August is always a quiet month on Wall Street as traders escape to catch some rays during the final days of the summer, but this year's lull is more pronounced than usual.

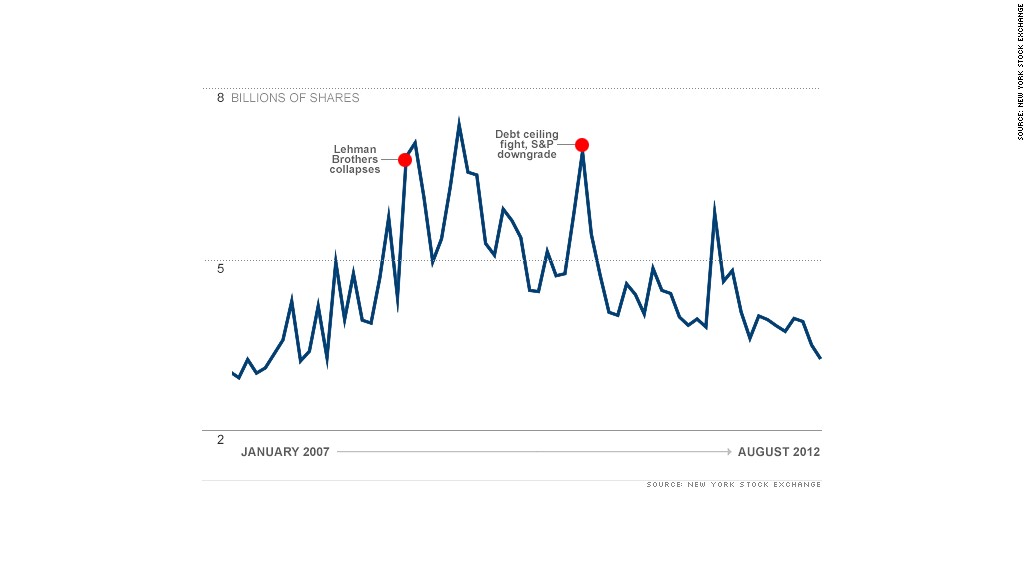

Trading volume hasn't been this low since September 2007, with a daily average of fewer than 3.3 billion shares exchanging hands so far this month. And trading volume is down more than 30%, compared with the average August over the past five years.

What's more, the unusually low volume comes as stocks trade near four-year highs, raising concern that the recent move higher lacks conviction, and it's just a matter of time before markets are mired in a sell-off.

But experts say investors shouldn't panic.

"One of the big knocks on this rally is that volume has been light," said Ryan Detrick, senior technical strategist at Schaeffer's Investment Research. "But it's been that way for a few years. It's not going to change anytime soon, and it's not a sign of danger ahead."

Trading volume has been trending lower since the height of the financial crisis, creating a new dynamic that investors are still trying to adjust to.

Beware of investor complacency

For starters, the market has virtually lost a generation of investors.

"Individual investors don't want much to do with stocks," said Detrick, pointing out that money has been bleeding out of stock mutual funds. "They're being pushed out of the market due to the scary headlines — Facebook IPO, JPMorgan London Whale, Knight glitch — which they perceive to mean that the stock market is performing poorly. But of course it's been going higher, and that makes people angry."

Not only has the market lost individual investors, but there also aren't as many hedge funds as there were just a few years ago, he added.

And many of those who remain in the market are shifting toward exchange traded funds.

"ETFs are where a lot of people are choosing to do their investing because it's easy to diversify, and most are buying index funds, which cuts into the volume you see on the New York Stock Exchange." said Lee Munson, founder of asset management firm Portfolio, and author of the book Rigged Money. "When I look at actual volume and money I trade, it's pretty much exclusively in ETFs, so I'm part of the 'problem.' I'd just rather trade the basket, but I'm trading a lot more shares than you might actually see in trading volume statistics."

Investors still dumping stocks. But they love ETFs.

Detrick also noted that more sophisticated investors are making bets in different types of assets, such as gold, and options volume is also steadily increasing.

While general trading volume has been declining, Detrick said it's worth noting that dollar volume is actually higher compared with 2010.

That's because banking stocks, which were mostly trading below $5 a share during the financial crisis, accounted for the bulk of the trading volume. "Now the big, sexy names" like Apple (AAPL), Google (GOOG) and Chipotle (CMG), which are all worth hundreds of dollars per share, are among trader and hedge fund favorites, said Detrick.

Apple is not overvalued ... yet

And stock prices are higher across the board. The S&P 500 has more than doubled in value since the March 2009 lows, so the prices of many of the stocks in the index are also twice as high.

"It costs more to buy stocks, so people don't buy as many," said Detrick, adding that average traders can't buy as much Google at $600 a piece, compared with how much Bank of America (BAC) they could buy at $7 a pop.

Don't look now. Bank stocks are rallying

It's also important to note that while volume has declined since the financial crisis, it is higher than it was during the last bull market between 2003 and 2006, said Detrick.

Historically, volumes tend to pick up in the fall as traders return from summer vacation. And this fall is expected to be busier and more volatile than usual, as investors return to watch the drama unfold in Europe and in Washington leading up to the November elections.

But even still, volumes aren't likely return to the financial crisis levels anytime soon.

A majority of respondents to a recent Credit Suisse survey said it will take 2-5 years, or even longer, for volumes to recover. And nearly half said macro risks -- Europe's debt crisis, the U.S. fiscal cliff and deficit, and potential recessions -- need to be resolved before investors are willing to step back in with conviction. That's a tall order.

"It's not a big deal, and nobody needs to freak out," said Munson. "We just have to get used to it."