenses -- averaging 1.3% of assets for actively managed big-stock funds, vs. 0.69% for index funds -- hampered returns. Plus, besting the S&P is harder in years like 2011, when the biggest stocks in the index outperform the smaller ones managers tend to load up on.

Sterling advice

Index: These poor results are no anomaly. S&P's own research shows that in most market sectors, a majority of managers fall short. So embrace indexing, except in areas where talent sparkles: international small-cap stock and emerging-market bond funds.

Be picky: When you do go with active management, choose funds from the low-cost, consistent performers in our MONEY 70 lineup of funds. Beating the market is a tough trick -- one that most managers don't have up their sleeves.

Send The Help Desk your investing questions.

Do you know a Money Hero? MONEY magazine is celebrating people, both famous and unsung, who have done extraordinary work to improve others' financial well-being. To nominate your Money Hero, email heroes@moneymail.com. ![]()

Carlos Rodriguez is trying to rid himself of $15,000 in credit card debt, while paying his mortgage and saving for his son's college education.

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: