President Obama on Wednesday proposed a $3.77 trillion budget for 2014 that would cut deficits by $1.8 trillion over the next decade.

Obama's budget blueprint -- which has already drawn criticism from the left and the right -- offers changes to Medicare and Social Security. It also includes tax increases that would primarily hit high-income households and corporations.

The plan calls for greater spending on infrastructure, early childhood education and nondefense research. Those investments would be paid for by other measures so that they don't add to deficits, Obama said.

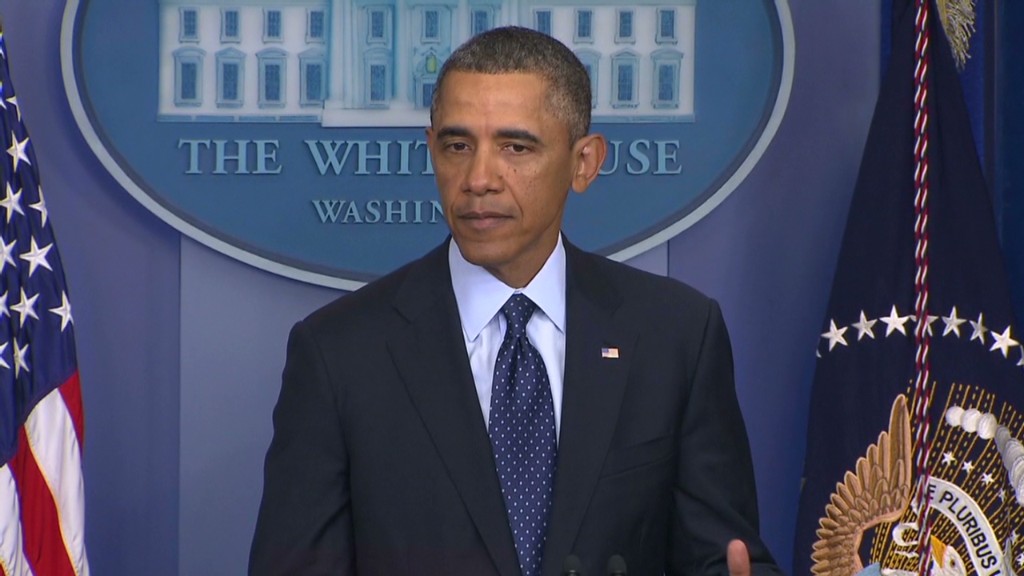

"[D]ebate in this town has raged between reducing our deficits at all costs and making the investments necessary to grow our economy. And this budget answers that argument. We can grow our economy, and shrink our deficits," he said.

The president's budget is late this year, coming after the Senate and House have each passed separate and very different 2014 budget frameworks.

While it's not expected to fly on Capitol Hill, Obama's budget nonetheless sets an important marker for continuing debt talks with lawmakers.

Boost infrastructure spending: The president's budget calls for a $50 billion investment to, among other things, repair highways, bridges, transit systems and airports. He would also create a National Infrastructure Bank to bring together public and private capital for important projects.

Related: Budget will target wasteful spending

Change how inflation is measured: Obama has already gotten blasted from the left for supporting a switch to "chained CPI," which is a new way to measure inflation that would reduce projected federal spending by slowing the growth in federal benefits that are annually adjusted for cost of living. Those include Social Security benefits.

His budget, however, calls for ways to compensate for the change for low-income veterans, recipients of Supplemental Security Income and the oldest Social Security beneficiaries, a senior administration official said.

Chained CPI would also raise more revenue, since many parts of the tax code are adjusted for inflation every year -- including income tax brackets, the standard deduction and contribution limits to 401(k)s.

By 2020, the use of chained CPI could mean an average tax increase of $311 among the nearly 81% of households that would see a tax increase, the Tax Policy Center estimates.

The White House estimates that the switch to chained CPI will raise $230 billion over 10 years.

Cap value of itemized deductions: As he has proposed before, the president wants to limit the value of itemized deductions and exclusions for high-income households.

Normally a taxpayer multiplies her top tax rate by the amount of a deduction to calculate the taxes saved. But Obama would cap that rate at 28%, which is below the top two income tax rates. So someone in the 39.6% bracket today would save $39.60 on a $100 deduction. Under Obama's proposal, she would save $28.

The proposal is estimated to raise $529 billion over 10 years.

Enact a Buffett Rule: Last year, Obama proposed the "Buffett Rule" as a guiding principle for tax reform.

The idea: to make sure that people earning more than $1 million paid their "fair share" of federal tax -- which he defined as a minimum of 30%.

This year, he includes a more concrete version similar to one proposed in a bill last year by Sen. Sheldon Whitehouse, according to a senior official.

That Senate legislation would impose a minimum 30% effective federal tax rate on those with adjusted gross incomes above $1 million, although it phases in for those making between $1 million and $2 million.

Taxpayers would still get a break for charitable deductions when calculating what they would owe under the Buffett Rule.

The proposal would raise $53 billion over 10 years if it were enacted on its own, without the cap on itemized deductions.

Impose new limit on tax-deferred retirement accounts: Among his new tax measures, Obama would set a limit on the tax-advantaged portion of an individual's savings across IRAs and other tax-preferred retirement accounts.

The account balance threshold would be based on what could finance an annuity of $205,000 a year in retirement. In 2013, that would be $3 million, the administration estimates.

At that threshold, the proposal would affect far less than 1% of IRA and 401(k) account holders, according to estimates from the Employee Benefit Research Institute. Depending on how the threshold is adjusted in future years, however, that percentage could rise significantly.

The proposal is estimated to raise $9 billion over 10 years.

Raise tax on cigarettes and other tobacco products: Obama is proposing a new federal tax on cigarettes to fund expanded access to pre-K education, which would cost $66 billion, and expanded home visits and care for infants and toddlers, which would cost $11 billion.

It wouldn't be his first increase in the cigarette tax. In 2009, Obama signed into law a federal tax increase on cigarettes to help pay for an expansion of the State Children's Health Insurance Program, which provides health care for 8 million children.

The president's current proposal would raise the federal tax on cigarettes by 94 cents to $1.95 per pack. The White House estimates the tax hike would raise $78.1 billion.

Raise tax rate on investment fund manager income: Managers of private equity, venture capital and hedge funds are taxed 20% on the portion of their compensation known as carried interest, essentially paying the long-term capital gain rate. Obama wants carried interest to be treated as ordinary income, a proposal he's made repeatedly. The result: fund managers could pay a rate as high as 39.6%, or more than 2.5 times the rate they pay now.

Reduce deficits by $1.8 trillion: Obama's debt reduction proposal comes straight from an offer he made to House Speaker John Boehner last year during their fiscal cliff negotiations.

The proposal would replace the automatic budget cuts that went into effect last month.

Close to $600 billion of the $1.8 trillion would come from new revenue -- specifically the cap on itemized deductions and the Buffett Rule.

The other $1.2 trillion would come from spending cuts: $200 billion from defense and nondefense programs on the discretionary side of the budget. Another $400 billion from Medicare and other federal health programs in ways that largely affect hospitals and drug companies. And $600 billion in cuts affecting non-health spending on things like agricultural subsidies and unemployment insurance.

The administration has made clear the president's deficit-reduction proposals are not a starting point for upcoming discussions. "I've already met Republicans more than halfway," Obama said Wednesday morning.

And officials made it clear there will be no future debt-reduction deal unless new revenue is included.

House Speaker John Boehner on Wednesday morning gave the president credit for including "some incremental entitlement reforms ... . But I would hope that he would not hold hostage these modest reforms for his demand for bigger tax hikes. Why don't we do what we can agree to do?"

Even if Republicans eventually agree to a revenue component, it is unlikely the president's proposals would be adopted wholesale. But if they were, his budget would bring total deficit reduction during his tenure to $4.3 trillion.