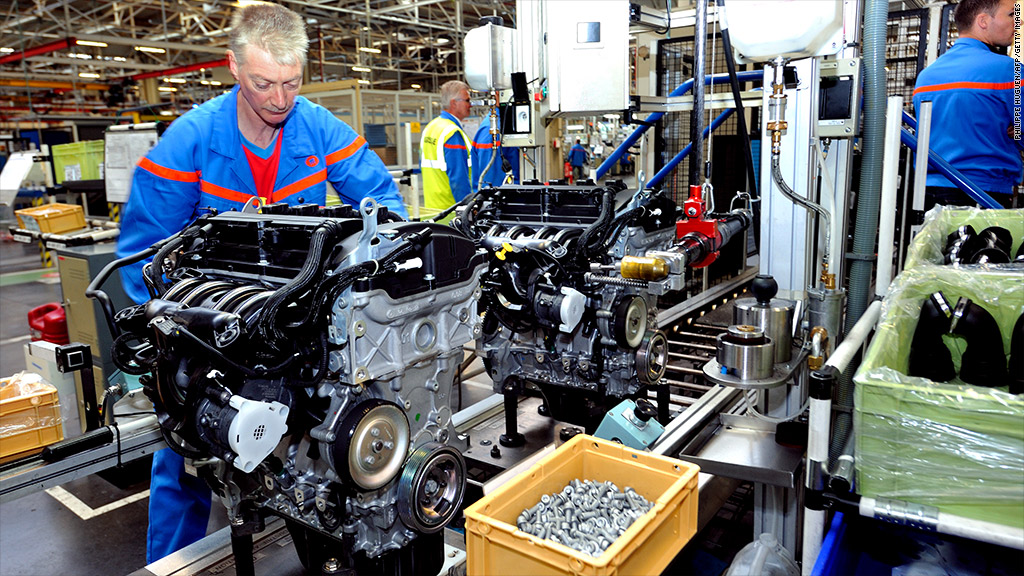

A weak performance by eurozone factories in October suggests the region could fall deeper into recession in the fourth quarter, as businesses shed jobs in the face of declining orders.

Preliminary data published Wednesday showed the weakest reading for eurozone manufacturing and service activity in 40 months, and a separate reading of business sentiment in Germany -- the region's largest economy - fell to its lowest level since February 2010.

Markit's composite purchasing managers' index for the eurozone was 45.8 in October, down from 46.1 the previous month, its fastest decline since June 2009, and consistent with a quarterly contraction in the region's economy of 0.5%. Index readings below 50 signal contraction in the manufacturing sector.

"Official data have shown surprising resilience over the summer compared to the survey data, but the underlying business climate has clearly deteriorated markedly in recent months," Markit chief economist Chris Williamson said in a statement.

"While GDP may decline only modestly in the third quarter, a steeper fall looks to be on the cards for the fourth quarter," he said.

Eurozone GDP shrank by 0.2% in the second quarter. It is expected to have contracted further in the third.

Full coverage on Europe's Debt Crisis

The October PMI reading was much weaker than expected and was entirely driven by declining manufacturing output.

"October's decline in the eurozone composite PMI is an unpleasant surprise and reinforces concern that the economic downturn in the region may be deepening and widening," ING senior economist Martin van Vliet said in a note. "All in all, today's PMI figures indicate that the eurozone economy remains firmly stuck in recession."

Ifo's business climate index in Germany fell for the sixth month in a row, dropping to 100 from 101.4 in September.

German exporters are feeling the pain of weak demand from other eurozone economies, where governments and consumers are reining in spending, and a global slowdown.

China's growth slowed to a 7.4% annual rate in the third quarter. But manufacturing PMI data published Wednesday suggested the world's second biggest economy was responding to stimulus measures, as new factory orders hit their highest level in six months.

China's manufacturing sector shows improvement

Unlike its European partners, including France which experienced another steep contraction, Germany experienced only a mild decline in output this month, according to the Markit data.

"The rate of decline (in Germany) gathered pace on September, but remained less severe than in both July and August," Markit said.

Spain's central bank said Tuesday preliminary data pointed to GDP shrinking by 0.4% in the third quarter, which would represent a 1.7% fall year-over-year, compared with 1.3% in the second quarter.