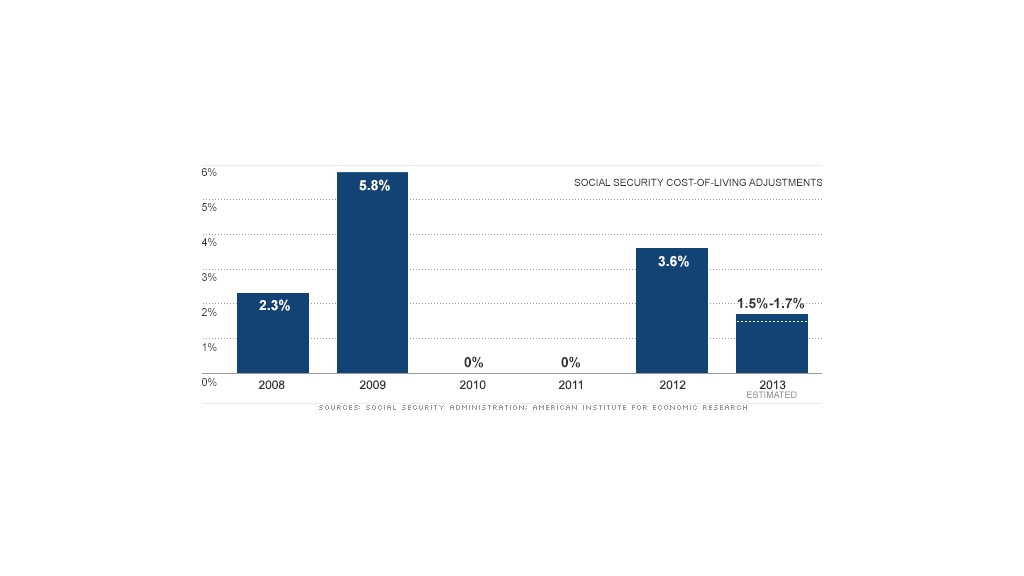

Social Security recipients will get less than a 2% increase in their benefits next year to account for a rise in cost of living, according to an estimate published Tuesday. That's less than half the increase in benefits they received in 2012.

The American Institute for Economic Research, a private think tank, estimates Social Security checks will increase between 1.5% and 1.7% in 2013.

The Labor Department will release its September inflation reading on Oct. 16, which is the final of 12 readings used to calculate the cost of living adjustment made annually to benefits. The Social Security Administration will announce the 2013 benefit increase at that time. Benefits increased by 3.6% in 2012, when inflation was higher.

Steven Cunningham, director of research and education for AIER, said that the increase will not be enough to cover the actual rise in costs faced by many seniors, who receive the overwhelming majority of Social Security benefits.

Related: Hey Social Security, I'm not dead!

Seniors don't typically have the same spending patterns as younger workers, whose purchases are more closely tracked by the government's inflation reading.

Cunningham pointed to larger increases in items more important to senior's spending, including food and beverages, which increased 2%; motor fuel, which rose 1.9%; and medical care, which jumped 4.1%. The AIER's estimate of the cost of every day items purchased by seniors showed a 2% increase over the last year.

"They're falling behind by about a half percentage point a year or so. It's not a huge amount, but over time that adds up," said Cunningham.

Related: Scam targets seniors' Social Security benefits

In 2009, benefits increased by 5.8% following a sharp rise in gas prices in 2008. But social security recipients saw no increase in 2010 and 2011, when spending dropped due to the recession and prices remained low.

This calculation doesn't only affect those receiving Social Security benefits. It is also used to raise the ceiling on wages subject to payroll taxes. This year's maximum is $110,100, but a 1.7% increase would subject an additional $1,872 to the 6.2% tax.