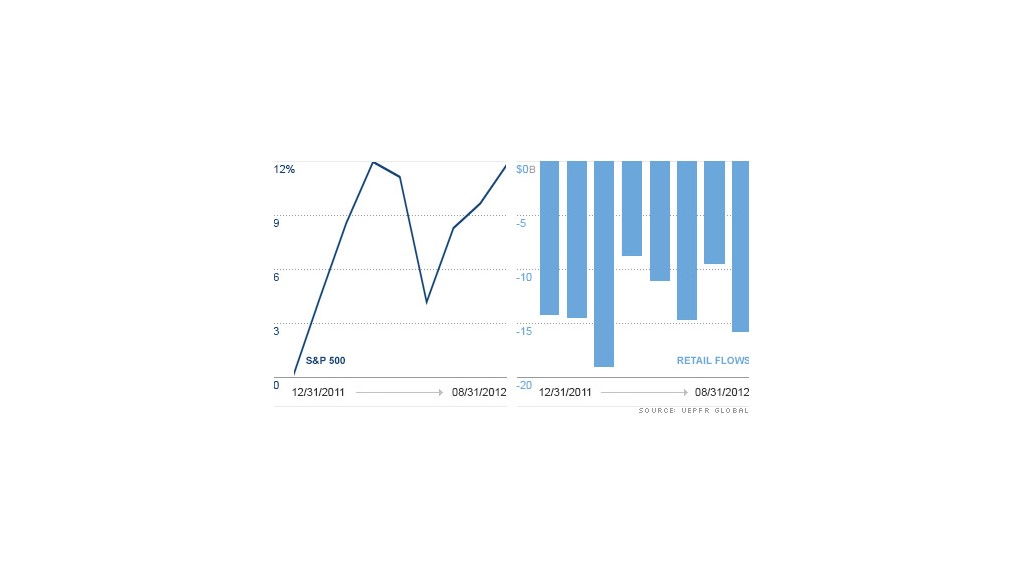

U.S. stocks have had a nice rally since the start of the summer, recently hitting their highest levels since December 2007. But individual investors are once again watching all the action from the sidelines.

As the S&P 500 gained nearly 10% from June through August, individual investors yanked almost $40 billion from the U.S. stock market, according to data from EPFR Global, a Boston-based firm that tracks fund flows for both mutual funds and exchange traded funds.

What's keeping them away? Experts say the steady exodus can be attributed to a change in investing behavior on the part of Baby Boomers, who represent the most sizable group among retail investors.

"The front end of the Baby Boomers are moving into retirement, and they've already suffered two major shocks in their portfolios in less than a decade: the dot-com bust and the financial crisis," said Cameron Brandt, director of research at EPFR Global. "They're supposed to be rotating into bonds anyway, but they've made the shift even sooner thinking, 'I might as well do it while I still have the money.'"

The retreat isn't exactly a new trend.

While the S&P 500 has more than doubled in value from the March 2009 lows, investors have withdrawn nearly $500 billion from U.S. stocks during that same time period. This year alone, they've pulled more than $100 billion from U.S. stock mutual funds and ETFs.

Related: Stock funds continue to bleed despite QE3

At the same time, investors have jumped into bond funds.

"They're very leery of equities, and they've taken their search for yield across the road to fixed income securities -- even ones that are quite risky, like high-yield bonds," said Brandt.

Since the beginning of the year, individual investors have plowed nearly $70 billion into U.S. bond funds, according to EPFR.

Individual investors have also grown more cynical toward Wall Street in the new age of high-frequency trading, following incidents like the May 2010 flash crash, Nasdaq's bungled Facebook IPO and the Knight trading glitch, said Kevin McDevitt, senior analyst at Morningstar.

"There's a greater amount of suspicion and skepticism among investors," said McDevitt, adding that many investors believe "the market is subject to more manipulation than it was in the past."

Related: Treasuy flash crash could become next reality

In fact, experts like Joe Saluzzi, co-head of equity trading at Themis Trading and author of Broken Markets, say that the evolving structure of the stock market makes it nearly impossible for small investors to succeed if they try to trade for short-term gains.

Traders on Wall Street have sophisticated trading programs and unparalleled access to market research and information in comparison to retail investors.

"If you try to trade, you will lose," he said bluntly. But Saluzzi also noted that current market fundamentals are not all that compelling for small investors either.

"Retail investors do have confidence issues and feel that the stock market is rigged, but they also don't understand how the market can have such a heated rally when they consider the health of the broader economy," he said. "They know that economic growth is anemic, but the Federal Reserve's policy keeps inflating the stock market. It just doesn't jive well."

Saluzzi said investors who are willing to execute a buy-and-hold strategy can still benefit from owning stocks.

But chances are that as long as investors consider all the risks plaguing the market -- from Europe's debt crisis to the U.S. fiscal cliff -- they'll continue their retreat.