Search News

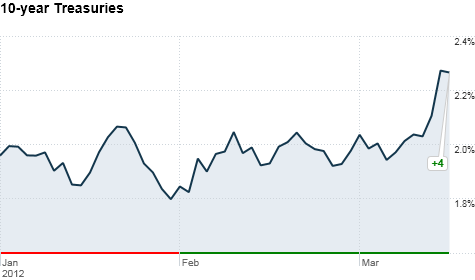

Treasury yields surged for the first time in 2012, after an optimistic economic prognosis from the Fed.

NEW YORK (CNNMoney) -- Despite this year's solid move in stocks, investors had mostly been staying in Treasuries, considered one of the safest bets during times of economic uncertainty. Until this week, that is.

Investors finally appear secure enough about the economy to leave that safe haven, pushing yields on the benchmark 10-year Treasury note briefly above 2.3% Thursday -- its highest level since October. Yields had been hovering below 2% for most of the last seven months.

Bond rates rise when prices fall. Typically, investors sell bonds as investors become more bullish and move back into stocks. The yield surge started after an announcement following the Federal Reserve's Open Market Committee meeting that said that the central bank is more optimistic on the health of the U.S. economy.

This week's moves in the Treasury market are a sign that what's been considered a bond bubble might finally be bursting.

"Investors started to think that maybe things are a little better here and started to recalibrate where yields should be," said Michael Brandes, global head of fixed income strategy at Citi Private Bank.

Indeed, yields ticked up immediately after the Fed announcement Tuesday and continued to move higher on Wednesday.

While the Federal Reserve did not make any other big changes to plans to keep interest rates low, simply acknowledging the strength in employment pushed rates higher.

"In a fragile environment where there's so much uncertainty, little comments like these from the most important central bank mean a lot," added Brandes.

While a world of Treasury yields above 2% may be the norm now, analysts don't expect rates to move that much higher because the Federal Reserve would still likely intervene to keep rates low.

Any signs that the U.S. economic recovery is slowing down could cause investors to move back into Treasuries. Another spike in oil prices could also send investors fleeing for cover.

James Rice, head of taxable fixed income trading at D.A. Davidson & Co., said that buyers quickly returned to scoop up Treasuries Thursday as yields approached 2.35%. In mid-day trading, the yield was down to 2.27%.

Meanwhile, the so-called risk-on trade is playing out not just in Treasuries but in gold prices, which have ticked down over the past several weeks.

The one irony of this week's drop in Treasury prices is that it comes just as the central banks of China and Japan are increasing their holdings of U.S. debt again, according to the most recent report from the Treasury Department on how much debt foreign countries hold.

According to the most recent report released Thursday morning, China held $1.16 trillion at the end of January, up from $1.15 trillion. But that is still down from the more than $1.31 trillion China held in July before the U.S. had its credit rating downgraded by Standard & Poor's a month later. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: