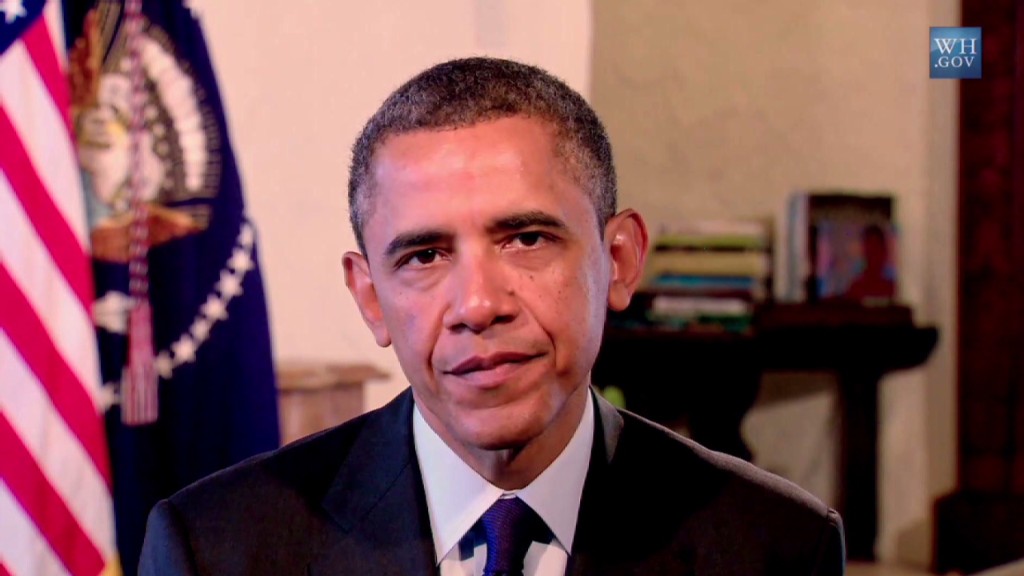

Wall Street can thank Congress for a $11 billion tax windfall from the fiscal cliff deal that President Obama signed into law at the beginning of this month.

Among the myriad of sweeteners in the deal was a break that helps Wall Street banks and giant companies such as General Electric lower their tax bills. The break costs taxpayers a total of $11 billion in 2012 and 2013.

Corporations typically face a 35% federal income tax, although many end up never paying that amount. While the companies that sell things overseas can defer taxes of profits from those items, financial services companies can't do that because of the nature of their business.

So they get what's called an "active financing exemption" that allows them to defer U.S. taxes on overseas profits on financial transactions.

"Active financing exemption puts financial services headquartered in the United States on a level playing field with international competitors and other U.S. businesses that have major foreign operations," said Payson Peabody, tax counsel at the Securities Industry and Financial Markets Association, a lobbying group for financial brokerage firms.

Related: Estimating your new taxes: It's worse than you think

But, to critics, active financing exemption is the poster child for offshore tax loopholes. They call it an undeserved taxpayer gift to Wall Street.

"It allows them to play games and move profits offshore to avoid paying taxes," said Rebecca Wilkins, a federal tax policy expert for the left-leaning Citizens for Tax Justice.

During the 2009 and 2010 tax years, the active financing exemption was a key reason behind conglomerate General Electric (GE)'s zero tax bill, experts say.

"We are pleased that Congress has acted to keep in place the longstanding provision for taxing global finance income for an additional two years," said GE spokesman Seth Martin in a statement.

It plays such a big role in reducing taxes that many big companies, such as Citigroup (C), Goldman Sachs (GS), Bank of New York Mellon (BK), American Express (AXP), Bank of America (BAC)'s Merrill Lynch and GE, have warned in public filings that their tax bills could go up "significantly" should the tax break go away.

These companies have spent millions on lobbyists to defend it over the last 16 years. In fact, Wall Street banks banded together to create their own lobbying effort calling it the Active Finance Working Group. The group spent $1.19 million since May 2009 solely on this tax break, according to Senate records.

Congress, with the blessing of the White House, decided to extend the break.

In Washington, it's no big surprise, as the tax break has been extended every one or two years since 1997, after a 10-year hiatus. Groups that represent Wall Street say it's no special break -- it should be in the code permanently.

The Senate Democrat who runs the Budget panel has sponsored a bill to make the tax break permanent. And the Obama administration has long had the Wall Street tax break for active financing on its wish list of those to be extended, even if only for a year.