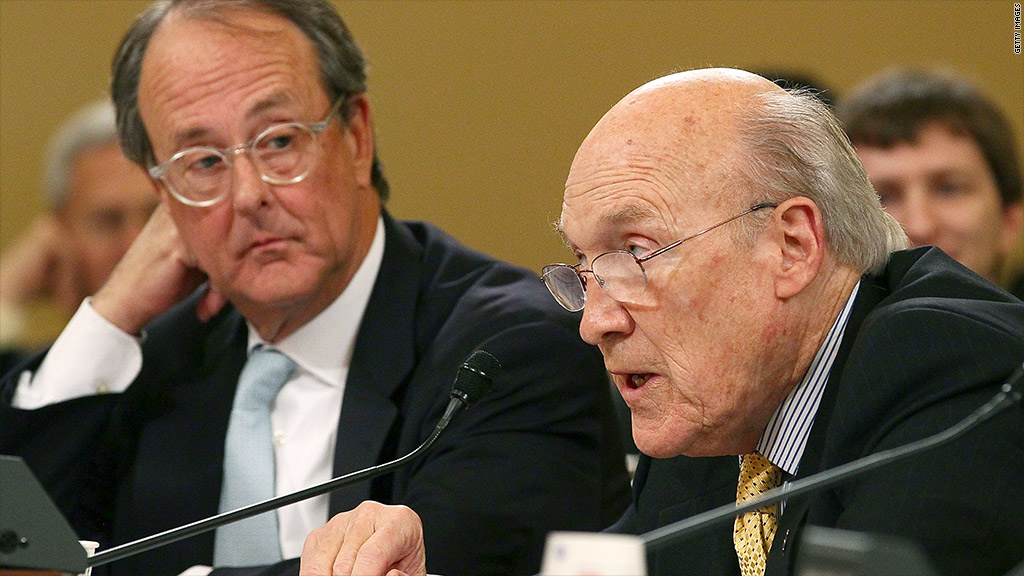

The deficit duo of Erskine Bowles and Alan Simpson will try again on Friday to get Democrats and Republicans to hold hands and make tough choices on the nation's debt.

They're releasing details of a proposed $2.5 trillion deficit reduction plan, which they originally outlined in February.

Bowles and Simpson were co-chairmen of President Obama's bipartisan fiscal commission in 2010, and their plan at the time was criticized by both liberals and conservatives.

The new plan is smaller in scope and seeks to build on the $2.7 trillion in deficit reduction that the White House and Congress have agreed to since 2010.

That $2.7 trillion (which the White House estimates to be $2.5 trillion) does not include the forced budget cuts -- also known as "sequestration" -- that went into effect last month.

Bowles and Simpson call those cuts "mindless" and think they threaten the economic recovery. Consequently, they propose canceling 70% of the cuts for this year and next. Similarly, they recommend delaying most of their plan's deficit reduction until 2016.

But backloading the changes can mean a steep hit in later years, such as $500 billion in deficit reduction in 2023 alone.

Here are some highlights from their new plan:

Debt reduction: $2.5 trillion in additional deficit reduction over 10 years is more than the $1.8 trillion that the president called for in his 2014 budget, but less than the $5 trillion House Republicans want.

The Bowles-Simpson plan aims to keep public debt on a downward path. By 2023, it's estimated to bring debt down to 69% of GDP, from an estimated high of 78% in 2014.

Together with the $2.7 trillion in deficit reduction already agreed to by policymakers, Bowles and Simpson estimate that more than 70% of total savings would come from reduced spending (including lower interest spending), and less than 30% would come from tax revenue.

The plan also recommends indexing the debt ceiling to inflation. Doing so would prevent episodes of political brinksmanship over raising the legal borrowing limit so long as debt stays on a downward path as a percent of GDP.

Taxes: The plan calls for fundamental tax reform that lowers rates, reduces tax breaks and maintains progressivity.

It would raise $585 billion in revenue for deficit reduction.

The plan also calls for a switch to a territorial tax system for corporate taxes. The United States currently taxes profits earned abroad by U.S.-based multinational companies. Under a territorial system, the federal government would only tax corporate income earned within U.S. borders.

Defense spending: The plan would undo most of the defense budget cuts this year and next. But it also would require that Congress achieve $220 billion of defense savings by 2023 relative to pre-sequester levels. It would cap defense spending growth at the inflation rate through 2025.

In addition, Bowles and Simpson suggest capping spending on overseas contingency operations. If Congress spends less than the cap in a given year, the unspent amount must not be used to fund unrelated defense spending.

President Obama never fully embraced the original Bowles-Simpson plan because, among other things, he felt it would cut defense too deeply.

Domestic spending: As with defense spending, the plan would cancel most of the nondefense discretionary budget cuts this year and next. But it also would require $165 billion of savings in domestic spending by 2023, compared with pre-sequester spending levels.

And it would cap spending growth at the rate of inflation through 2025.

Medicare: Bowles and Simpson will touch some nerves with their proposals to curb spending on Medicare and other health spending by $585 billion over a decade.

For instance, they would slowly raise the Medicare eligibility age from 65 to 67 by the mid-2030s. But at the same time, they propose creating a "buy-in" option for 65- and 66-year-olds so they, too, could receive Medicare benefits.

They would also change how Medicare beneficiaries pay for Parts A and B (the programs that cover hospital care and doctor visits).

In addition, they would expand means-tested Medicare premiums, so the highest income beneficiaries would pay even more for their premiums.

Their plan includes a host of health care delivery reforms as well.

Social Security: The plan calls on Congress to make the system solvent over the next 75 years. It also includes one specific and very controversial proposal: changing how annual cost-of-living increases are calculated for benefits .

Using "chained CPI" would be a more accurate way to measure inflation, proponents say. Some liberal economists disagree.

President Obama included the idea in his recent budget. Chained CPI would slow the growth rate in all federal payments that are inflation adjusted. Besides Social Security benefits, the change would affect civilian worker and military pensions, veterans' benefits, and Pell Grants.

The Bowles-Simpson plan includes protections against the effects of chained CPI for the most vulnerable Social Security recipients.

Chained CPI would also raise revenue, since it would slow changes to tax parameters that go up with inflation -- and that could mean somewhat higher taxes for many filers. Measures adjusted for inflation include income tax brackets, the standard deduction, phase-out levels for tax credits and contribution limits to 401(k)s.

All told, the chained CPI proposal would reduce deficits by an estimated $280 billion over a decade.