Search News

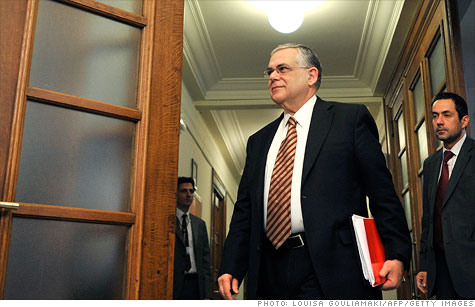

Greek Prime Minister Lucas Papademos at the Greek parliament earlier this month after lawmakers adopted an emergency law allowing the historic debt write down with private investors.

NEW YORK (CNNMoney) -- Standard & Poor's downgraded Greece's credit rating Monday to "selective default" after the government took legal steps to impose losses on all holders of Greek government bonds.

The move, which had been expected, was prompted by Greece's decision last week to insert "collective action clauses" into the contracts of most Greek government bonds, S&P said in a statement.

In March, Greece is expected to finalize a deal with investors to write down 53% of its debt held by the private sector as part of a second €130 billion bailout from the European Union and International Monetary Fund.

The collective action clauses would give Greece the power to force losses on bondholders who refused to take part in the agreement, which involves investors exchanging government debt for securities with lower interest rates.

S&P said that unilaterally changing the terms of the bond contracts constitutes "a de facto restructuring and thus a default" under its definitions.

Greece would face "an imminent outright payment default" if a sufficient number of investors do not accept the debt exchange, S&P said.

Greek bondholders must decide on the offer by March 12 in order for Greece to secure the bailout money it needs to make a €14.5 billion bond payment on March 20.

Meanwhile, S&P said it would likely consider the selective default "cured" once the debt swap is officially "consummated." At that point, the agency said it could restore the nation's previous "CCC" credit rating.

Even a CCC rating would signify that Greece still had a bleak economic outlook and unsustainable debt.

Greece has been struggling to avoid a default for over two years as the nation's economy has sunk deeper into recession and the government has been shut out of the bond market.

To qualify for its second bailout, Greece is scrambling to enact a series of austerity measures linked to its initial 2010 rescue and has pledged to undertake structural reforms to make its economy more competitive.

On Monday, German lawmakers approved the second rescue package for Greece, which is deeply unpopular in Germany.

But many economists say Greece will not be able to avoid a default without more support or additional restructuring. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: