Search News

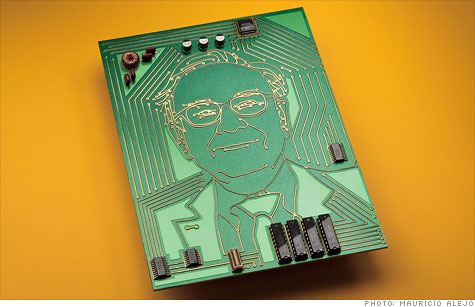

A push into tech and banks reveals an oracle who's bullish, but Warren Buffett may be more cautious than you think.

(MONEY Magazine) -- Digging into Berkshire Hathaway's portfolio to see what Warren Buffett has been buying lately -- and to gain clues as to what the world's most successful investor really thinks about the markets and economy -- has become a bit of a national pastime.

And the early reaction to Berkshire's recent moves, revealed through Buffett's annual shareholder letter and two SEC filings, was that the Oracle of Omaha appears to be putting his money where his bullish mouth is. On the surface, Berkshire seems to be doing everything you'd expect:

Be greedy when others are fearful. Check. While spooked investors pulled more than $140 billion from stock funds in the scary second half of 2011, Buffett's conglomerate went shopping.

Favor stocks over other assets. Check. Berkshire (BRKA, Fortune 500) has been avoiding gold and Treasuries lately, and its cash stake has shrunk from more than $47 billion at midyear to less than $37 billion at year-end.

Boost ownership of first-class businesses. Hello, IBM (IBM, Fortune 500)! Last year, Buffett made a massive bet on this industry-leading giant and its pristine balance sheet.

Dig a little deeper, though, and you'll find that appearances aren't always what they seem. The acquisitions made by Buffett and his new lieutenants -- former hedge fund managers Todd Combs and Ted Weschler -- show signs of caution that you may want to heed.

At the very least, you'll see that while many of Berkshire's purchases were made at prices that are no longer available since the recent rally, they're still tailor-made for investors who think a recovery could be at hand, but who want to hedge their bets.

If that sounds like you, consider Berkshire's following moves:

Plenty of eyebrows were raised when Buffett picked up nearly 64 million shares of International Business Machines (IBM, Fortune 500), valued today at around $12 billion. That vaulted the IT behemoth to the No. 2 spot in Berkshire's $77 billion investment portfolio, surpassed only by Coca-Cola. Berkshire also built a smaller stake in Intel (INTC, Fortune 500).

What made this so surprising is that Berkshire has never owned tech. It's an economically sensitive sector known for short product cycles and unpredictable earnings, and Buffett has traditionally favored Steadier Eddies. During the dotcom bubble, in fact, Buffett famously declared that "technology is not something we understand, so we don't invest in it."

Take a look at the type of tech Berkshire picked up, though. IBM and Intel are both entrenched, mature businesses -- oligopolies, really -- that have more in common with classic Buffett staples such as Coke or Procter & Gamble (PG, Fortune 500) than younger tech innovators that grab the headlines like Salesforce.com (CRM).

"With IBM and Intel you get stable earnings, a high return on equity, dominant market position and quality management. That's classic Berkshire," says Edward Jones analyst Tom Lewandowski. Both firms are also swimming in cash and have been aggressively boosting their dividend payouts, hallmarks of conservative stocks.

In his shareholder letter, Buffett declared that "the banking industry is back on its feet," a bullish indicator if there ever was one. So last year he snatched up another 40 million shares of Wells Fargo (WFC, Fortune 500), boosting his stake in the nation's fourth-largest bank from 6.8% to 7.6%.

Yet Wells is among the more conservative banking plays. Pat Dorsey, president of Sanibel Captiva Investment Advisers, says that unlike other major U.S. banks, Wells has "no investment banking arm dealing in derivatives that can get into trouble." Nor is it exposed to European banks, protecting it if that region's debt crisis suffers another leg down.

Hasn't Buffett also been betting on the much weaker Bank of America (BAC, Fortune 500)? True, but he made this $5 billion wager through preferred shares that pay a cushy 6% yield, not the common stock.

Two other financials that entered Berkshire's portfolio last year -- Visa (V, Fortune 500) and MasterCard (MA, Fortune 500) -- can also help you hedge a rebound. Both credit card processors stand to benefit from an improving economy. If the recovery fails, though, these firms won't be so vulnerable. Neither extends credit; card issuers do that. Visa and MasterCard merely process transactions.

The conglomerate also made new investments -- though relatively small in size -- on the pharmacy giant CVS Caremark (CVS, Fortune 500), the kidney dialysis company DaVita (DVA, Fortune 500), the satellite television provider DirecTV (DTV, Fortune 500), the retailer Dollar General (DG, Fortune 500), and the media giant Liberty Media (LMCA).

What do these wildly different businesses have in common? Customers are apt to keep buying their goods and services even in less-than-booming times.

Buffett recently wrote that equities will be the "runaway winner" among the major asset classes going forward. But is he finding enough good bargains? One sign he isn't is that in 2011 Berkshire approved its first-ever stock repurchase program (to date, the firm has bought back $67 million in stock).

Remember, it was only last year when Buffett boasted: "Not a dime of cash has left Berkshire for dividends or share repurchases during the past 40 years." Instead, management has always found better uses for the money.

Of course, the program could simply be an indication that the board thinks Berkshire's stock is a compelling buy. Berkshire's B-class shares rallied 9% the day of the announcement and have continued to climb since. Yet "even at today's $79 share price the stock is still cheap. Period," says Dorsey.

He cautions the days of BRK's market-thwacking gains are past. "But as a core holding that can deliver above-average returns over the longer term," he says, "it still makes a lot of sense."

Do you know a Money Hero? MONEY magazine is celebrating people, both famous and unsung, who have done extraordinary work to improve others' financial well-being. Nominate your Money Hero. ![]()

Carlos Rodriguez is trying to rid himself of $15,000 in credit card debt, while paying his mortgage and saving for his son's college education.

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: