The bull market hit a speed bump this week as investors begin to consider what life will be like when the Federal Reserve starts to taper off its long-standing asset purchasing program.

The Dow Jones industrial average, the S&P 500 and the Nasdaq all ended little changed Friday. Trading volume was light Friday, ahead of the Memorial Day Holiday. U.S. and U.K. markets will be closed Monday.

But all three U.S. indexes ended lower for the week, snapping a four-week winning streak.

Investors were rattled this week by signs of a growing split within the Federal Reserve over the size of the central bank's bond buying program, which has been a big driver of the bull market over the past few years. The Fed is on its third round of quantitative easing, but investors seem to be coming to terms with the idea that there may not be a fourth, according to analysts at Barclays.

"Market movements are saying the Fed's exit is now more 'when' than 'if'," the Barclays analysts wrote.

The jitters over Fed policy ricocheted around the world on Thursday. Japanese stocks recovered Friday, one day after the Nikkei plunged more than 7%.

Despite that drop, Japanese stocks are still up more than 70% over the past 12 months. The Bank of Japan has launched an aggressive campaign to fight deflation by pumping money into the economy.

With the major U.S. gauges up about 15% for the year, some investors have speculated the market is on the verge of a long-awaited pullback. Others argue that stocks still will continue to grind higher as investors who missed the rally look for opportunities to buy on dips.

Click for data on gold prices, currencies and bonds

P&G shares pop: Shares of Dow component Procter & Gamble (PG)rose after the company ousted CEO Bob McDonald and replaced him with his predecessor A.G. Lafley. The company had been under pressure from activist investor Bill Ackman to make the move.

Long Elon Musk/Short Mark Zuckerberg. Shares of Tesla (TSLA) hit a record high as investors continue to bet the electronic car company founded by Elon Musk is miles ahead of the competition.

Meanwhile, Facebook (FB) shares fell below $25 a share, a level not seen since November. The social network has struggled since its initial public offering as investors worry about Facebook's ability to make money off of mobile users. The stock is now down 9% so far this year.

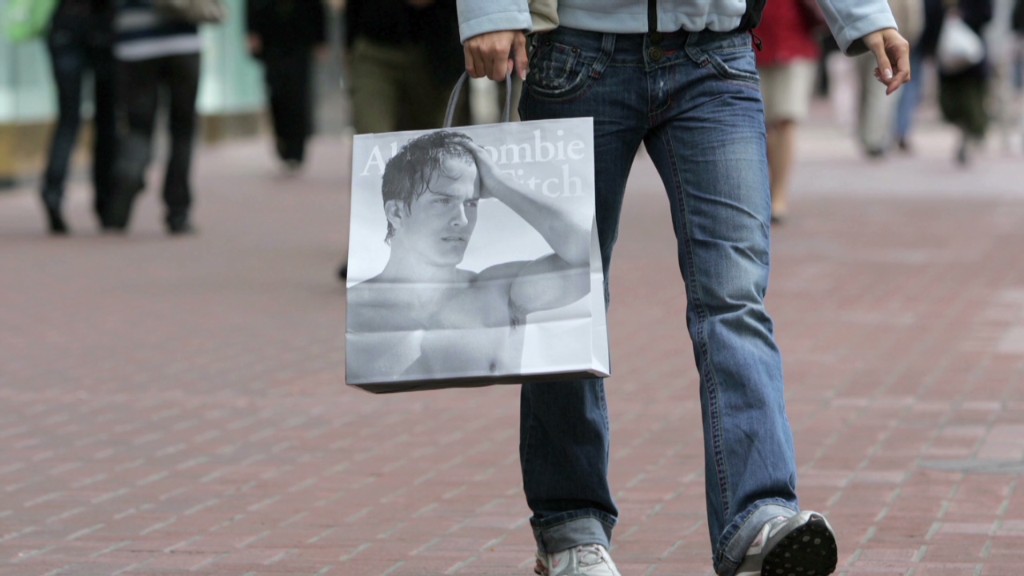

Retailers under pressure: Shares of two well-known retailers plunged on weak results. Sears Holding (SHLD)and Abercrombie & Fitch (ANF) sank after reporting larger than expected losses in the most recent quarter.

Shares of Salesforce.com (CRM) slid more than 7% as the company offered a weak 2014 outlook. Gap (GPS) shares also fell on weak guidance.

Pandora (P) shares erased earlier gains, sliding more than 4%. The music site reported better-than-expected revenue and a slightly smaller-than-forecast loss after the close Thursday.

Shares of pharmaceutical firm Valeant (VRX) shot up after the Wall Street Journal reported it may be buying Bausch & Lomb in a $9 billion deal.

GameStop (GME) shares sank after the video game retailer said earnings fell in the most recent quarter. Investors are also concerned about how the introduction of Microsoft's (MSFT) new Xbox One game console will change the market for used games.

Related: Fear & Greed Index slides into greed

Durable goods bounce back: New orders for durable goods rose 3.3% in April, following a drop of 5.9% in March, according to the Commerce Department. Economists surveyed by Briefing.com had predicted a 1.6% rise.

Despite the rise in orders, shipments of durable goods fell last month, suggesting the rebound in U.S. manufacturing activity is running out of steam, said Paul Edelstein, an economist at IHS Global Insight.

"The sector is settling into a softer growth trajectory that is more consistent with the overall economy," he said.