Search News

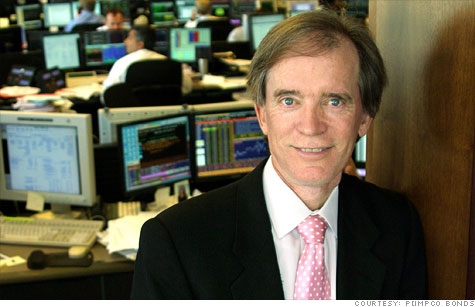

The Pimco Total Retun ETF, which began trading Thurday, aims to mirror the performance of Pimco's Total Return Fund, and it will be managed by Pimco founder and chief investment officer Bill Gross.

NEW YORK (CNNMoney) -- Bill Gross is now officially in the ETF business. Pimco launched the ETF version of its Total Return Fund Thursday, and experts say it could be a game changer.

The Pimco Total Return ETF (TRXT) aims to mirror the performance of Pimco's Total Return Fund (PTTRX), the world's largest bond mutual fund with nearly $245 billion in assets. And it will be managed by Pimco founder and chief investment officer Gross himself.

The fact that it is a version of such a popular fund and has Gross' star power makes Pimco's newest ETF a litmus test for the actively-managed ETF space.

So far, a good chunk of the 40 or so actively-managed ETFs, which represent just 0.5% of the total ETF market, have struggled to attract sizable assets and trading volumes.

But ETF industry watchers have been hoping Pimco's ETF will usher in a change.

So does Gross.

"The Total Return ETF harnesses Pimco's time-tested investment process and our skills as an active manager, and we believe it signals an important new phase in the development of the ETF marketplace," he said Thursday in a statement.

Earlier this year, Gross said he expects the Total Return ETF will follow in the footsteps of its mutual fund version to become the largest ETF in the world.

But Standard and Poor's cautions investors from flocking to the ETF out of the gates.

While the ETF version is less expensive that its mutual fund counterpart, boasting an gross expense ratio of 0.55% compared to 0.85%, it's more expensive than the larger fixed income ETFs in the market, notes Todd Rosenbluth, S&P Capital IQ ETF analyst.

Rosenbluth also warned that the ETF's holdings are likely to vary slightly from the mutual fund's holdings, since the Securities and Exchange Commission restricts the use of derivatives in new ETFs.

Trading volume for the Pimco Total Return fund topped out at 550,375 shares, trading just under $100 apiece. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: